Melcor Developments: Is It Worth Investing In This Alberta Land Business That May Always Be Undervalued?

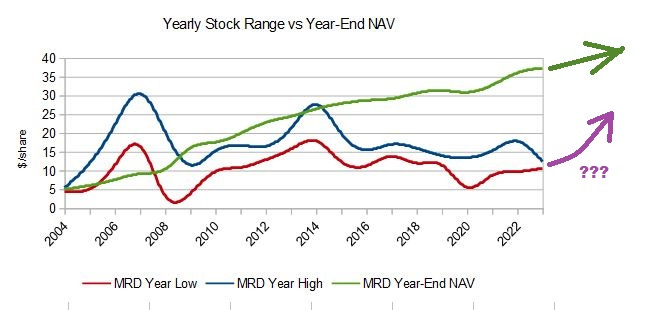

Melcor Developments (MRD) is a family-controlled real estate business based in Northern Alberta that has been managed for long-term value creation. The company has compounded book value at 15% over the past 20 years, pays meaningful dividends, has been steadily repurchasing shares, and the CEO has been buying. Earnings and NAV are at record highs, but the share price is below its 20-year average.

Melcor takes great pride in its 100-year heritage. Shares are tightly held with a 53% stake belonging to Melton Holdings and 15% held directly by board members. The 9/13/24 stock price is 5% below the average close over the past 20 years, but should respond to a favorable multi-year outlook for Alberta real estate.

Topics:

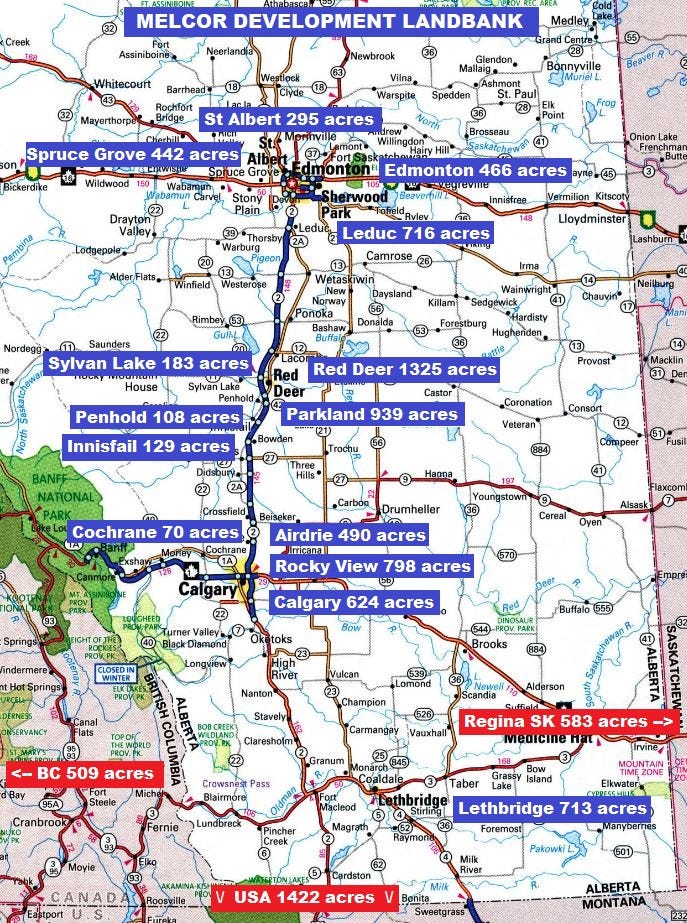

Melcor’s Business. Residential Land Segment segment owns 9800 acres of land for development in planned communities, primarily along the Highway 2 corridor from Calgary to Edmonton. Property Segment (and 55% owned Melcor REIT) owns completed investment property for leasing, mostly in the same areas as the Land segment.

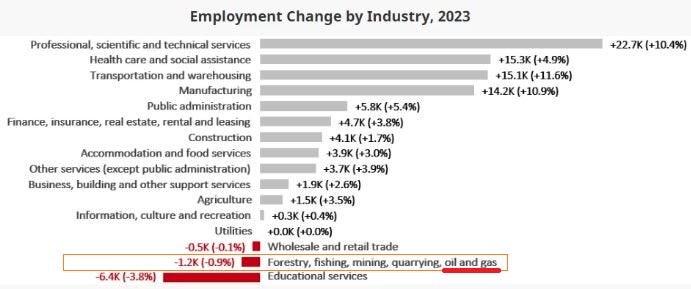

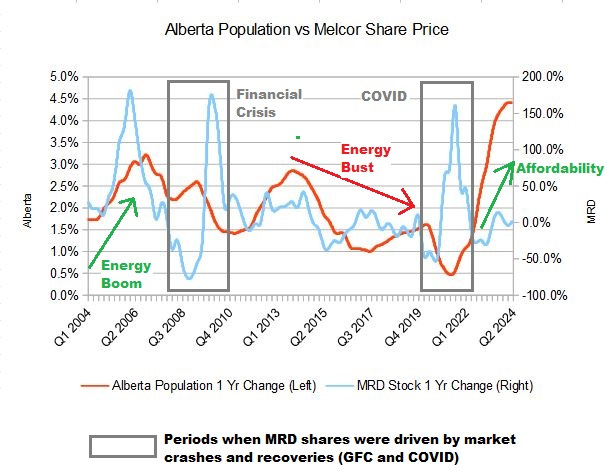

Alberta Real Estate market had a strong historical relationship with Energy sector cycles (booming 2003-2008, busting 2014-2020), but is now thriving due to appealing affordability despite tepid energy employment growth.

Governance. Public investors have minimal influence over company strategy, but the company has a good record of serving their interests.

Financial Metrics. Funds From Operations and Net Asset Value are at all-time highs and good news is likely to continue with a surging Alberta population supporting real estate demand.

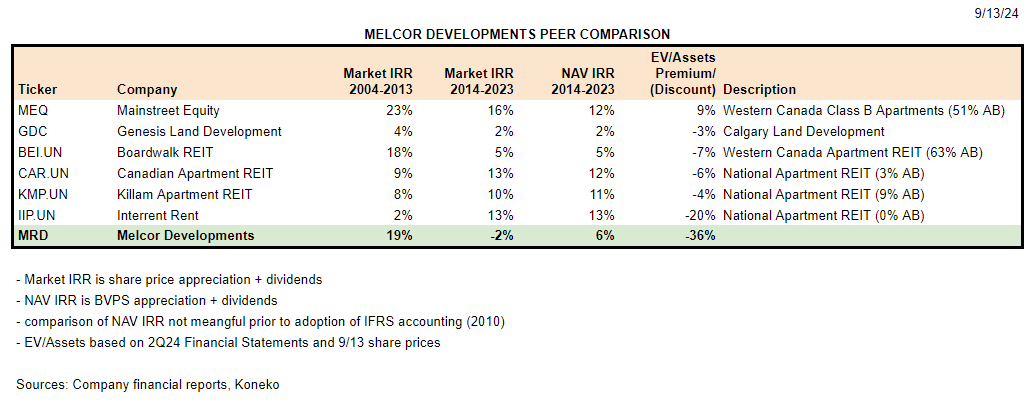

Valuation Benchmarks. Melcor trades at the largest valuation discount among peers. Its historical share price and NAV performance has handily exceeded Alberta development peer Genesis Land, has tracked Boardwalk REIT, and in the past ten years has lagged REITs with GTA exposure (CAPREIT, Interrent, and Killam). Mainstreet trades at a premium reflecting its history of superior value creation.

Melcor just agreed to privatize Melcor REIT following a Strategic Review that began in February. The REIT had suspended its dividend and planned to sell non-core assets in order to deleverage and conserve funds ahead of a $46mm debt maturity in December. MRD also reduced its quarterly dividend from $0.16/share in 2023 to $0.11/share in 2024 without explanation. These developments created uncertainty among investors about the outlook for both entities that will be removed through consolidation of the REIT.

MRD shares should be of interest to patient value investors comfortable with the absence of a catalyst to force the price higher.

Melcor’s Business

Melcor has two primary segments:

Residential Land Development (Estimated 57% of Net Assets) acquires large parcels of undeveloped land at the edge of growing communities and prepares them for development. Steps include extensive work with government authorities on environmental and heritage assessment and preservation, and infrastructure planning (transportation, water and sewers, education and health care). The business requires significant capital investment to acquire land and then build value that may not be realized until 10-20+ years after initial purchase when individual lots are sold to homebuilders or acreage is sold for commercial use. This Rocky Creek Conceptual Scheme provides a sense of the work involved - technical studies supporting the plan date all the way back to 2006 and development has not yet begun. Melcor doesn’t provide a map of its landbank, but its communities are mostly along the Highway 2 corridor from Calgary to Edmonton.

It would help investors understand Melcor if the company provided information about the stage of development of its most important assets, which are at a conceptual stage, which have completed municipal agreements, and which have completed infrastructure and are ready for phased sales depending on demand. That information is probably all available through various Alberta municipal offices, but investors (including me) are not going to make the considerable effort to research it. The $71mm balance at 6/30 on MRD’s credit facility is secured by a portion of its lot inventory and land inventory, but quarterly disclosures do not include the undrawn availability and the carrying value of pledged assets.

Investment Property (Estimated 43% of Net Assets following consolidation of Melcor REIT) acquires and manages commercial property, primarily in the same areas where the company is developing residential communities. Cash flow from retail and office leases should be less cyclical than land sales, but the overall weakness in the Alberta economy from 2014-2020 following the oil price collapse, the adverse impact of ecommerce on retail sales, and the adverse impact of COVID on office usage, led to prolonged weakness in commercial rents. Lower property operating income, higher interest rates, and higher cap rates led to declines in commercial property valuations. The Melcor Leasing site provides a quick view of the portfolio - a lot of community shopping centres that should be fine now, plus some suburban and Class B offices. Melcor CEO Tim Melton says the company will take a more cautious approach to future commercial development. The REIT’s 1H24 FFO is only -4% yoy despite a much weaker unit price return prior to the privatization offer. MRD’s wholly owned commercial property segment reported 1H24 FFO +6% yoy - Canadian retail performed well and US offices lagged. Melcor and the REIT have pledged most of their investment properties as security for mortgage borrowings.

Last week MRD agreed to acquire Melcor REIT for $4.95/unit. The price is a 45% discount to 6/30/24 NAV, 6.4X TTM FFO, 9.7X TTM AFFO, and I estimate an 8.9% equity implied cap rate. I previously believed privatization was unlikely due to the long-term strategic advantage of the REIT’s access to third party capital for financing its stabilized investment property, however this benefit is balanced by the opportunity to require the public units at a cyclical low valuation. By fair value the REIT’s portfolio is 60% Retail, 31% Office, 6% Industrial, and 3% Land Lease. While the outlook for office remains uncertain, prospects for the other sectors are favorable. Reit unitholder Firm Capital in March demanded privatization at 95% of NAV and has not commented on the current buyout offer. The scheme requires approval of a majority of the public holders and the price premium is probably high enough to get a deal done even though it will disappoint long-term holders. MRD’s 55% stake makes a competing bid unlikely and the new credit line at a 12% interest rate is a bit of a poison pill. The transaction does not have a financing contingency and the $65mm cost can be covered by MRD’s 2024 FFO.

Alberta Real Estate

Alberta’s economy and population growth have traditionally been significantly affected by cyclical exposure to the energy sector (my 2023 article on the Calgary office sector had some background). Most oil and gas company headquarters are in Calgary while Edmonton is more anchored by a large government sector. The province is trying to diversify its economy through initiatives like AI Innovation (Alberta Machine Intelligence Institute) and Nanotechnology (Alberta Nanotechnology Initiative).

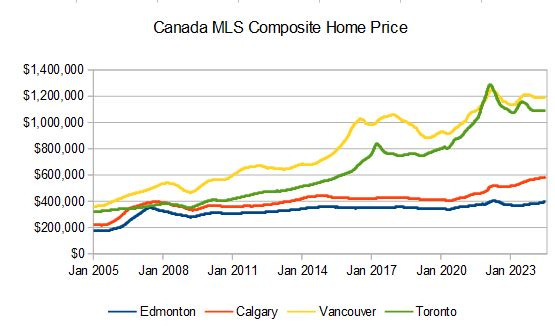

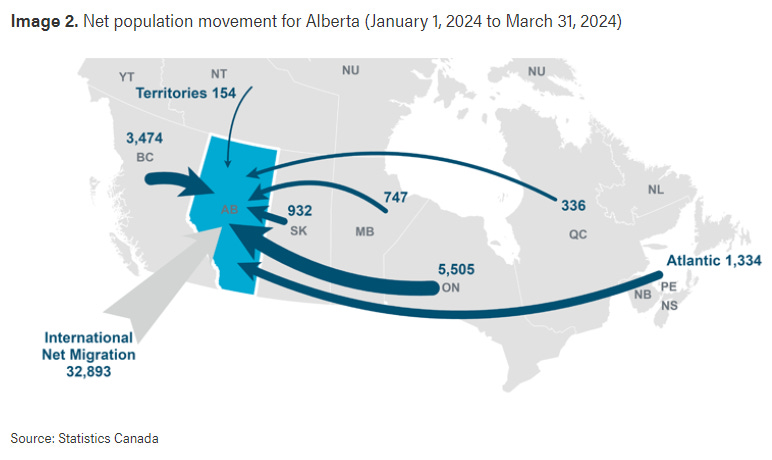

Calgary and Edmonton have smaller pools of skilled labor compared to Toronto, Montreal, and Vancouver so they are dependent on migrants from within Canada and international immigrants. Housing affordability has emerged in the past two years as a major factor encouraging population flows. Home prices in Edmonton are only 11% above their 2007peak while in Toronto they are 191% higher. An average Calgary home cost 4% more than one in Toronto in 2007, but is now 47% cheaper.

Housing affordability provides a huge benefit to standard of living and is drawing people from every other province:

Alberta still has high Energy exposure, however the sector has changed considerably over the past 15 years. In 2007 there were many small companies with huge ambitions funded by optimistic capital markets. Exploration and production technologies were rapidly evolving - many things seemed possible. After the 2014-2020 bear market the industry has become much more conservative, more concentrated with a smaller number of more professional companies, more disciplined and less cyclical. Alberta’s strong recent population growth has come despite a decline in Energy sector employment. This has an extremely positive implication for the durability of increased demand for all types of real estate (residential, retail, and even office).

Governance

Melcor takes great pride in its 100-year history under 3 generations of Melton family leadership. 53% of the shares are held by Melton Holdings which is more than 50% controlled by Melcor CEO Timothy Melton and Melcor REIT CEO Andrew Melton. Timothy Melton directly holds an additional 7.5% of the shares and there are probably significant additional holdings by non-insider family members and friends. Total exchange turnover in the past year has only been 1.7mm shares, about 5% of outstanding. Melcor resembles the family-controlled Hong Kong real estate businesses that I described in June that plan strategy on a dynastic time horizon. Public shareholders have legal protections, but extremely limited influence.

Melcor has nevertheless delivered value to all of its shareholders:

NAV has grown from $4.57/share at 12/31/03 to $38.13/share (adjusted - see blow) at 06/30/24

Dividends of $9.14/share were paid in the 20 years from 2004-2023. The current quarterly dividend of $0.11/share was reduced from last year’s rate of $0.16 while Melcor REIT conserved cash for its upcoming debt maturity. Over time, Melcor has provided meaningful cash returns to its investors.

Share buyback has retired nearly 2.5mm shares since 12/31/21 (7.5% of outstanding). The company has fewer shares now than in 2003. Melcor did issue 2.2mm shares in 2014 in conversion of debentures at $18.51/share.

Melcor has no meaningful related-party transactions, except those between Melcor Developments and Melcor REIT.

CEO Timothy Melton has purchased 175,000 shares since 12/31/21 at prices from $10.23 to $13.90.

Melcor REIT’s conference calls and analyst coverage provided some visibility into MRD which has less coverage. It would be helpful to investors if MRD began holding conference calls following the REIT privatization.

Financial Metrics

Melcor earnings are volatile over short periods due to fluctuations in property demand and closing of larger sales. However the company has remained consistently profitable due to modest overhead and conservative leverage. During periods of low demand Melcor sells fewer lots and acres, but the value of those assets is retained and realized when demand recovers.

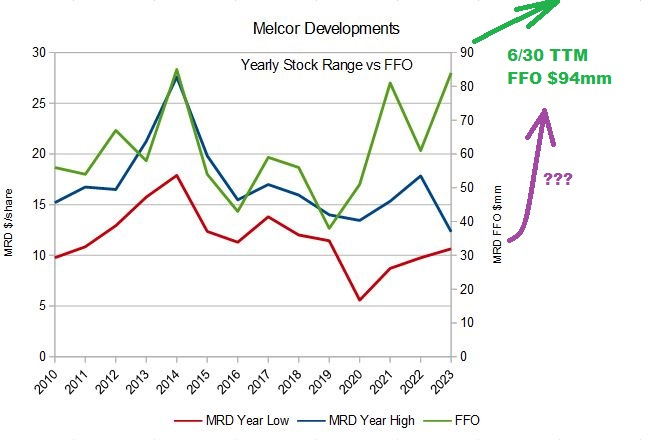

Funds From Operations (FFO) is essentially Net Income without changes in the fair value of investment properties. In the 10 years from 2014-2023 cumulative FFO was $612mm, an annual average of $61mm with a range from $38mm to $85mm. FFO in the 12 months ending 6/30/24 reached a record high $94mm so one might expect MRD shares to also be at a high, but in the past 3 years there has been little connection between earnings and the stock price.

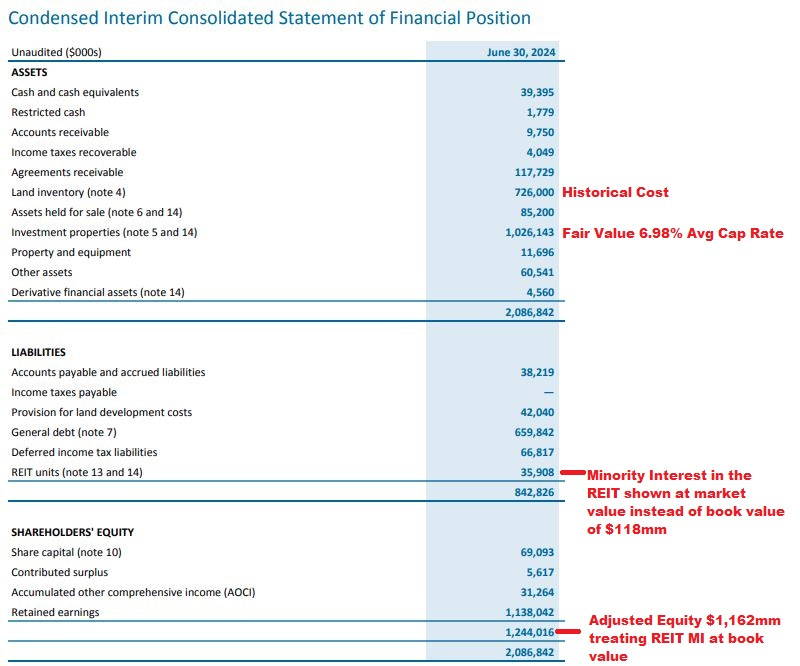

Adjusted Net Asset Value (NAV), or book value with one significant adjustment, should be a reasonable measure of the fair value of Melcor’s assets. Consolidation of Melcor REIT complicates understanding of the parent company financials and has led to a small consistent exaggeration of NAV. MRD consolidates the book value of all the REIT’s assets and liabilities, but reports the publicly held minority interest as a liability at the market value of the public shares (there’s a similar problem at Morguard Corporation, Dream Unlimited, and other entities that consolidate REIT subsidiaries - the companies are following IFRS rules that require this treatment). In any case, I use an Adjusted NAV which is a little bit lower, and I believe more accurate, than the one reported by Melcor.

Privatization of the REIT at $4.95/unit would increase adjusted BVPS from $38.13 to $39.06 and adjustment would no longer be needed.

MRD carries its Land Inventory at Historical Cost - the market value is certainly higher, but hard to judge because none will be sold as raw undeveloped land. Instead it will be transformed into elements of a planned community and sold as small lots for residential housing or larger blocks for commercial use. The uncertain timing and pricing of those future sales makes it impossible to calculate a discounted Net Present Value. Historical cost is reasonable and conservative.

Management probably cares a lot about building their long-term wealth through growing NAV, but Melcor’s share price performance has had little correlation with the steady rise in its adjusted NAV.

Population Growth: Outside of crisis periods, MRD shares have had a strong and logical correlation with the growth in Alberta’s population. When people are moving to Alberta investors become optimistic that the full value of the transformed land inventory will be realized more quickly, creating much higher present value. When population stagnates the transformation could be delayed indefinitely resulting in more pessimistic sentiment about present value.

Summary: By every metric (FFO NAV and Population), Melcor shares have not responded to favorable developments in the past two years. Good news is likely to continue for several years and the stock price could be 50-100% higher with prospects for further appreciation, but there’s no specific catalyst to force it to trade at fair value.

Valuation Benchmarks

Public residential real estate companies with Alberta exposure mostly outperformed during the strong energy market of 2004-2013 (MRD BEI MEQ) and then lagged peers with high ON/QC/BC exposure from 2014 (CAR KMP IIP).

Genesis Land has the business model closest to Melcor. GDC is entirely focused on the Calgary area and does not own commercial property. GDC has provided weaker long-term share price and NAV returns, but its share price is +74% ytd (to 9/13) due to enthusiasm about Calgary housing.

Mainstreet Equity has delivered exceptional share price and NAV returns in all market conditions with its unique value-add strategy. MEQ buys Class B apartments where there is little institutional competition, renovates, refinances and recycles capital to new acquisitions. MEQ’s valuation premium is justifiable if it can continue to grow as it has done for the past 20 years.

Public REIT returns have largely reflected their market exposure. It’s not obvious that any one is significantly superior. Boardwalk leads in 2024 with a +30% ytd total return, but it was a laggard prior to COVID. Interrent has a +1% ytd return, but its high GTA exposure looked smart until 2022.

Dream Unlimited is not shown because it has only been public since 2013 and has a much more diverse and complex business. Dream owns 2460 acres of Alberta land for development, nearly all of which has been held for over 20 years. Like Melcor, Dream sells lots to third-party homebuilders, but also builds homes. Recognizing strong demand Dream has begun adding rental homes, townhouses, and apartments to its developments. I visited Dream’s Alpine Park community in Calgary last year.

Melcor’s NAV long-term return has outperformed GDC and BEI, but its valuation is severely discounted and its 2024 share price return of +18% lags.

Disclosures & Notes

At the time of publication the author held shares of Melcor Developments, and also shares of Dream Unlimited. This disclosure should not be interpreted as a recommendation to purchase or avoid any security and these holdings could change at any time. Investors are encouraged to check all of the key facts cited here from SEDAR filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.

MRD segment reporting has income statements, but no balance sheet. In estimating the Net Assets per segment I assumed the corporate credit facility was entirely attributable to the Land segment.

Melcor directly derived its name from the Melton family, but the origin of the family name is probably related to that sweet apian spittle. Don’t argue with the kitten about this!

Great article! Like the colour you give on the land holdings.

Was surprised with the acquisition of the reit as well. Not a bad price. Guess at current trading price there was no possibility to raise capital anyway at the reit level.

Great article! Thanks so much for taking the time to do the research and write this up. As a long time shareholder I read everything I can find about Melcor, but it's pretty under the radar!