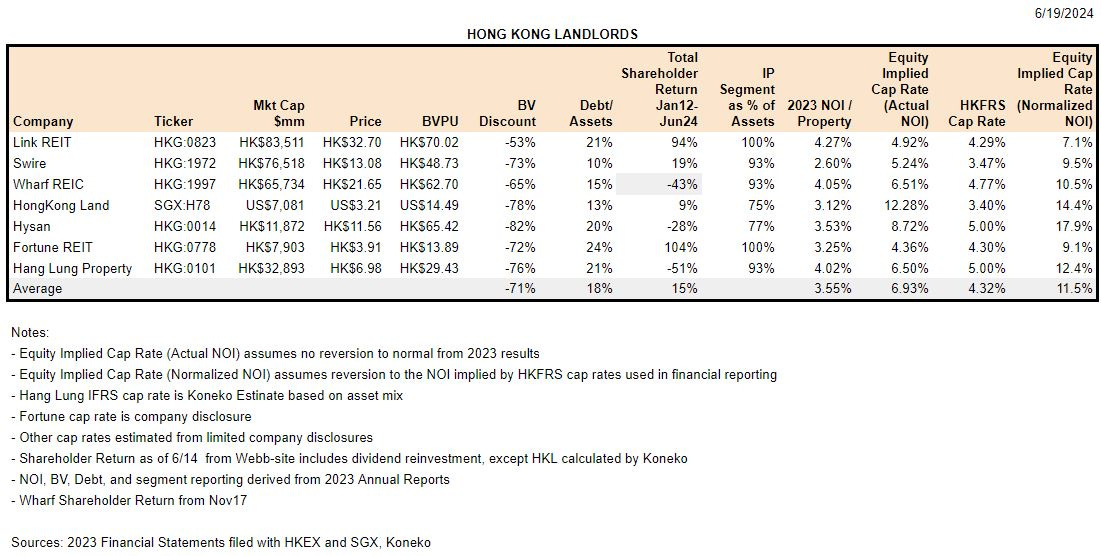

Hong Kong has some of the world’s most expensive real estate properties and some of the world’s cheapest real estate equities.

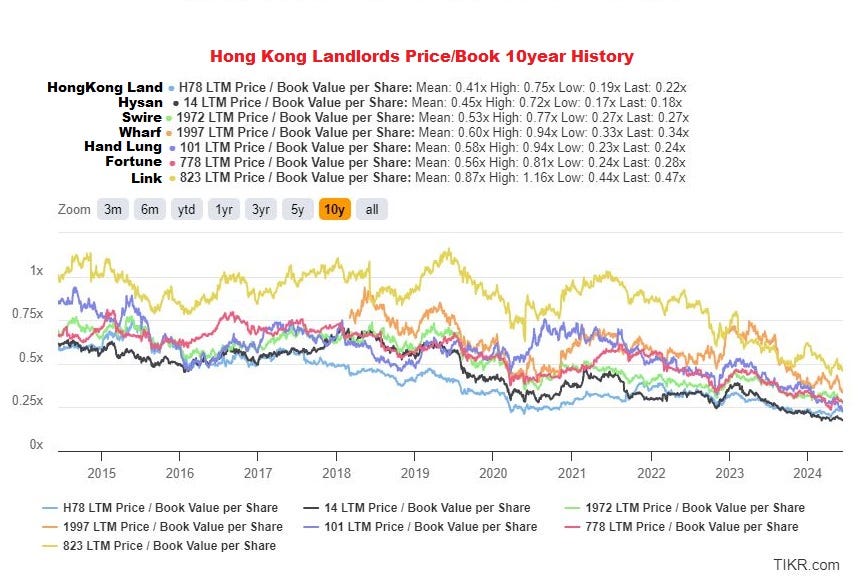

Lack of confidence in the appropriate valuation of Hong Kong property and lack of growth in property income have resulted in a continual decline in equity valuations to an average 71% NAV discount (as of 6/19/24).

Equity implied cap rates look through capital structures to measure the asset level discount reflected in current share prices. Six major Hong Kong landlords have an average equity implied cap rate of 11.5%. HongKong Land appears most attractive at 14.4%.

Topics:

Characteristics of Hong Kong Real Estate Demand - Gateway city with scarce real estate (jump to section)

Characteristics of Hong Kong Kong Real Estate Companies - Family control, dynastic time horizon, low leverage (jump to section)

Unique Hong Kong Market History & Risks - China Growth at US interest rates, unrest, COVID (jump to section)

Market Cap Rates - 3-5% for quality property (jump to section)

Equity Implied Cap Rates - company details (jump to section)

Characteristics of Hong Kong Real Estate Demand

Global Gateway City - International infrastructure, rich culture, exceptional talent pool (6 major universities plus skilled immigration), corporate headquarters and related service providers (legal accounting marketing etc...) and the world’s fourth most important financial center.

Gateway to China - Unique financial and legal status. Approximately 2/3 of capital flows into and out of China pass through Hong Kong and 75% of offshore RMB trading is settled through Hong Kong.

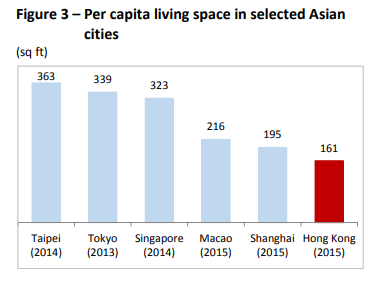

Scarcity - Hong Kong is one of the world’s most densely populated areas with 6300 people per square kilometer, however that understates the degree of crowding because only 24% of the territory’s land is built up, the remainder is mostly undeveloped parkland,

Characteristics of Hong Kong Kong Real Estate Companies

Family control - Most Hong Kong real estate companies are controlled by a family with a 30-75% ownership stake. Public shareholders have legal protections, but very limited influence over corporate actions. These companies will never be taken over by an outside party and are immune to activist pressure. Naive investors sometimes believe that ‘the share price is down, they have to do something’, but … actually they don’t. However, after many generations a controlling interest may be held by a trust with many family beneficiaries not involved in the business and primarily interested in distributions they may receive from the trust. This may impose a governance discipline separate from public share ownership. Hong Kong companies often use pyramid structures to preserve voting control greater than economic interest (e.g. The Keswick family and other members of the “Principal Shareholder Group” own 43% of Jardine Matheson which owns 53% of HongKong Land). Any investor in a Hong Kong property company should understand its ownership dynamics.

Dynastic investment horizon - Corporate planning has a multi-generational outlook. The President of Hang Lung Properties once responded to analyst question about weak retail sales in China by explaining that the company sees the life of its shopping mall developments as about 50 years, and the life of a business cycle as about 7 years, so every shopping mall should be able to withstand 7 business cycles, so the current downcycle was not a great cause for concern. Hysan Development’s used the theme of “The Next 100 Years” for its most recent Annual Report:

Low leverage - Low debt ensures that these companies can withstand any cyclical downturn. They are never distressed sellers of assets and can invest opportunistically without relying on debt financing. Distressed sales of Hong Kong real estate in recent years have been largely from mainland Chinese owners.

Asset mix. Each company is different - they aren’t trying to fit any particular capital markets model of a real estate enterprise. They have varying emphases on property investment vs development, varying exposure to different real estate asset types ( Office/Retail/Residential/Hotel.) They have varying exposure to mainland Chinese and international assets. They have varying exposure to non-real estate businesses.

Unique Hong Kong Market History & Risks

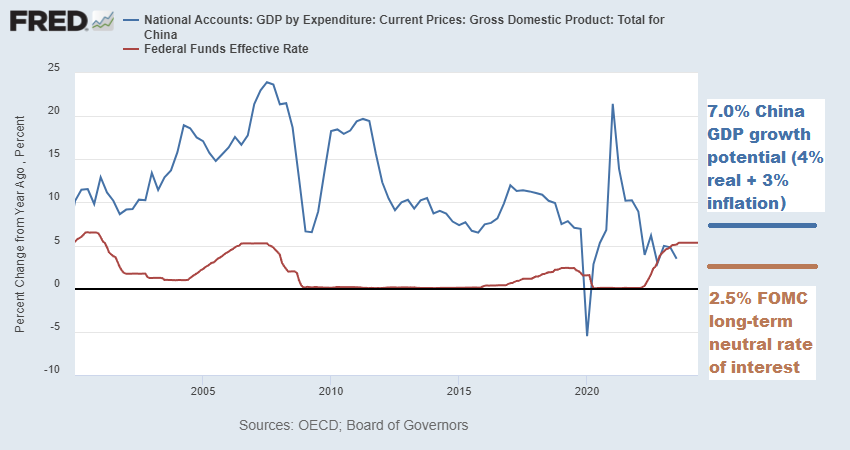

China Growth + US Monetary Policy - For many years Hong Kong was at the intersection of high Chinese GDP growth and accommodative US monetary policy (HK interest rates mimic the Fed due to the currency peg). That bullish backdrop for asset prices reversed in recent years as China shifted to low growth and price deflation while FOMC policy turned restrictive. Over a 3+ year horizon a more supportive environment should reemerge.

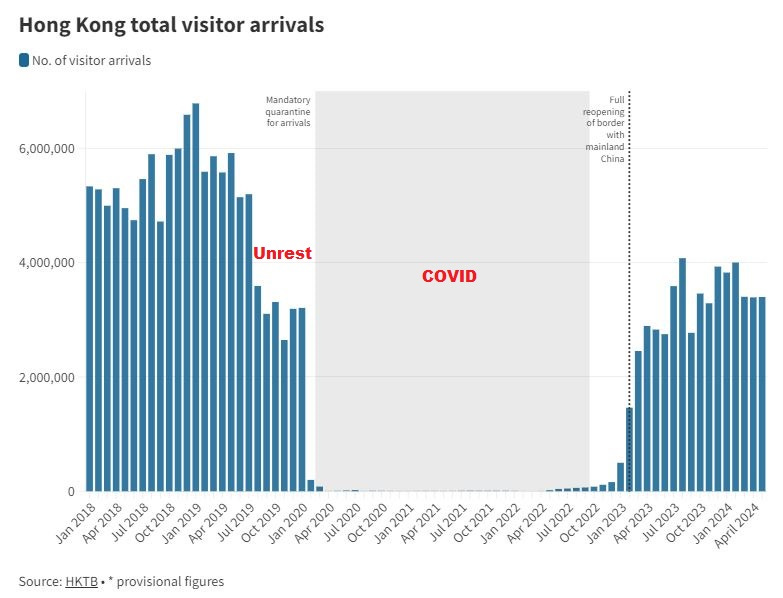

Unrest - Popular demonstrations began in the Spring of 2019 against a proposed law in Hong Kong that would permit extradition to mainland China. People feared that Hong Kong citizens would effectively become subject to mainland Chinese law and courts. Opposition to the law catalyzed demands for democracy. Over the summer and fall of 2019 government intransigence led to a cycle of increasingly disruptive protests and increasingly violent security response. This led to a brain drain of skilled professionals and exodus of businesses.

COVID - Hong Kong pursued a “zero-COVID” strategy with mandatory 21-day quarantine for all arrivals (except Jamie Dimon). The city’s economy depends on its longstanding position as an international gateway, but the gate closed. It imposed a great burden on businesspeople and their families accustomed to easy travel connections. The direct impact of the tourism collapse on hotels was mitigated by quarantine revenues, but the luxury retail sector was severely impacted. The pace of recovery to date has been below expectations and maybe it’s just a matter of time before there is a complete rebound or maybe it wont happen.

New Productive Forces - In the face of increasing domestic and international economic challenges, the government of Xi Jinping continues to bang the cowbell of greater state participation. It’s unclear whether this will work in the long-term in China and what role will be available for Hong Kong’s private enterprises. To some extent Hong Kong has benefited from the fading of what had been possible competition from free trade zones in Shanghai and Shenzhen that also aspired to be intermediaries for international capital flows.

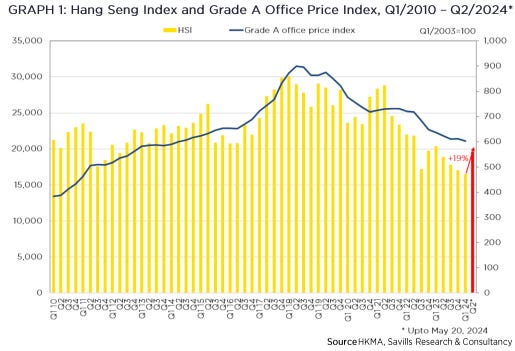

Weak financial markets have tempered demand for office space. Savills noted a high correlation between the Hang Seng Index and office valuations.

Market Cap Rates

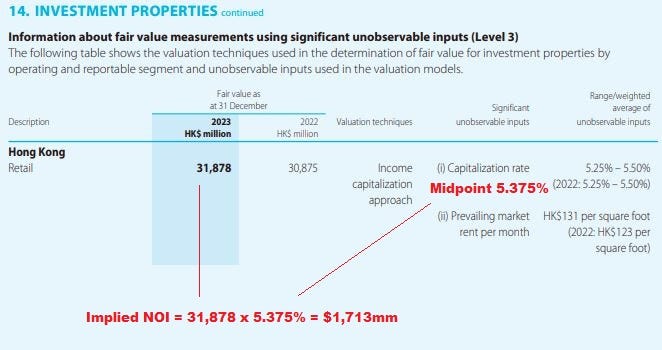

Under Hong Kong Financial Reporting Standards, property held for investment is recorded at fair value determined by an external appraiser using prevailing market cap rates and net property income which can be adjusted for potential changes in occupancy and rents (reversionary income). While Hong Kong interest rates are linked with the US, HK inflation has been lower due to the weak local economy and connection to China which has had consumer price deflation for much of the past year. Leveraged investment in HK real estate is at a negative margin, but unleveraged investment still has a positive real yield.

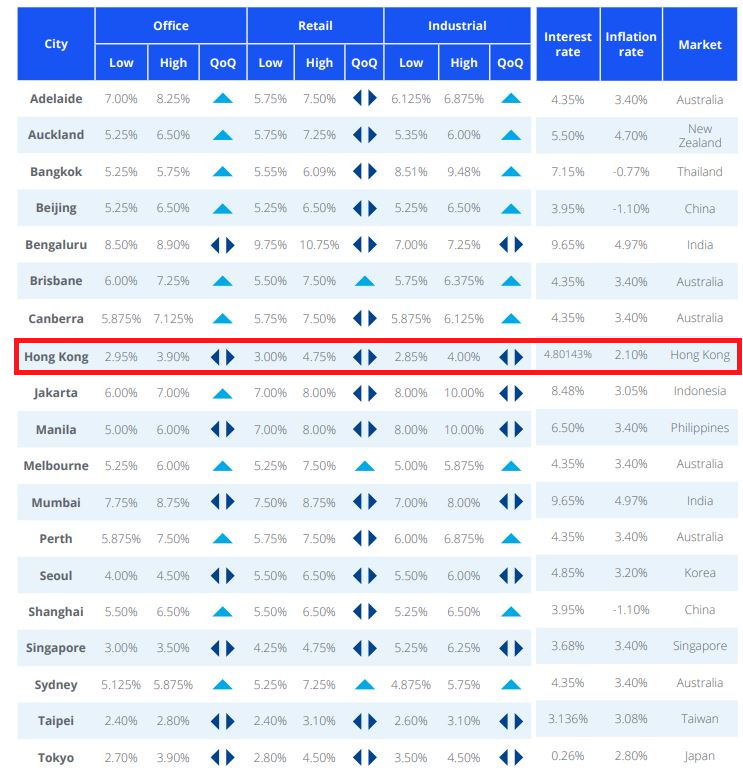

Colliers 1Q24 APAC Cap Rate report showed cap rates from 2.95% for Office and 3.00% for Retail.

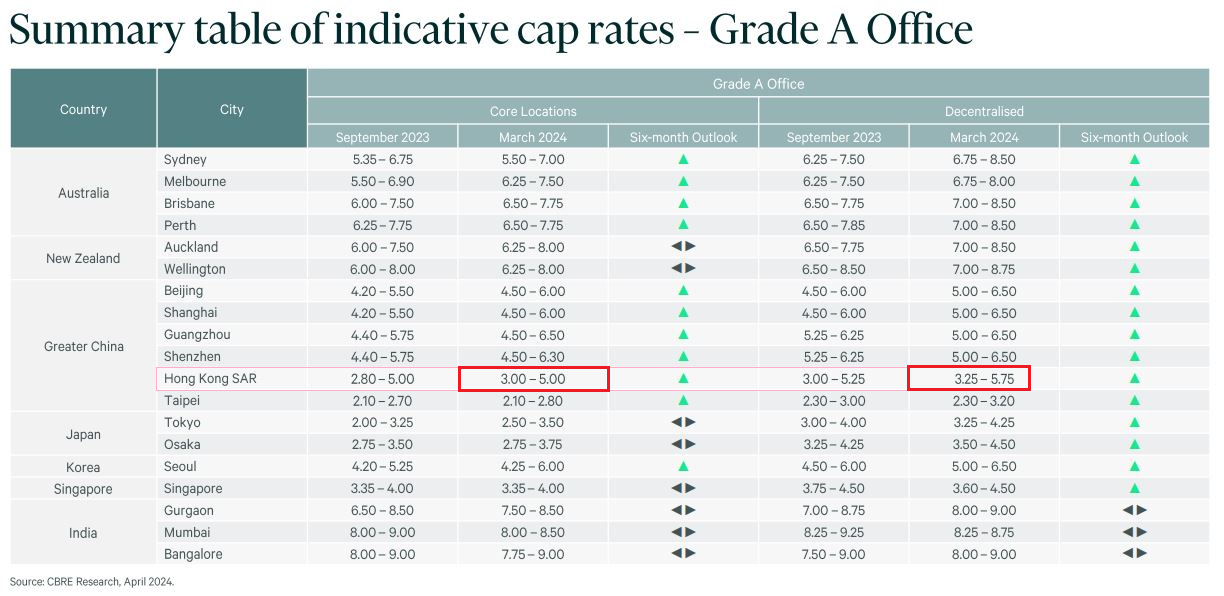

CBRE Q1 2024 Asia Pacific Cap Rate Survey shows cap rates from 3.00% for the best HK core office and 4% for the best HK retail

JLL produces a monthly Hong Kong Property Market Monitor with the latest information about rents, vacancies, and transactions in different Hong Kong business districts.

Equity Implied Cap Rates

Calculation of the property cap rates implied by current share prices of Hong Kong landlords facilitates comparison with international REITs. Comments on the data:

The companies all follow the same accounting standard, but financial statement disclosures about the inputs in property valuation vary considerably. Fortune REIT discloses income and cap rate for every asset. Hang Lung discloses nothing.

Comparison is only meaningful for companies with most of their assets in Investment Property. Some well-known real estate businesses like Sun Hung Kai Properties and Henderson Land were excluded because they have more assets in other operating segments.

Reversionary income can reasonably be assumed to be higher than 2023 results because tenant demand was still significantly affected by COVID and below-trend growth in china. However there’s a risk that overly optimistic recovery expectations could lead to overestimation of normalized income and overvaluation of investment property assets. The table displays a cap rate based on actual 2023 property income and a cap rate based on the reversionary income implied by the property valuations in 2023 financial reporting.

All Hong Kong real estate equity valuations have been depressed by the same factors so this is not an argument in favor of one over another. A similar cap rate analysis of small-cap Hong Kong landlords reveals some with implied cap rates over 20%. A few company notes:

HongKong Land is attractive due to Trophy quality portfolio, financial strength, and strong shareholder return (buybacks + dividends) driven by its parent company (Jardine Matheson). See the 2023 Results presentation for additional detail. HKL’s low cap rate is in line with market rates for its premier Central District properties and actual 2023 income is close to the reversionary income used in calculating property values.

Swire Pacific (parent of Swire Properties) was the subject of an excellent detailed analysis by Asian Century Stocks in 2022 - it’s free and highly recommended!

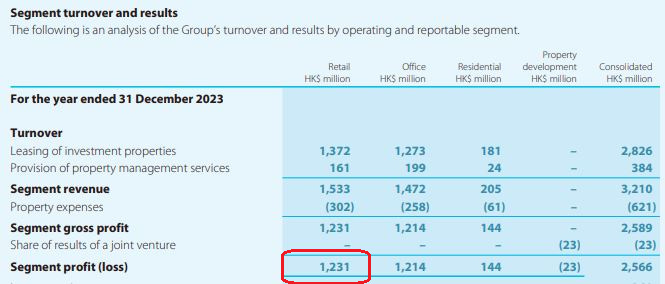

Hysan Development was profiled last month by Superfluous Value. Hysan appears to have been most aggressive in its property valuations. For example, the 5.375% midpoint of its disclosed cap rate range for HK retail property would imply segment NOI at $1,713mm, but actual 2023 segment NOI was only $1,213mm. Management explained in its YE23 conference call that removal of space for renovation depressed 2023 rental income by 6-7% and that annualized rents will recover at a high single digit to low teens rate by the end of 2024. The current share price probably gets you a >10% cap rate on 2025 NOI, very attractive even though it will still fall short of the Reversionary Income implied by its property valuations.

Disclosures & Notes

At the time of publication the author held shares of Jardine Matheson. This disclosure should not be interpreted as a recommendation to purchase or avoid any security and these holdings could change at any time. Investors are encouraged to check all of the key facts cited here from HKEX filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.

Estimation was required due to varying company disclosures about the cap rates used in valuation of investment properties. Please comment if something looks odd.

Yes I agree very thorough analysis. I also like Hongkong Land, especially by holding it through JMH. Funnily enough analysts in the beginning of the year were the most bearish HKL, and the most bullish Link REIT. HKL has been one of the best performers and Link REIT one of the worst so far.

Like someone else mentioned here Great Eagle is also a great property play, although large part of the assets are not IP, but operating assets. But this is just one of the reasons there is so much hidden value there.

Thanks for the excellent analysis. Yes, there is little doubt Hysan's book value is somewhat overstated and while this has some implications for debt/assets etc, hopefully it is more than in the price.