Downtown Calgary has been North America’s most troubled office market with vacancy over 25% for most of the past decade. This article includes first-hand observations of market conditions and REIT-owned properties, but does not have any trade idea. Topics:

The Calgary economy is strong and the downtown area is busy. High office vacancy has not resulted in any “doom loop” of decay and abandonment

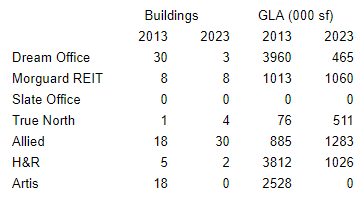

Office REITs hold few downtown properties after asset sales over the past 10 years - a detailed review of exposure at Allied, Dream, H&R, Morguard, and True North

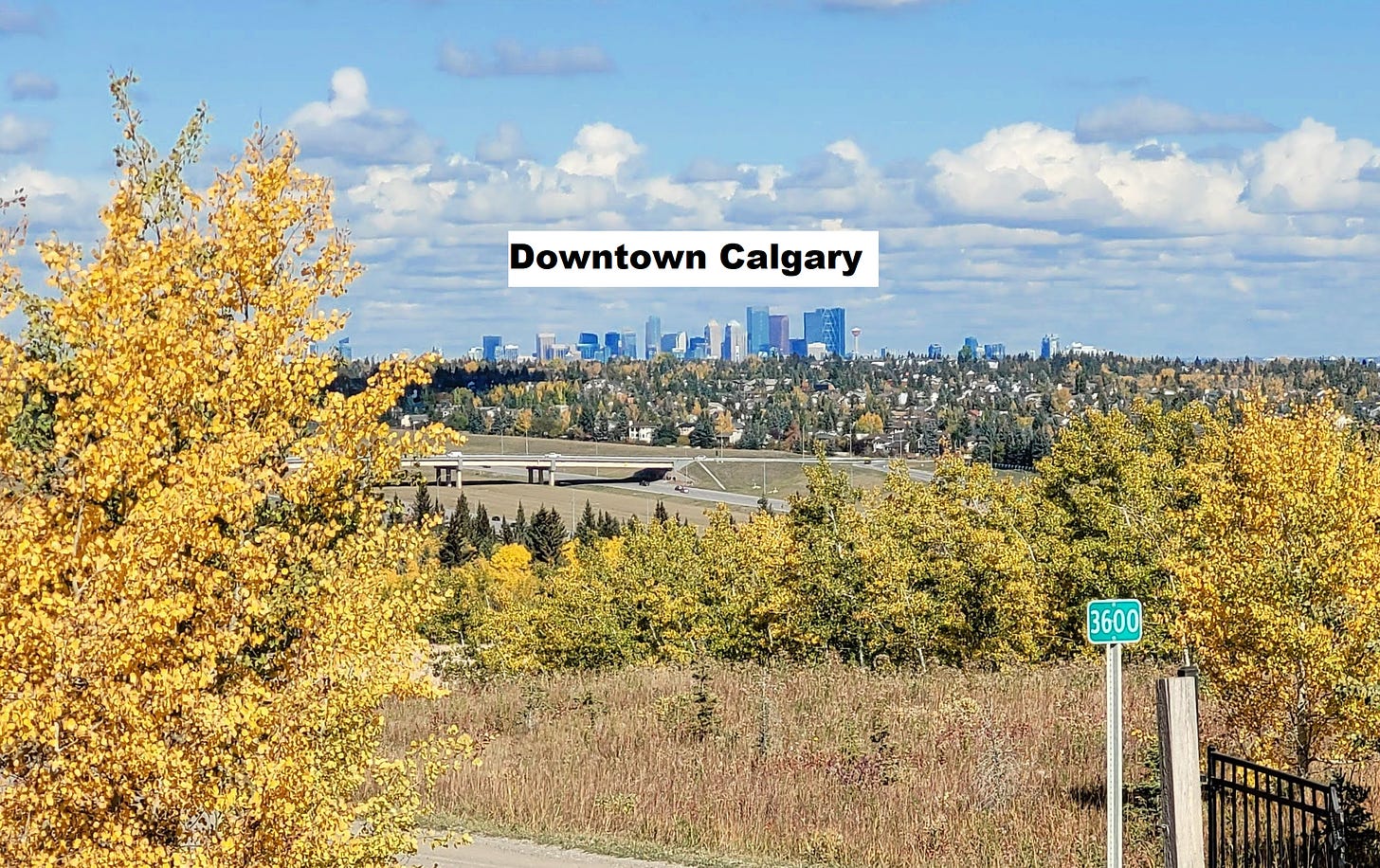

A visit to Dream Unlimited’s Alpine Park suburban residential development

Invitation and discount code for the 2024 Canadian REIT Investor Conference at the St Regis Hotel

Calgary Economy

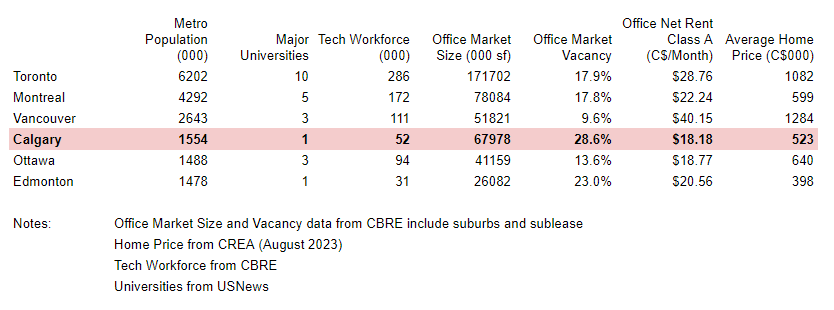

Calgary’s population and economy have grown rapidly over the past 50 years due to the strength of the regional energy sector, business friendly government, affordability, and attractive climate. It shares similarities with Sunbelt markets in the US. The city has also suffered from dependence on the energy sector and weaker educational and cultural institutions compared to Toronto, Montreal and Vancouver.

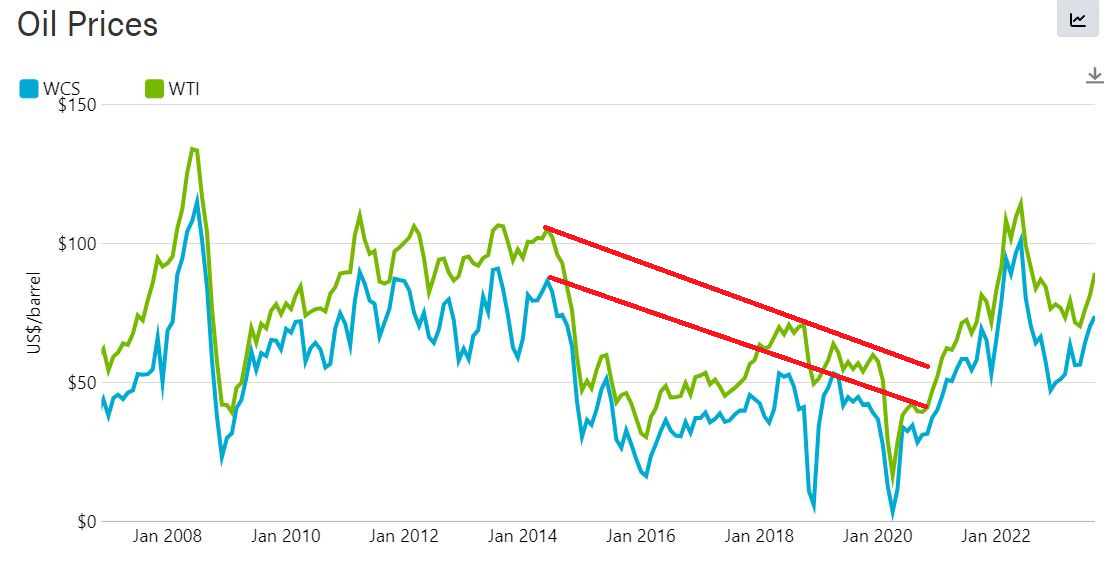

Oil prices fell into a lengthy bear market from 2014 with Western Canadian Select (WCS - a benchmark price for blend of Canadian heavy sour oil) falling almost to zero in 2018 and again in 2020.

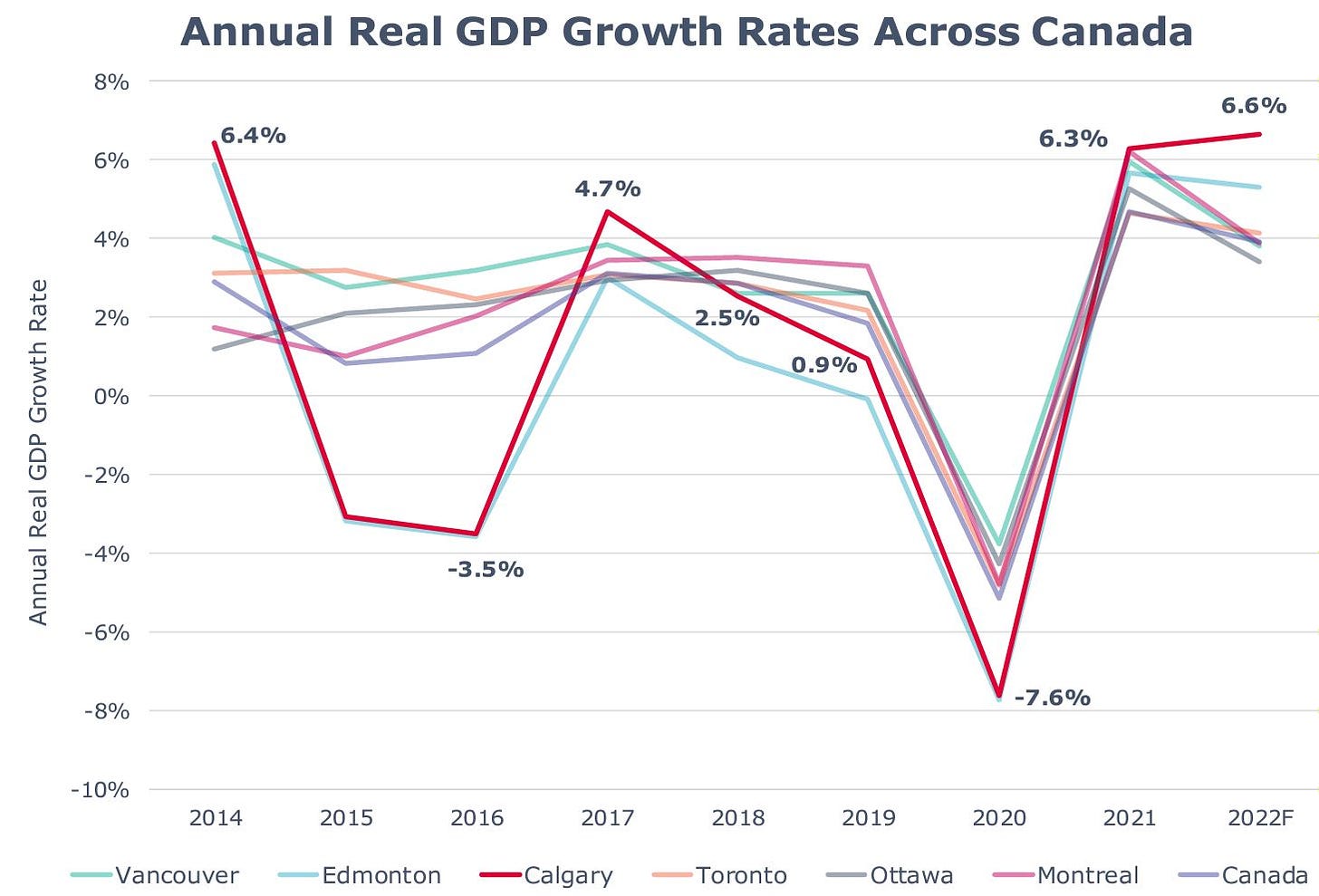

The Calgary economy lagged national growth for 2015-2020 and its GDP actually declined in 2015, 2016, and 2020.

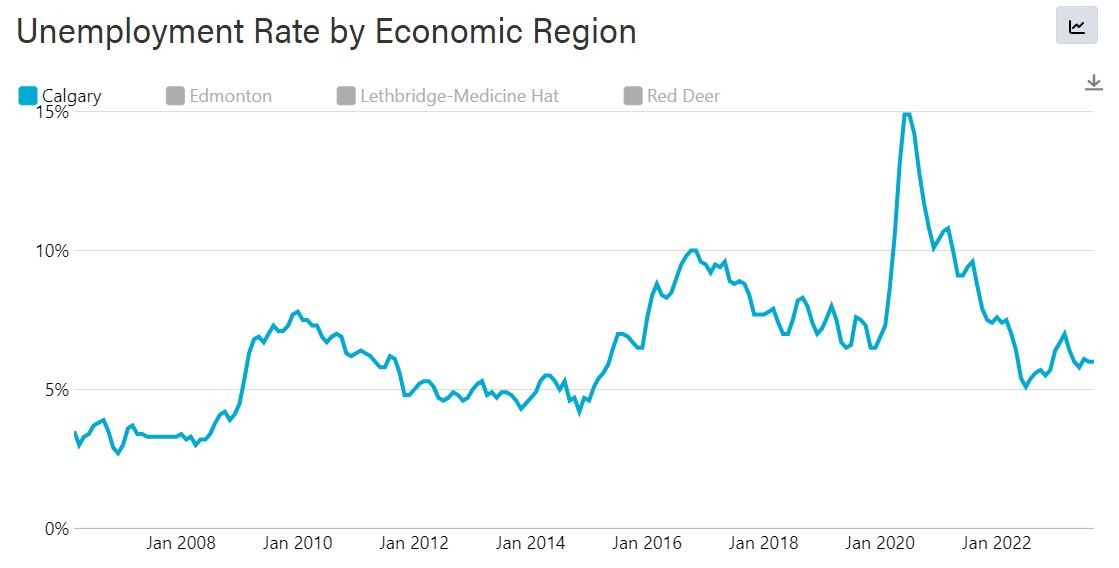

Unemployment trended higher from 2015-2019.

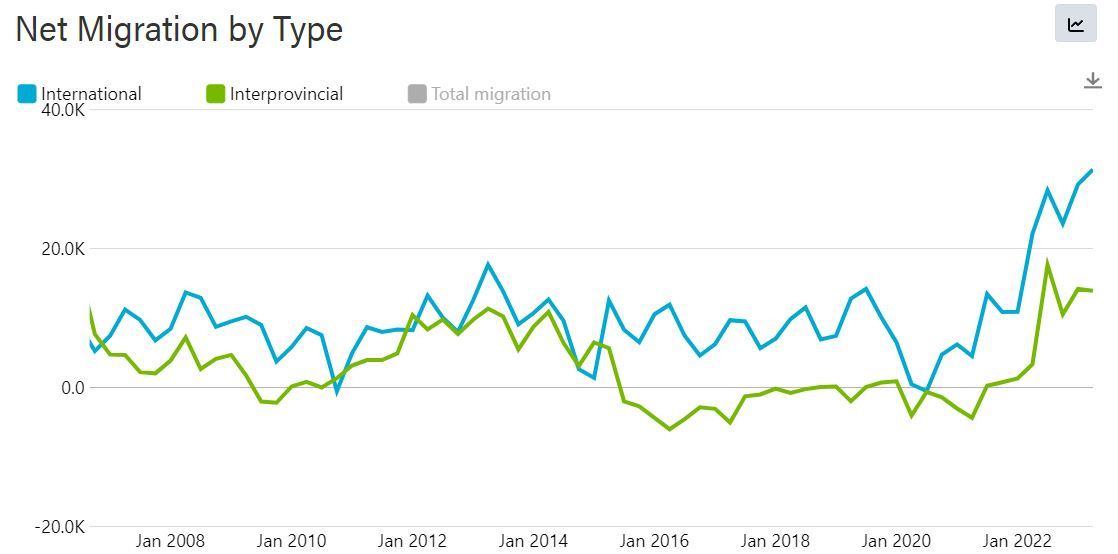

Alberta’s population growth stagnated with continued modest international inflow, but migration to other provinces from 2016-2021.

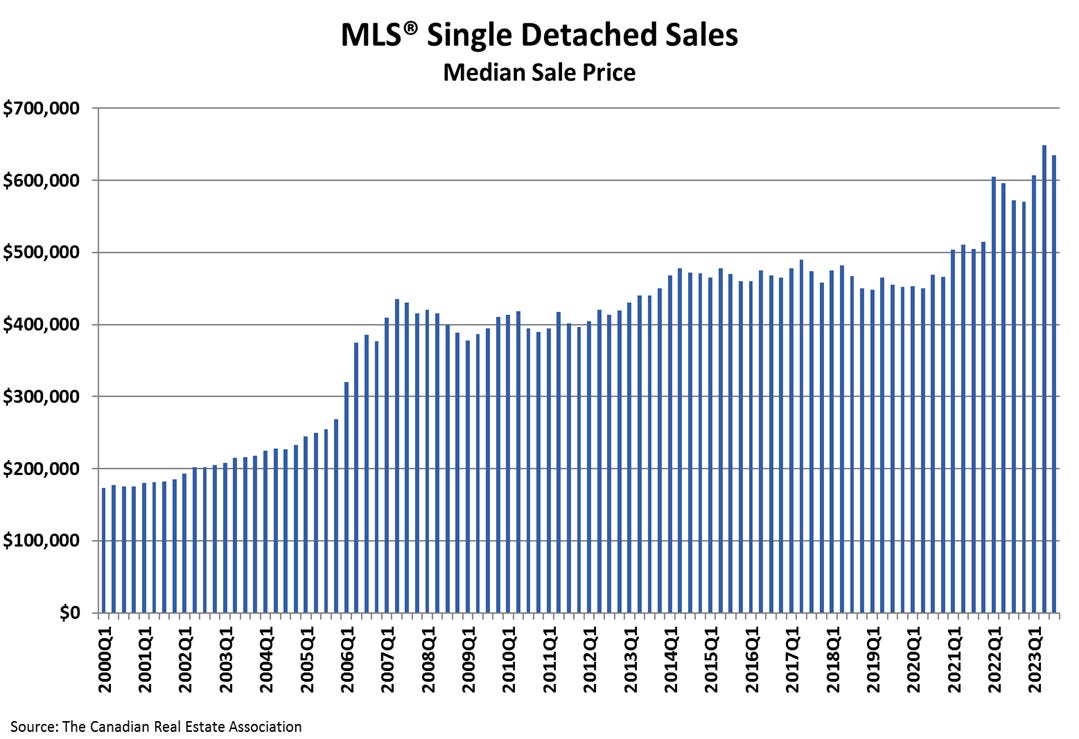

Home prices were flat from 2014-2019 while they surged in Toronto and Vancouver.

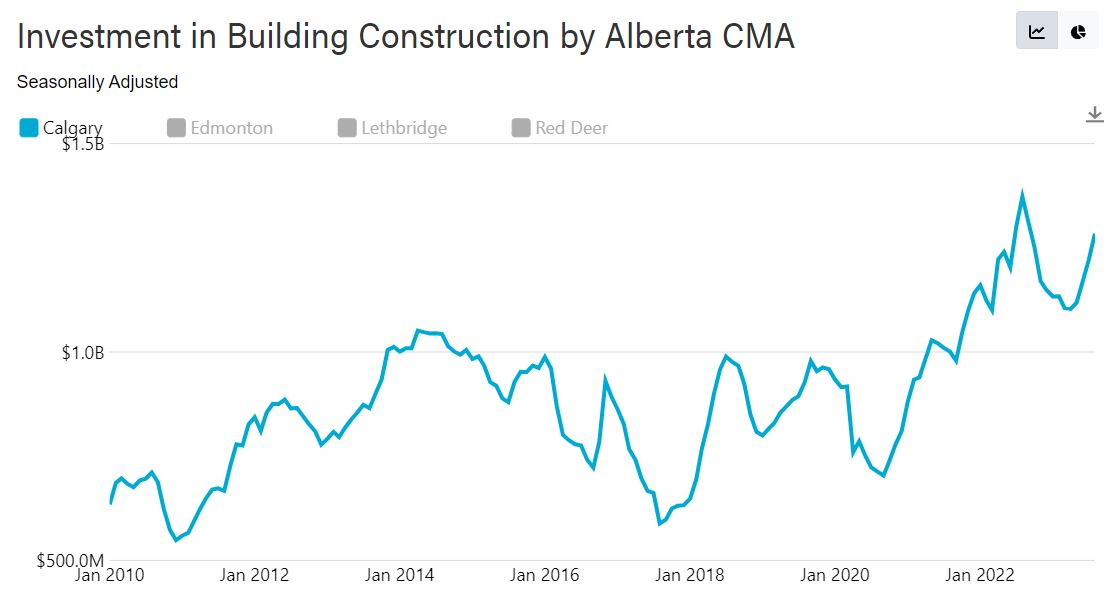

Real Estate Investment was weak from 2014-2020

All the numbers are pointing in the same direction: after a lengthy slump from 2014-2020, over the past 2 years the Calgary economy has rebounded, population is surging, real estate investment and home prices are rising, but remain extremely affordable compared to Toronto and Vancouver.

My personal observation was that downtown streets were busy. The city’s high office vacancy rate has not resulted in any “doom loop” of decay and abandonment. Retail vacancies are low (overall 4.2%, including 6.4% for street front locations). I saw a few homeless people, but no panhandlers and nobody causing any disturbance. The crime rate is low with just 29 murders in 2022. Even alleyways have no trash, no tags, no stickers and no chaos.

Calgary Office Market

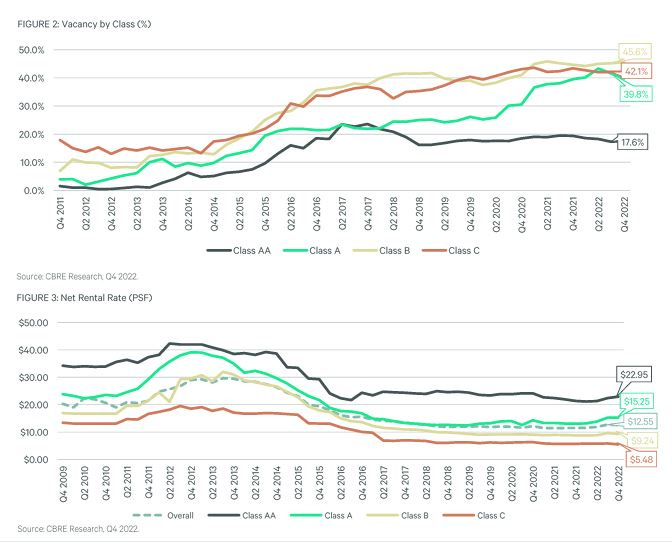

The long oil boom from 2003-2013 led to a surge of premium office supply that swamped the market just as oil prices and office demand collapsed from 2014.

Even as demand disappeared, developers delivered super-prime towers planned during the boom, including The Bow (2012), Telus Sky (2020), Brookfield Place (2017), 707 Fifth (2017), City Centre (2016), and 8th Avenue Place (2014).

These trophy towers have benefited from leases with anchor tenants and best-in-class design and amenities. They have maintained relatively healthy occupancy by draining demand away from older buildings. Rents at every type of property fell sharply and have yet to recover.

REIT investors value clarity and predictability which have been impossible to deliver from Calgary assets suffering falling occupancy and NOI. REIT exposure to the downtown Calgary Office market declined substantially over the past 10 years.

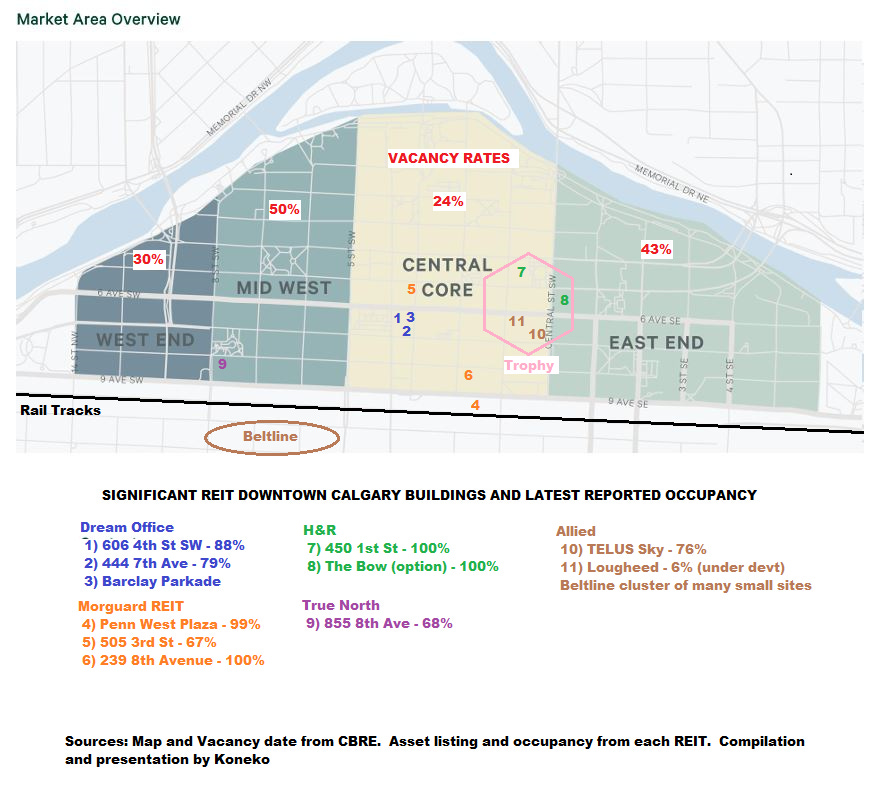

Calgary’s Central Core is Relatively Stronger

Excluding suburban properties, REIT holdings are concentrated in the Central Core where vacancy is lowest.

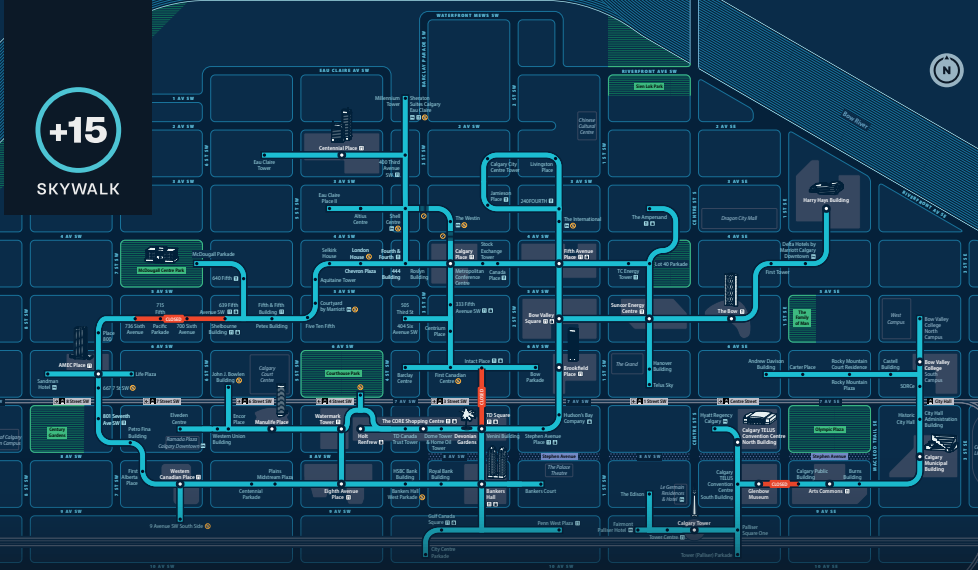

The Central Core is connected by the all-season +15 Skywalk network. Such pathways have sometimes been faulted for draining pedestrians away from street level, however leading Calgary office buildings have created attractive open public spaces connecting ground and skywalk levels. Nearby towers with appealing public access form a desirable neighborhood, such as the area I described above as “Trophy” space with The Bow, Telus Sky, Brookfield Place, and the Suncor Centre.

Public spaces at The Bow, Suncor Centre, and Brookfield Place:

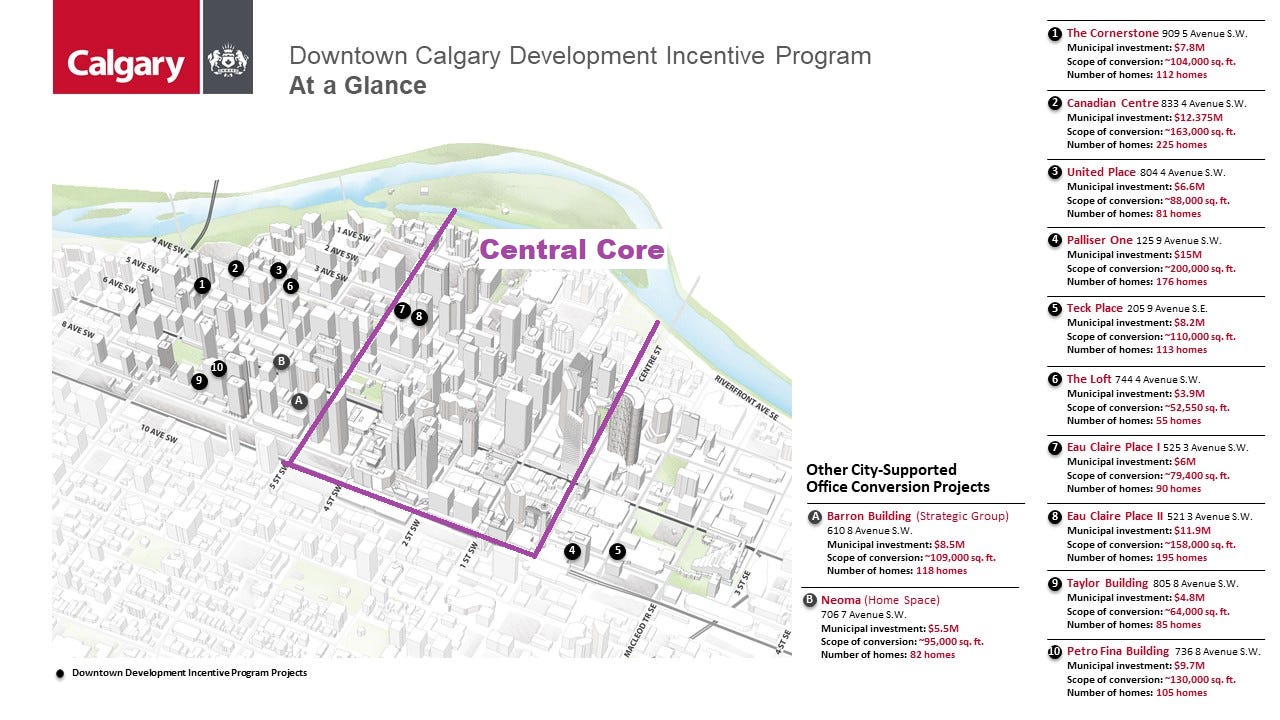

In order to address high vacancy rates outside the Central Core, the City of Calgary provides a significant incentive ($75/sf) for conversion of office space to residential use and has added incentives for conversion to educational use and even for demolition.

Conversions are benefitting from the city’s economic strength and very high demand for multifamily housing with rents up 27% in the past year and waitlists at some properties.

Office REIT holdings:

Dream Office (D)

D has 3 remaining downtown locations forming a solid city block: 444 7th, 606 4th, and an adjacent parking garage. The buildings face the attractive Courthouse Park and the Calgary Courts Centre. Field Law is the anchor tenant at 444 with its name at the top - the location will have lasting appeal for legal and professional services tenants. The low density of the block (10 storeys at 444, 14 storeys at 606, and 4 at the parkade) suggests it may have long-term redevelopment potential and it makes sense that D patiently held these properties while it disposed all its other downtown Calgary assets.

Morguard (MRT)

There has been minimal change to MRT’s Calgary holdings over the past 10 years, most of which are in a suburban area close to the airport. MRT has just two properties directly affected by the weak downtown market. Penn West Plaza has been 100% leased to Obsidian Energy (f/k/a Penn West Petroleum) since 2010 with a lease expiring in January 2025. MRT modified the lease and agreed to a rent reduction in 2020 when Obsidian nearly failed. Obsidian has sublet a portion of its space to Athabasca Oil and others. The challenge for MRT will come in 2025 when the Master Lease expires, but the REIT disclosed on its 3Q23 conference call that it has already completed lease extensions covering half the space - a very positive development. The building is new (finished 2010), the location is OK in the central Core, adjacent to the Fairmont Hotel, close to the Trophy towers, and at the tail end of the +15 network, but the public space is small and plain with visitors greeted by a horse’s ass.

Not attractive, however the 100% lease to Obsidian gave Morguard no incentive to make improvements. An upgrade program could enhance its appeal as a multi-tenant property from 2025.

MRT also owns 505 3rd. It’s at an OK location in the Central Core, on the +15, and for some reason there’s a deformed concrete head at the entrance (you can almost see tears). The building is aging (1978), unattractive, and does not really deserve significant capital investment, but occupancy is still too high for residential conversion.

MRT also owns a downtown property at 239 8th Avenue which is 100% leased to the private banking division of National Bank. The adjacent Stephen Avenue is a major pedestrian mall known for some of Calgary's finest restaurants, cafés, pubs and bars. If National Bank were to leave then MRT’s property would be a very attractive retail location and possibly an extremely valuable mixed-use development site (the existing building is only 3 storeys).

True North (TNT)

TNT has 3 suburban Calgary buildings leased to government tenants, leaving 855 8th Avenue (Century Park Place) as its only property exposed to downtown market weakness. It’s in the Mid-West district with Calgary’s highest vacancy. Several nearby office towers are being converted to residential use and that could be the best outcome here.

Allied (AP)

Allied is the only REIT that increased its exposure to downtown Calgary over the past 10 years, but mostly through its niche strategy of accumulating small heritage buildings with unique character and long-term intensification potential. The REIT has renovated several heritage buildings near the trophy towers (Lougheed Block, OddFellows, and the Telephone Building).

Allied also retains the office portion of TELUS Sky, one of the city’s trophy towers, which it describes as “the only cowgirl in a city of cowboys”.

Allied has accumulated a portfolio of low-rise heritage buildings in the Beltline district adjacent to the rail tracks that were once the center of the city’s economy. It resembles the strategy the REIT used very successfully in Toronto where it acquired property slightly outside the core CBD from 2003-2010 and then from 2010-2020 shifted to adding modern towers above the existing structures. Allied expects that its current Calgary inventory of 1.2mm sf could support additional density of 1.2mm sf 10+ years in the future. For the time being an uncertainty about this strategy is that Allied’s core knowledge-based tenants (Tech + Advertising + Media + Information) are a small portion of the Calgary market. Calgary wants to diversify its economy by attracting such businesses, but the limited local talent pool (fewer tech employees and fewer top colleges) means it will depend for many years on migration.

H&R (HR)

HR has a single downtown property 100% leased to TC Energy until 2030. The REIT also has a retained interest in the The Bow tower which HR built backed by a 100% lease to Ovintiv (f/k/a/ Encana) until 2037. Seemed like a great idea: one of Canada’s best buildings, one of Canada’s best companies (at the time), and one of Canada’s highest rents. Exposure to Ovintiv and Calgary risks came to dominate investor perception of H&R so in 2021 the REIT sold an economic interest in the property and the income from the Ovintiv lease to Oak Street Real Estate, but retained an option to repurchase the property in 2038 for $737mm (368/sf, well below construction cost). Analysts estimated that proceeds were equivalent to a cap rate of about 8% and better than dismal investor perception of Calgary office values, however that below market repurchase option will look more and more valuable over time. The H&R team deserves credit for the structure of this deal - how many CEOs would push to include an option that would only pay off 15 years in the future?

Dream Unlimited Alpine Park

What I learned from visiting in person:

The property is on a ridge providing beautiful views in every direction

Development is moving fast.

Alpine Park is an especially attractive development in a growing city with good affordability and appealing lifestyle.

Alberta has a lot of land, but now I see why Michael Cooper bought this property for Dream over 20 years ago.

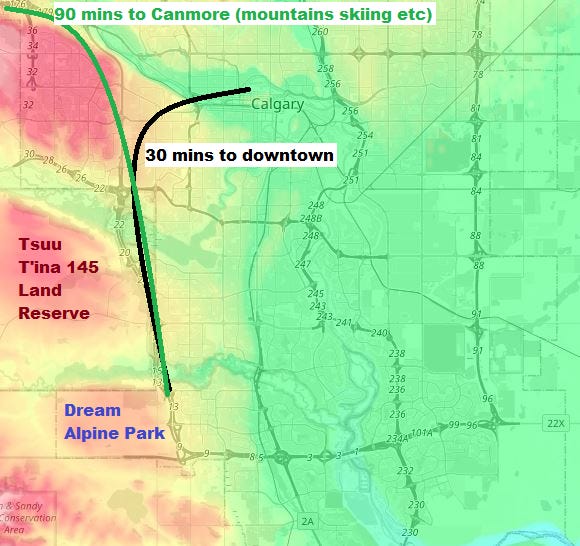

The property’s elevation offers premium views of downtown and the surrounding area. The recently completed ring road provides excellent connectivity. Topographical map:

Immediately north of Dream’s Alpine Park is the Tsuu T’ina First Nation 145 Land Reserve. Like Alpine Park it has great natural beauty, but it will remain outside the boundary of Calgary city and municipal services. The Tsuu T’ina signed an agreement with Candarel to develop property along the ring road. At this point their development does not have residential property in competition with Alpine Park. An already completed Costco is very convenient for Alpine Park residents.

Dream owns 1650 acres comprising a majority of the space described on the above map as Dream Alpine Park. Within that larger area Qualico is currently building a 160 acre development it calls Vermillion Hill. I asked Dream whether Qualico had acquired its land from Dream and whether there was any Master Plan including all area landowners and have not received any response.

When I visited Alpine Park the beautiful autumn foliage had been clear cut to make space for rapid construction of the Dream community.

Some homes are completed and residents have already begun moving in.

Dream is building a portion of the property itself while also selling lots to independent builders. Dream’s financial statements provide extremely limited disclosure about its land development business. The 2Q23 MD&A mentions a total of 52 lot sales and 47 home sales in Western Canada (Calgary + Edmonton + Regina + Saskatoon), but no detail or commentary and no mention at all of Alpine Park. It’s obvious that this land will be a very valuable asset for Dream, but it’s hard to find that value in Dream’s financial statements.

Dream’s Investor Day presentation shows the initial 650 acre Alpine Park development to which I added what I believe is the site of the Qualico property. Dream’s commercial Village Centre (“inspiring public art, curated shops, and charming cafes”) will be in Phase 2 with direct connection to the ring road. Development by Qualico will feed more traffic through this area. Phase 3 may include multifamily rental units.

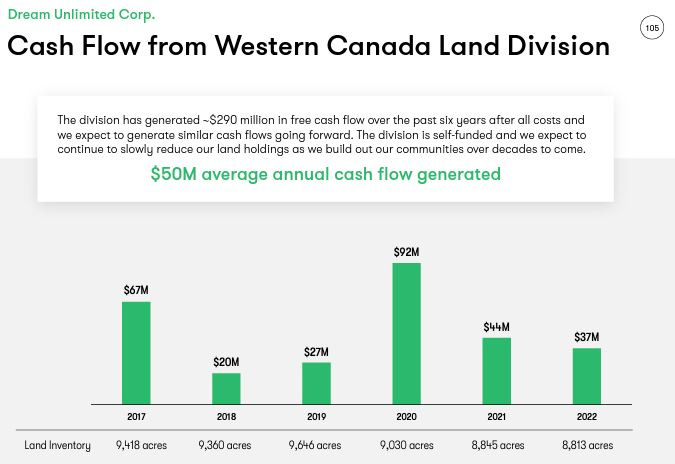

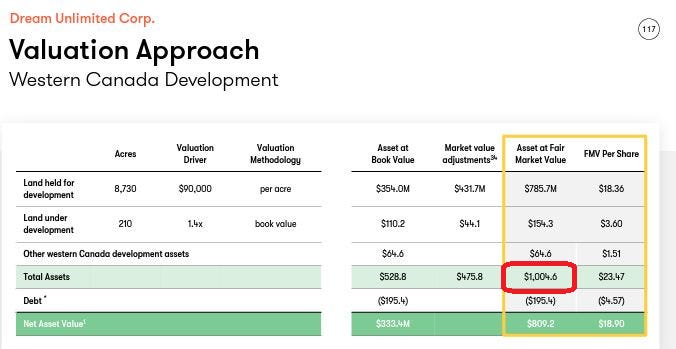

The Investor presentation suggests that Dream may achieve a “land development IRR” of 30% with “minimal new cash equity needed”. Dream attributed $1,004.6mm of asset value to its Western Canada land development business and disclosed that “Cash Flow from Western Canada Land Division” has averaged +$50mm/year.

I asked Dream where I could find this information its its financial statements and have not received any reply. Dream’s 2Q23 MD&A showed 1H23 FFO from “Development - Western Canada” of ($5.8mm). I asked Dream whether FFO disclosed in the MD&A was comparable to the “Cash Flow” mentioned in the Investor Presentation and have not received any reply. I believe this has been an ongoing problem for Dream investors that it’s difficult to connect the exciting anecdotes from CEO Michael Cooper with analysis of the financial statements. Alpine Park appears to live up to and exceed everything Michael Cooper has said, but the company’s MD&A never mentions it. Dream investors and management can compare Dream’s disclosures with those of Melcor Developments and Genesis Land that also have Alberta residential developments. Dream has a broader business than those companies, but investors would benefit from better visibility into this division that Dream says is worth $1Bn, more than the company’s 11/1 market capitalization of $711mm.

2024 Canadian REIT Investor Conference

The prestigious St Regis Hotel in downtown Calgary has everything Canadian REIT investors need after a difficult 2023.

Use code KONEKO for a special early bird discount (LINK)

Disclosures & Notes

At the time of publication the author owned shares of Dream Unlimited and units of Dream Office REIT and H&R REIT. These have been disappointing investments so it would probably turn out badly for you if you bought them. The author does not make any recommendation regarding any investment in any company mentioned in this article. Investors are encouraged to check all of the key facts cited here from SEDAR filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be correctly as promptly as possible.

Calgary’s St Regis Hotel closed in 2006. It is one of very few remaining buildings in the city built before WW1. Maybe Michael Emory (Allied Properties) will try to buy it.

A link to this article was sent to Dream Unlimited. I will edit the article if the company responds to any of my questions.

Great write-up. Thanks for sharing. Own TNT, Dream Office, AP in small positions and a large postion in Artis. Hope I don't end up at the Regis! Hah