Canadian REITs have delivered a -1.8% ytd total return (XRE to 3/22/24) but offer reasons for optimism over the balance of the year:

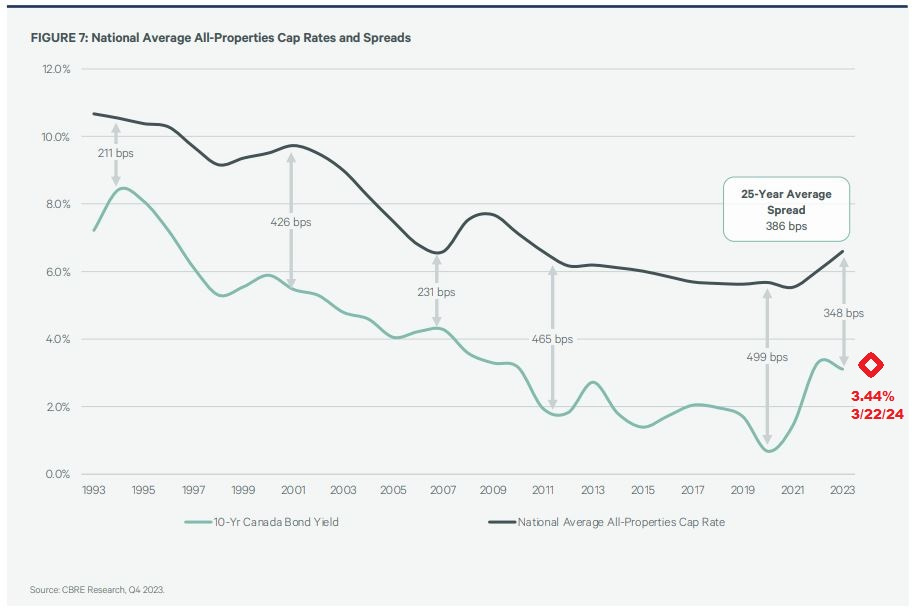

The yield premium of cap rates over 10-year bond yields is near the middle of its historical range. Cap rates are less volatile than bonds - the spread tightens when bond yields rise and expands when bond yields fall.

Insiders at 19 of 33 REITs have been buyers so far in 1Q24. 4 REITs have had net insider sales.

Financing has remained available - even the weakest REIT has been able to extend expiring mortgages. Commercial real estate foreclosures have been rare.

Transaction volume is recovering and REITs that need to sell assets have an opportunity to do so. Private Buyers are available for smaller deal sizes (under $100mm). Institutions and public companies have been on the sidelines. Foreign buyers have made a few large strategic purchases in the past year. Office transactions are most difficult and every case is a special situation that may involve vendor financing or development/conversion potential. For additional information on market conditions see: CBRE 2024 Canada Real Estate Market Outlook, JLL Canada Real Estate Outlook, and Marcus & Millichap 2024 Canada Investment Forecast.

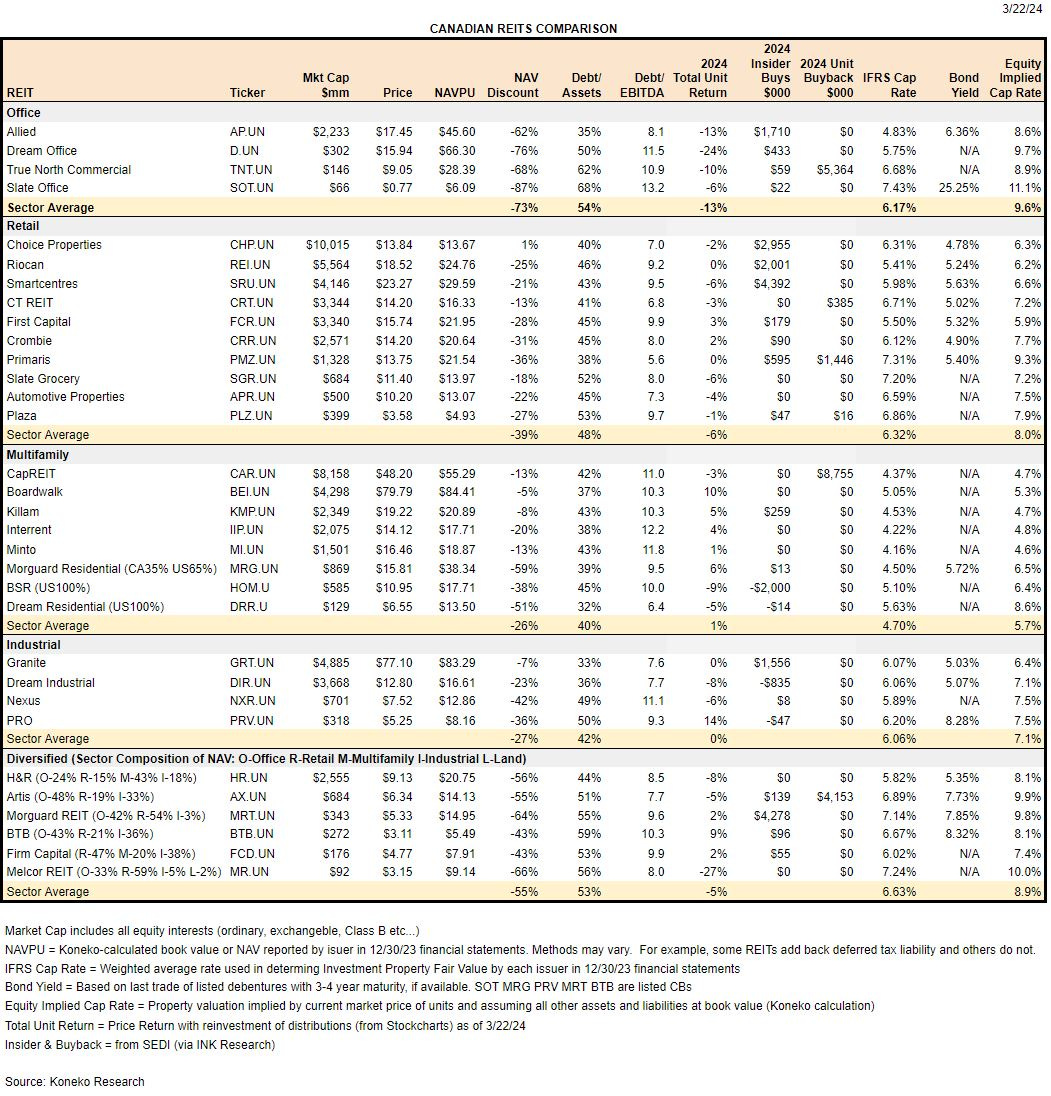

H&R and Primaris offer the best balance of potential return vs risk.

A comprehensive review of all REITs provides valuable context in identifying individual opportunities, especially among the diversified REITs. This article adds comments on companies at valuation extremes or with recent corporate news that has implications for the whole sector. Please comment if you think any significant news or opportunities were overlooked.

Jump to topic:

Office Section with comments on Allied Properties and Dream Office

Retail Section with comments on Primaris

Industrial Section with comments on Nexus

Diversified Section with comments on H&R, Artis, Morguard, and Melcor

Office REITs

Office market challenges are extremely well-known. It’s taking time for tenants to determine their long-term occupancy needs as hybrid work arrangements become permanent. REIT equity prices amply discount the risks, but its hard to forecast when fundamental office demand will improve.

Allied Properties (AP.UN)

AP has generated the best lifetime return among Office REITs through a disciplined focus on top markets (Toronto, Montreal, Vancouver, Calgary), creative spaces for knowledge-based tenants (TAMI - Tech Advertising Media Information), and conservative leverage. The REIT has remained extremely active over the past year in pursuit of its long-term vision, however uncertainty over the near-term outlook has increased with the recently announced acquisitions of properties in Vancouver and Toronto. Concerns:

TAMI tenant demand softened in 2023 while a couple of large “next-generation creative office spaces” are entering the Toronto market (T3 Bayside on the lakefront and T3 Sterling near MOCA and the Dufferin Mall). Allied’s 4Q conference call mentioned increased tour activity and a high level of leases under negotiation, but with a much longer time to complete transactions than pre-2020. Dream Office cited increased interest at its properties from Tech tenants so that could be a good signal for AP: “We're starting to hear on tours that some tech firms are starting to get some more funding, which bodes well going into 2024.”

The Well office space in Toronto offered for sublease by Shopify remains unfilled. Shopify continues paying rent to Allied under its 15-year lease, but the continuing vacancy in this high-profile property that has received extremely favorable public reviews poses competition for other Allied buildings and depresses market sentiment.

Allied’s acquisition of 400 West Georgia in Vancouver at a valuation of $395mm ($1066/sf) is a premium price for a premier property in North America’s strongest office market. The pricing for the purchase of 19 Duncan in Toronto at a valuation of $526mm (about $1087/sf) reflects use of about 2/3 of the space for residential rental. Cap rates on these transactions could be about 4.5% and Allied said: “The transactions will put modest and temporary upward pressure on Allied’s total indebtedness ratio and net debt as a multiple of Annualized Adjusted EBITDA” and “The transactions will also put modest and temporary downward pressure on Allied’s cashflow per unit.” Investors will hope for clearer guidance when 1Q24 results are released. Prior to these transactions Allied intended to maintain its current dividend of $1.80/year which requires about $230mm. Investors will hope to hear whether management may reduce the dividend during the “temporary” period of higher debt and lower cashflow.

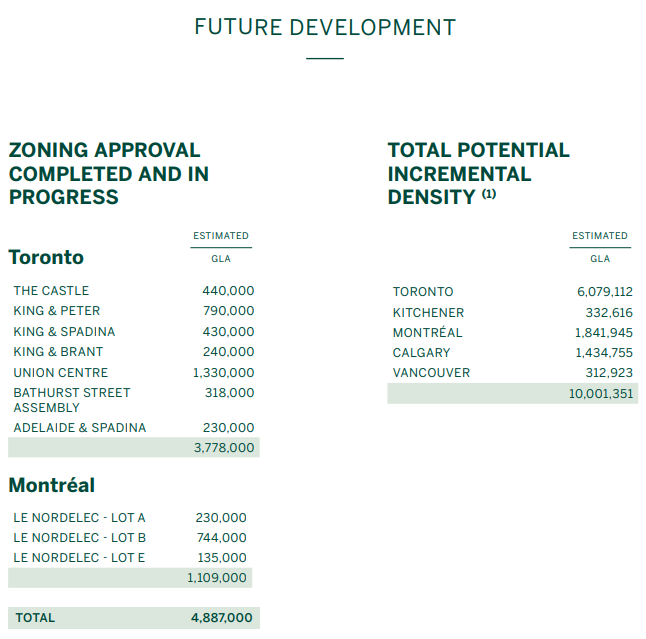

Allied’s acquisition of the residential spaces at TELUS Sky in Calgary and 19 Duncan will “establish our urban rental-residential portfolio in a concrete, material and timely way”. The REIT has not previously retained residential rental property for long-term investment so investors will hope to hear how the REIT’s strategy may evolve and impact the realization of value from the large future development potential of Allied assets:

Dream Office (D.UN)

D was described in detail in my commentary (DREAM Unlimited & DREAM REITs: A Fresh Look At Opportunities To Maximize Shareholder Value). Recent news supports my belief that the REIT is an attractive acquisition target.

The valuations of Allied’s recent purchases in Vancouver and Toronto show that there is no distress and no bargains available for top quality properties. Purchase of Dream Office REIT would give a conservative long-term investor the unique opportunity to acquire a concentrated Toronto core portfolio at a discounted price not available through direct asset acquisitions. D is not “for sale” and does not need to sell, however a deal price at $40/unit would imply a cap rate of 7.3% that would be very attractive for the buyer while providing Dream Unlimited (holder of 33% of Dream Office) with a large liquidity infusion that it could use profitably elsewhere in its portfolio. An ongoing role for DRM as minority investor in the buyout vehicle and manager of disposition of D’s non-core assets might increase the appeal of a transaction. Recent purchases of D by Artis REIT raised its stake to 17% and CEO Samir Manji commented in his Letter to Unitholders that it was a “potential target for M&A activity”.

Dream Office would benefit from one non-core asset sale in 2024 to cover the cash used for its building improvement program and tenant incentives. Allied commented that it has received “unsolicited offers to purchase” smaller properties in Toronto that are not part of its long-term plans. Similar private demand is likely to be interested in Dream assets.

Retail REITs

Retail real estate performed well-through COVID. Excess capacity resulting from retailer bankruptcies and ecommerce impacts was largely resolved in 2015-2019. COVID demonstrated the resilience of consumer demand for essential services shopping (grocery and pharmacy) and omnichannel became the dominant retail model for maximization of customer convenience, brand awareness, and efficient distribution. Alberta markets that were weak from 2015-2020 are now thriving due to an energy sector rebound and affordability of housing. Financing remains available for Retail property owners and REITs have been able to dispose of non-core Retail assets.

Primaris (PMZ.UN)

Malls continue to be out of favor with investors which provides an excellent opportunity for Primaris to apply its financial strength in execution of its growth strategy. CEO Alex Avery explained on the 4Q23 conference call: “…we have robust liquidity and are finding lots of attractive opportunities. We have capacity for more than $1.5 billion of acquisitions and require no financing conditions in our deals” and “we're also very disciplined around what we're willing to do. If we're going to do acquisitions, the hurdle for us is that we try to make them FFO neutral and at the same time, we want them to be additive to portfolio scale, portfolio quality.”

PMZ’s equity implied cap rate of 9.3% stands out among all Canadian REITs: 1) it offers a very large return premium for equity holders over the same issuer’s bonds, and 2) it as providing an almost distressed asset return for a business that is performing strongly:

Multifamily REITs

Canadian Residential REITs performed well in 2023 led by Boardwalk with its high Alberta exposure. REITs with US assets underperformed due to a supply surge in Sunbelt markets.

Industrial REITs

The surge in Industrial real estate demand and rents over the past 10 years is well-known. Extreme scarcity of space in major Canadian markets is easing, but the financial outlook for REITs is supported by large premiums of market rents over existing leases, and new long-term (5-10 year) leases being signed with annual rent escalation of 3-5%.

I estimate that the early 2023 privatization of Summit Industrial REIT by Dream Industrial and Government Investment Corporation of Singapore was priced at an equity implied cap rate of 3.8% (vs SMU’s average IFRS cap rate of 4.0%). Summit’s properties were concentrated in the extremely strong GTA and GMA markets that have loosened a bit over the subsequent year. However, with continued strong fundamentals and institutional interest in the asset class, I believe any of the remaining 4 Canadian industrial REITs could be privatized at an attractive premium to current prices if they were willing to sell.

Nexus (NXR.UN)

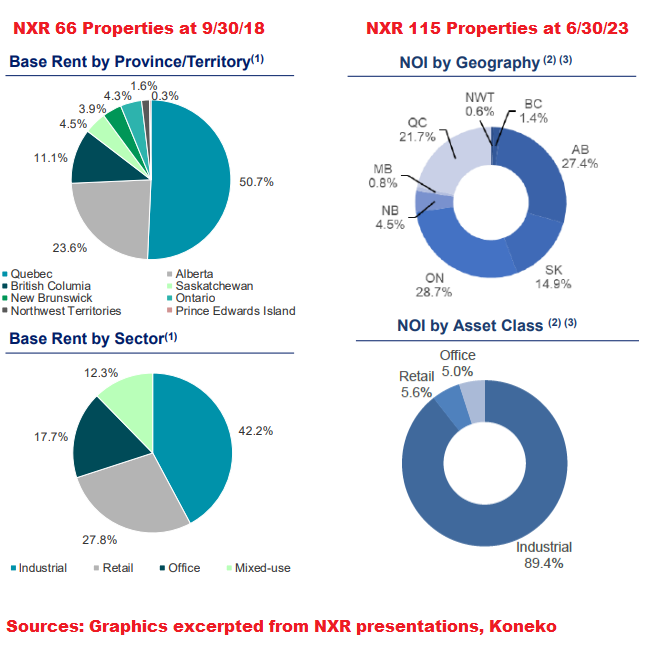

NXR has transitioned over the past 5 years from a diversified REIT with high exposure to Quebec to a national Industrial REIT.

NXR acquired a majority of its Industrial portfolio through transactions announced in 2021/22 at a weighted average cap rate of 5.53% (presentation page 9). Most of the properties were built or renovated within the past 15 years, have long-lease terms with annual escalation, very high occupancy, and in-place rents below market. Dispositions of retail and office properties currently under negotiation plus contemplated sales of non-core Industrial properties would generate proceeds over $200 and reduce leverage by the end of 2024.

With continued buyer interest from dedicated capital pools in the Industrial sector, Nexus could be an attractive acquisition if its unit price continues trading at a discount to the fair value of its assets. Buyout at a 6% equity implied cap rate would deliver $12/unit. The REIT is internally managed and not liable for any manager termination/incentive fees. Nexus would be a more attractive acquisition than Pro REIT which has a lot of older properties in Atlantic Canada.

Diversified REITs

REIT investors reward clarity, stability, and predictability. Diversification limits risk, but also makes a REIT harder to analyze and more likely to have at least one underperforming thing that becomes the primary focus of investor and analyst attention. Lower equity valuations mean a higher cost of capital that inhibits long-term growth potential. H&R should be able to deliver an attractive return by simplifying its complex business.

H&R (HR.UN)

HR is into the third year of its Strategic Repositioning Plan which will transform its diversified portfolio to 85% Residential and 15% Industrial. The REIT met its disposition target for 2023, but delayed residential development plans due to the unfavorable market environment. H&R’s financial strength gives it flexibility in adjusting the pace of divestitures and new investments. Recent news and points of interest:

The $233mm sale of Corus Quay to George Brown College is anticipated to close in April. GB enrollment has grown from 13,914 students in the 2010-11 academic year to 26,944 during 2021-22 and it planned to gradually take occupancy of the building, most of which is still leased to Corus for the next 10 years. The recently announced two year reduction in Canadian issuance of student visas may affect the school’s anticipated space requirements, but it’s hard to plan when the visa rules will be reexamined in 2026. By the time H&R’s 1Q24 earnings are released we should know whether the school sought any delay in closing or modification of deal terms. If the transaction does not close then the downtown waterfront location ensures that another buyer would probably be available at a similar price.

H&R’s largest tenant by revenue is Hess Corporation which is currently in the process of being acquired by Chevron. Hess has leased 100% of the Hess Tower until 6/30/26 and in 2020 agreed to extend the lease on 2/3 of the tower for an additional ten years. It was a savvy move by H&R to make some concessions in order to secure that commitment, otherwise Chevron might be tempted to exit the space.

H&R acquired 75% of a large residential development site in Brooklyn’s Gowanus neighborhood. The potential development of >400k sf would be about 1/3 the size of H&R’s Jackson Park project in LIC which cost about $2Bn to develop. The Brooklyn market has been strong with February 2024 average rents +6.0% yoy. It will be interesting to hear H&R’s plans for the site.

H&R filed a prospectus for a public offering of units in a partnership that will develop two Lantower projects in Florida. It seems like a complicated way to raise $50mm of third party development capital that H&R does not need anyway. Maybe they want to test the structure to see if could be used on a larger scale? The offering projects an 18-20% IRR for investors, why wouldn’t H&R want to retain that?

Artis (AX.UN)

AX reached the end of its failed 3-year Business Transformation Plan and has now failed its review of Strategic Alternatives. Even if the plan to build a best-in-class real estate asset management firm had been successful, it’s unlikely that there would have been public investor interest. Artis has become more opaque and unpredictable so it’s not surprising that its units are near an all-time low price/NAV valuation.

My 2021 article (ARTIS REIT: Lagging Price Performance Due To Lack of Investor Interest In The REIT’s Vague Vision) described the problems with the Artis plan, but also suggested that CEO Samir Manji has staked the success of his Sandpiper Asset Management on the ability to realize a gain from Artis. One way or another he will be under increasing pressure to deliver a favorable outcome. Challenges and opportunities:

Office - Artis has large numbers of buildings in small markets with very limited demand (9 in Winnipeg MB, 16 in Madison WI, and 6 around Minneapolis MN). The CEO letter noted: “In today’s market, office buyers are generally expecting bargain prices or vendor financing, neither of which are compatible with our goal of generating financial liquidity from dispositions.”

Retail - Artis has 28 Canadian Retail properties of which 19 are in strong Alberta markets. These assets could likely be sold for their carrying value.

Industrial - Artis has 16 US Industrial properties which are mostly modern with high occupancy. These assets could likely be sold for their carrying value. The REIT has 36 Canadian Industrial properties, of which 26 are in Winnipeg MB including some that are small size and older vintage. Artis could probably realize its carrying value of these assets by patiently selling them, one by one if necessary.

Cominar - The fair value of Artis $88mm common equity and $144mm preferred equity stake in the poorly-timed and highly-leveraged March 2022 buyout of Quebec focused Cominar REIT is approximately zero. Cominar is still a public reporting entity and its 12/31/23 financials show $1,013mm of shareholder equity based on a weighted average investment property cap rate of 6.4%. Artis holds its stake through the buyout parent IRIS which had only $270mm of common equity at 12/31/23 (implying an additional $600mm of debt with undisclosed terms plus the Artis preferred which is paying 18% PIK). Valuing the IRIS common at zero would still imply a 7.4% valuation for the Cominar property portfolio which is 56% Retail, 44% Suburban Office and Downtown mixed-use. Valuing the IRIS preferred at zero would still imply an 8.1% valuation for the property portfolio. That’s probably about right. IRIS should be working on a recapitalization that would reduce financing cost, relieve pressure to sell assets in a weak market, and provide funds for capex that would maintain and maximize property values. Artis will probably have to contribute additional equity or suffer dilution of its ownership.

Securities - Artis held $152mm of units in First Capital and Dream Office at 12/31/23 and has subsequently been buying more D. Artis’ Chairman’s Letter speculated that both could be “potential targets for M&A activity.” I agree about D as described above. I see an acquisition of FCR as unlikely because it’s large and fairly valued - a buyout could work in a spreadsheet but private equity dry powder is focusing on other sectors right now (e.g. multifamily, industrial, data, student housing, and storage)

Excluding the IRIS/Cominar investment would reduce Artis equity implied cap rate to 9.1% and NAV to $11.98. Those valuations are not uniquely attractive among Canadian REITs, however Artis will enhance them with continual accretion from selling assets at NAV and repurchasing common and preferred units at a discount. If that were the only thing Artis did then investors would embrace the plan and the unit price discount would decrease, however the recently published Chairman’s letter suggests that CEO Samir Manji hopes to indefinitely extend his failed 3-year plan and reallocate the majority of proceeds from asset sales into unspecified new investments: “ We plan to use the proceeds from dispositions during the year to reduce debt and reallocate some of the capital into initiatives that we believe will achieve the highest possible return over time, ultimately contributing to our most important objective – growing NAV per unit. Our improved liquidity position will allow us to be opportunistic and pursue investments we believe are in line with our strategy, which may include equity securities and real estate acquisitions or developments. “ So no clarity, no stability, and no predictability. I believe that at some point Manji will have to change the strategy in order to deliver value to his Sandpiper investors and the Joyce family.

Morguard REIT (MRT.UN)

MRT keeps plodding along. Subsequent to my detailed profile, the 4Q23 conference call disclosed that occupancy at Penn West Plaza in Calgary is over 90% and that NOI would drop $10-15mm once the master lease with Obsidian expires in January 2025. Good news on balance, but the REITs liquidity will constrain its ability to invest in property upgrades. I believe that divestiture of one or more non-core assets would be beneficial. Morguard Corporation realized $125mm ($68mm net of mortgage) when the tenant of an Ottawa office building exercised its option to purchase. I believe MRC is probably not planning to buy MRT, however each asset sale makes a transaction more feasible.

Melcor REIT (MR.UN)

MR dropped sharply after suspending its distribution, two independent directors resigned, and the REIT commenced a review of strategic alternatives. Firm Capital issued a press release claiming to be the REITs largest independent unitholder and demanding a privatization by Melcor Development (MRD) at 95% of NAV.

MR faces a liquidity squeeze from the December 2024 maturity of a $46mm convertible debenture that cannot be refinanced on reasonable terms in the current market (Firm Capital incorrectly stated that it matures in June). The REIT had $3mm of cash on hand at 12/31 and has been generating about $15mm/year in free cash flow (after tenant capex). MR listed 3 properties as “Held for sale” at 12/31/23 at a valuation of $34mm. I believe MR will be able to repay the debenture at maturity from cash flow plus sale proceeds and the review of strategic alternatives will not result in any changes at the REIT:

The 3 Retail properties assets in Regina held for sale have occupancies of 93%, 100% and 80% at 12/31/23. MR should able to realize their fair value.

Melcor Development is in strong financial condition with parent standalone assets (entirely excluding its 55% stake in the REIT) of $1.4Bn at 12/31/23 and Liabilities of only $0.3Bn. MRD is enjoying strong cash flow from the booming Alberta residential market. The current corporate structure with volatile higher ROE development at the parent company and lower ROE stabilized commercial property in a controlled public REIT is ideal for the long-term (compare with the less ideal jumble at DREAM) so it would be a mistake to privatize the REIT amid a short-term cyclical downturn from which it will recover. Melcor takes great pride in its 100-year history, including 55 years as public company. MRD is valued in the market at only 28% of its book value (which is below fair value due to carrying land for development at historical cost) so it would be irrational to privatize the REIT at fair value. The REIT has traded below NAV for an extended time, but MRD has never bought units in the public market.

MRD could backstop the REIT by providing a credit facility similar to the one available to Morguard REIT from Morguard Corporation. This would eliminate any uncertainty about the ability to repay the debentures due to temporary factors (delay in asset sales, lower than projected proceeds, weaker than expected cash flows)

A review of strategic alternatives does not require any action. Artis REIT and European Residential REIT both recently concluded reviews without any transaction. ERE explained: “the Board agreed that there was no proposal which achieved the objective of maximizing value” without releasing any further details.

MR’s unit price has rallied from recent lows, however investors may be disappointed over the remainder of the year as dividends will probably not resume until 2025 and privatization is unlikely.

Analytical Framework

Equity implied cap rate is the most useful starting point for discovering bargains because it looks through different capital structures to assess underlying property valuations.

IFRS cap rate shows the real estate market and management perception of asset value. REITS record their investment property assets at “fair value” which can be calculated using several accepted methods (see endnote for additional explanation). Volatile interest rates and an illiquid transaction market made REIT investors skeptical of these valuations in 2023, however they still provide a helpful starting point for understanding portfolio composition, management perspective on valuation, and comparison against data from service providers like CBRE.

Bond Yield shows the credit market perception of issuer risk. Yields above IFRS cap rates show the business is under stress (cost of capital is higher than return on capital), equity valuation should be discounted, and the REIT should deleverage. Note that liquidity in most of these bonds is limited.

Equity Implied Cap Rate shows the property valuation implied by the current market price of common units, assuming all liabilities and all assets aside from Investment Properties (including JV interests and development) are worth their carrying value. A large NAVPU discount might not truly be a bargain if much of a REIT’s Enterprise Value is represented by debt. Conversely, a large NAV discount at a REIT with low leverage may be an extremely attractive opportunity. Implied cap rate looks through the varying capital structures and leverage levels to see the underlying property valuation at each REIT.

Dividends have a large impact on investor sentiment, but provide little fundamental insight because they simply transfer value instead of creating value. Common equity is always a residual economic interest entitled to cash flow after payment of all operating expense, overhead, and finance costs. Equity returns are always variable. A steady dividend is a discretionary management decision rather than a truly fixed income. So I offer minimal commentary about dividend yield.

Disclosures & Notes

At the time of publication the author held units of Dream Office, Primaris, Dream Residential, Nexus, H&R, Artis, and Morguard REIT. This disclosure should not be interpreted as a recommendation to purchase any of these securities and these holdings could change at any time. Investors are encouraged to check all of the key facts cited here from SEDAR filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.

I have not been using Twitter @konekoresearch for several months, but often post brief comments on Threads @konekofinance

The discussion on the various sectors—Office, Retail, Multifamily, and Industrial—offers a well-rounded perspective on the current market conditions. The challenges faced by Office REITs, especially with hybrid work becoming more permanent, are significant. However, the opportunities in Industrial REITs and the resilience of Retail REITs are encouraging. Great breakdown!

https://urbanteam.com/