Morguard REIT (MRT) has been a bad investment for the past 10 years:

NAV was -36% from $24.28/unit at 12/31/13 to $15.45/unit at 9/30/23

FFO was -48% from $1.59/unit in 2013 to $0.83/unit (est) in 2023

Unit Price was –68% from $16.45/unit at 12/31/13 to $5.30/unit on 01/19/24

Very significant insider buying in 2023 prompted a fresh look at the REIT, sources of past underperformance and investor concern, and potential upside that would justify insider accumulation.

Retail assets are performing well after a difficult period.

Office assets face challenges, but only a few properties have significant risk.

MRT assets have very large redevelopment and intensification potential that the REIT has not detailed for investors, but the REIT also does not have the financial capacity to exploit them.

Privatization by Morguard Corporation (MRC) could be a win-win outcome. A buyout premium could give MRT investors some of the upside that the REIT would have difficulty realizing as an independent company. Over time MRC could build value from development of the acquired assets. However the low dynamism and high cost of capital of the Morguard Group suggest the current structure may continue as it has for 25+ years.

Introduction to Morguard REIT

Diversified Portfolio with 50% of NOI from Retail, 48% from Office, 2% from Industrial. I estimate 40% of NAV is attributable to Office, 57% Retail, and 3% Industrial.

IPO in October 1997 at $10/unit

Morguard Corporation (MRC) is paid property management fees (3.3% of revenue) but does not receive any corporate management or incentive fees.

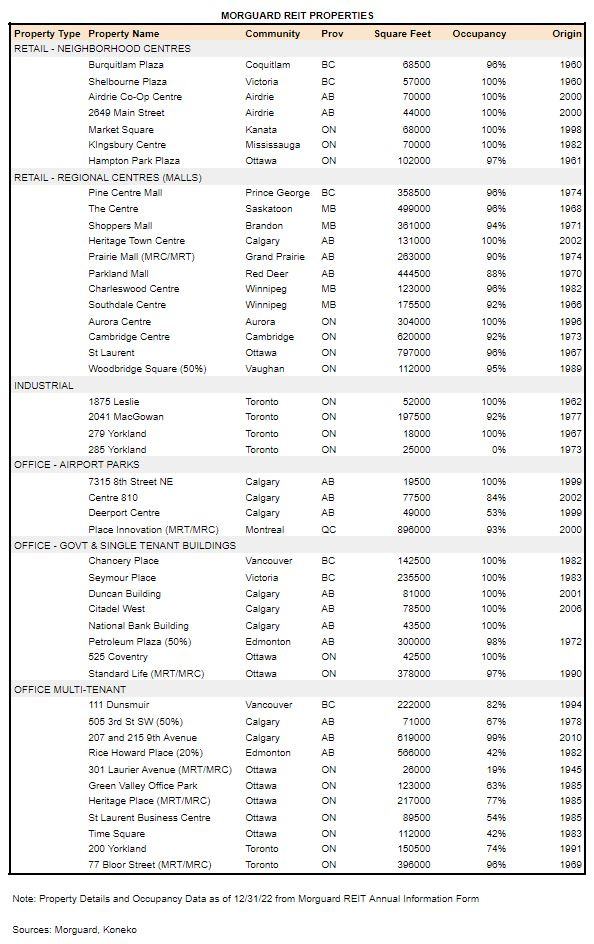

Key points about Morguard's properties in the following table:

Nearly every retail property is enjoying high occupancy

Many older Retail properties have significant redevelopment potential as surrounding communities have enjoyed high population growth

A significant portion of offices are fully leased to government tenants. These are reliable payers unaffected by economic cycles. Government buildings tend not to be the highest quality since the tenants are reluctant to pay for amenities and upgrades.

The multi-tenant office list includes some smaller properties that are part of long-term redevelopment plans (e.g. 301 Laurier in Ottawa). Current occupancy and rents are not reflective of the long-term value that could be realized.

The multi-tenant office list includes a few significant properties suffering from current weak market conditions.(e.g. Rice Howard Place in Edmonton and 505 3rd in Calgary).

MRT has traded at a large discount to Net Asset Value for over 10 years

Morguard's financial statements record all off its investment property at fair market value, but the unit price has traded at a large discount to that value for many years.

Reasons why the valuation has remained low

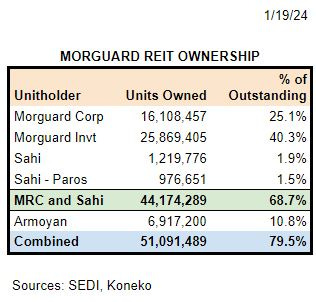

Morguard Control – MRC has effective control through direct ownership of 65% of MRT units and MRC Chairman Rai Sahi owns an additional 3%. MRT pays MRC for property management and leasing services at competitive terms, but MRT corporate affairs are internally managed. MRT G&A expense was a very low 0.3% of equity in 2022 compared to 1.3% for retail peer Primaris and 0.7% for office peer Dream Office. Property Operating Expense is also low (MRT 28% of revenue in 9M23 vs 43% for PMZ and 46% for D). MRT has not raised equity through a public offering of units since its IPO. In 2002 MRT issued convertible bonds, most of which converted to equity in 2006. MRT and MRC have co-ownership of a few assets but intercompany property transactions have been rare.

High Exposure to Alberta – MRT received 28% of 9M23 NOI from Alberta properties, plus an additional 5% from Saskatchewan and 9% from Manitoba. The Alberta economy went through prolonged weakness following the oil price collapse in 2014 and the impact on the real estate market was magnified by oversupply from construction begun during the boom years. Calgary office vacancy rose from under 5% in 2013 to over 30% in 2022. The high cost of real estate in Toronto, Vancouver, and Montreal has recently led to migration of residents and some businesses to Alberta due to superior affordability (similar to the “Sunbelt” in the US). I shared some background and first-hand observations about Calgary real estate in this October article.

High Exposure to Retail – MRT received 52% of 9M23 NOI from retail properties and 65% of that was from the out-of-favor “Mall” format. The 2015 bankruptcy of Target Canada closed 133 large stores and was followed by the 2017 bankruptcy of Sears Canada which shut 140 stores. These led to elevated vacancy rates and decreased traffic to other tenants of shopping centers. Pandemic disruptions posed a huge additional challenge, however they also demonstrated the resilience of demand for “essential retail” services such as grocery and pharmacy. At this point REIT investors remain cautious about retail due to the extended bear market, but private market demand is strong. Mall specialist Primaris says that Canada never had mall overcapacity comparable to the US and mall space per capita in the country has fallen 20% in the past 10 years.

High exposure to Office - MRT received 46% of 9M23 NOI from Office properties. Problems with office real estate are both real and also really well-known. However, a property-by-property review of MRT’s 23 Office assets suggests that only a few merit concern. The rest serve niche markets such as government services or airport markets.

Lack of Dynamism - MRT has held largely the same portfolio for many years. It does not own unique Prime assets. It has not made any significant property acquisitions since 2013 and has not made any significant asset sales since 2008. It has never issued common equity to fund growth. It has only one significant development in progress. Investor relations are basic with no effort to promote interest.

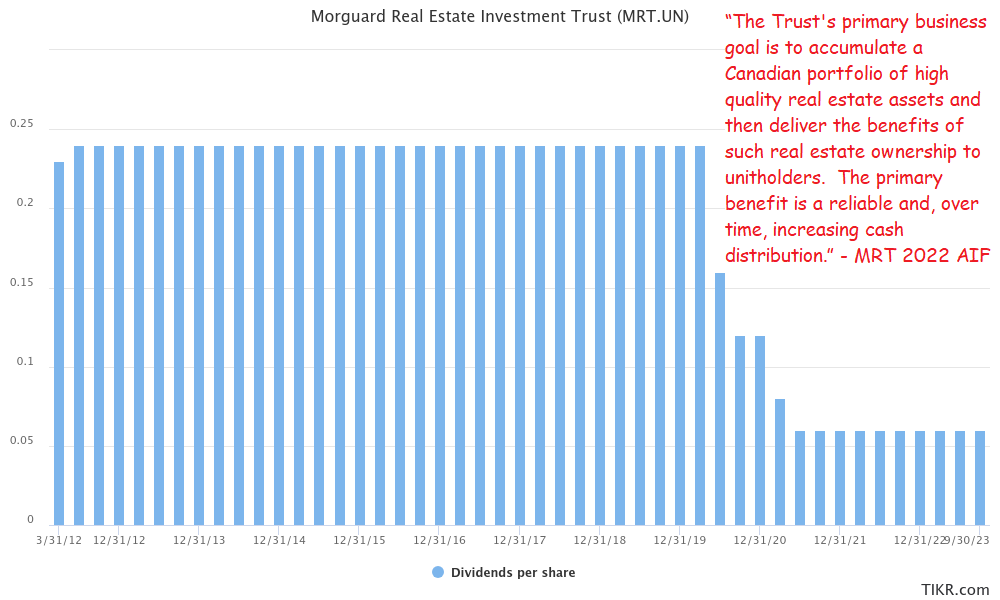

Mediocre Financial Condition – MRT's long-time target has been to have a ratio of debt/assets between 50-55% and it was near the top of the range at 54.5% at 9/30/23. Falling values of Retail and Office assets in recent years required debt reduction and left no capacity for acquisitions and development. MRT conserved cash by reducing its annual dividend from $0.96/unit in 2019 to $0.24/unit in 2023. MRT's 9M23 FFO was $45.2mm, leasing costs were $14.7mm, and dividends of $11.6mm left $18.9mm of discretionary cash flow. MRT invested $29.2mm of capex in 9M23 for property improvements such as reconstruction of vacant mall anchor space and an office lobby.

Insider Buying

Morguard Corporation has purchased 2.5mm MRT units since December 2022 at prices up to $5.60/unit. Well-known Canadian value investor George Armoyan recently disclosed a 10% ownership stake in MRT and has filed purchases at prices up to $5.55/unit.

George Armoyan is the long-time Chairman of Clarke Inc and has long experience as an investor in real estate properties and also REITs. He held a significant stake in Cominar prior to its 2022 privatization and over the past year gained board representation after an activist campaign at Slate Office. This substack article contains interesting background on Morguard, Sahi, and Armoyan. The same author added a lengthy profile of Sahi's history with Morguard.

Armoyan also recently disclosed ownership of a 10% stake in Morguard Corporation. His investment in MRC is worth $124mm and in MRT is worth $37mm. He must really like Rai Sahi and be very comfortable with the long-term value in both companies. It would not be in Armoyan’s interest to push for a privatization of MRT at a high price because that would detract from the value of his larger investment in MRC.

Why a corporate transaction makes sense and why it may not happen

MRT’s unit price of $5.30 on 1/19/24 implies a cap rate of 10.4% for its property assets (see Canadian REIT Valuations And 2024 Opportunities for context about cap rates). That’s a bargain based on their current use, however the areas surrounding many MRT properties have transformed enormously in the 20-60 years since construction of the existing buildings and have potential to add considerable asset value and cash flow through development. Retail properties that were once at the edge of town are now surrounded by large communities. Unfortunately MRT’s weak cash flow and elevated leverage constrain its ability to invest in its properties. A well-capitalized buyer could realize more than the current carrying values of MRT’s assets.

MRT’s existence as an independent entity provides no benefit to the Morguard group. MRT has a high cost of capital and is unable to raise equity for growth. MRT pays no management or incentive fees to MRC and has not been acquiring assets from MRC. Observers assume that MRT’s poor return can be attributed to exploitation by MRC, and it would have been typical capital markets behavior for MRC to exploit a captive public subsidiary, but that has not actually happened.

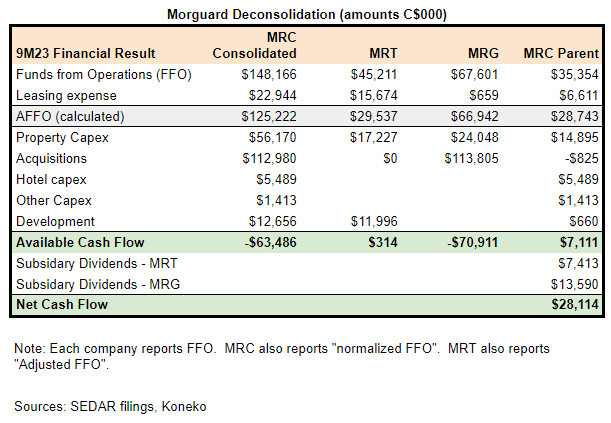

Unfortunately Morguard Corporation has limited financial capacity for an acquisition. MRC is not easy to analyze because its financial statements consolidate MRT and Morguard North American Residential (MRG) and do not provide any parent standalone reporting. My analysis:

Acquisition by MRC of the 22.2mm publicly held units of MRT (including those owned by Armoyan and held directly by Sahi) at $7.50/unit would require $167mm. Morguard had to pay an interest rate of 9.5% for its poorly timed $175mm debenture offering last September. That bond most recently traded at a 6.9% yield which is still significantly above the weighted average cap rate of 5.6% at which MRC values its consolidated investment property assets. A cost of capital higher than return on capital is signaling that MRC should deleverage and the recently completed sale of its hotels for net proceeds of $361mm is very prudent. Potential uses for these funds include:

Redemption of $225mm of MRC debentures at 1/25/24 maturity No other refinancing has been announced so this is nearly done.

Redemption of $225mm of MRC debentures at 11/27/24 maturity

Reduction of mortgage balances maturing in 2024 ($431mm at MRT and $243mm at MRC)

Development and redevelopment. MRC has multiple high potential opportunities led by the Centerpoint Mall in Toronto where 22 towers with 8325 residential units in total floor area of 7.5mm sf have been proposed. MRC has not disclosed any budget, but total capex could easily exceed $2Bn.

Privatization of MRT would likely be followed by payment of $99mm in 2026 for the publicly held portion of the MRT debentures maturing in 2026.

The hotel sale makes an MRT privatization immediately feasible, however adding the Jan24 bond maturity would exhaust all of the hotel proceeds leaving no capital for the development potential at MRC and MRT. In my opinion further asset sales would be the wisest choice for both MRC/MRT. Their Ottawa properties might be a Core asset with meaningful operating synergies. Every other individual asset could potentially be disposed in order to recycle capital for reinvestment.

Development Potential at Selected Morguard REIT Properties

MRT has only one disclosed development project, the Burquitlam shopping center in a Vancouver suburb. On MRT’s 3Q conference call I asked management about development plans and they replied that Burquitlam was the near-term priority and that other high potential sites would be looked at in 5-10 years.

Redevelopment in Progress: Burquitlam Plaza

The 68500sf neighborhood shopping centre at Burquitlam Plaza is the only project currently classified by MRT as under development. The Vancouver suburb of Coquitlam has seen its population grow from 29000 in 1960 when the plaza was built to 149000 in 2021. In 2016 a light rail Skytrain Station opened immediately adjacent to the plaza offering 40 minute transit time to downtown Vancouver.

MRT's proposed redevelopment is awaiting planning approval. The 1.8mm sf project will include 2200 residential units in 6 towers from 28-53 storeys plus 85000sf of retail and commercial space.

MRT has not disclosed a budget for the project, but construction might cost $400/sf or $720mm in total (see Altus 2024 Canadian Cost Guide). If project financing for 65% were available then MRT would still need to commit $252mm in capital. MRT does not have $252mm so its options include:

Once zoning approval is obtained sell a portion or all of the project to a third party

Sell a portion or all of the project to MRC.

Sell a portion or all of the project to Morguard North American Residential (MRG). MRG has low net debt, and positive free cash flow. MRG already has both US and Canadian assets. MRG does not currently have any projects under development.

Sell all of MRT to MRC.

Sell other MRT assets to raise capital for this development.

Future Development: Phase 3 Ottawa

MRT has accumulated all of the individual parcels required for a substantial new downtown Ottawa development within blocks of Parliament and government offices. The final purchase in 2021 was a 5 storey building built in 1945. The rest of the parcel is currently a parking lot and several aging row houses. The remainder of the city block (in red below) is the Standard Life Centre and the Jean Edmonds Towers, both 100% leased to the Federal government. MRT has not disclosed any particular plan for what it refers to as the “Phase III Development/Redevelopment Site”, but the location is obviously valuable. Morguard’s concentration of nearby properties should provide operating synergies.

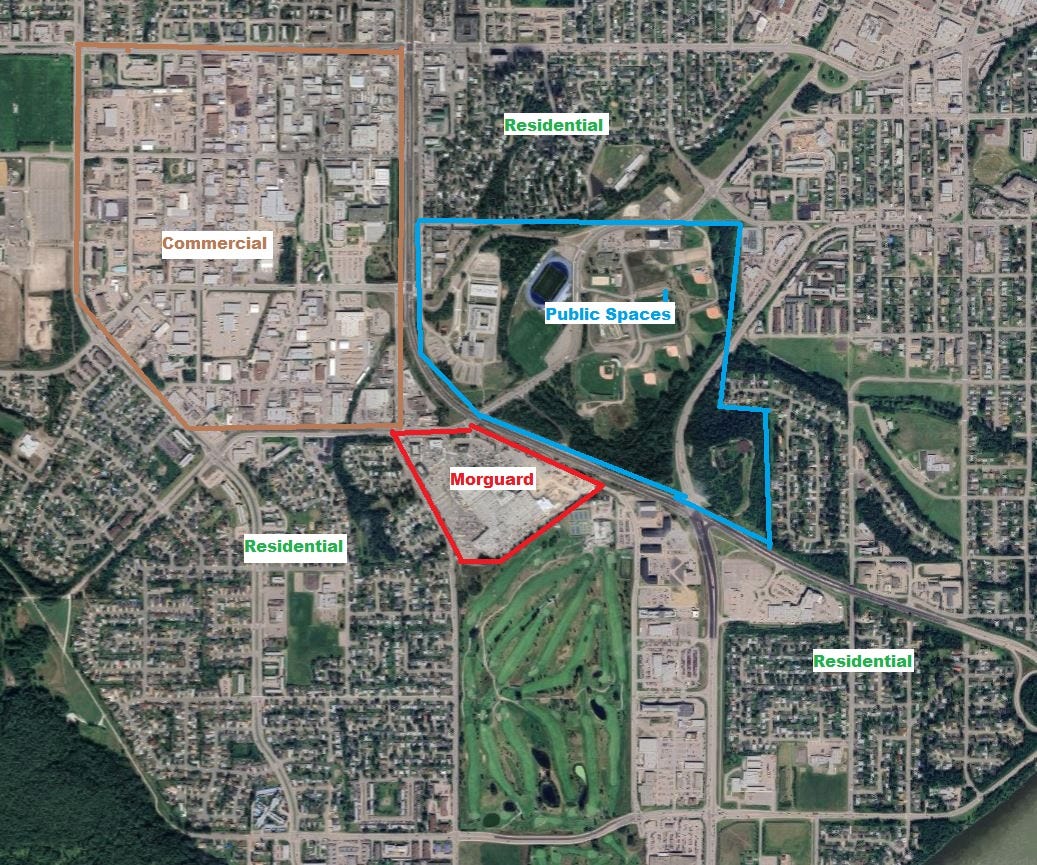

Future Development: St Laurent Shopping Centre

MRT owns the dominant shopping centre in Eastern Ottawa and acquired several adjacent parcels to facilitate long-term planning. A recently completed rail station immediately adjacent to the mall provides 15 minute service to downtown. The combined site is over 50 acres, substantially larger than MRC’s 36 acre Centerpoint Mall project, and possibly worth more than MRT’s entire market cap.

MRT intends to redevelop the space around the centre, but has not disclosed any plans beyond this brief mention in the MD&A: “The Trust is also advancing an application for site plan approval on the vacant land adjacent to St. Laurent, seeking approval for a 30-storey residential tower with approximately 421 units. This site plan represents phase 1 of the Trust's residential development of the land”. In 2019 MRT Chairman Rai Sahi was quoted in the Ottawa Business Journal:

Office is probably not a high priority in 2023, but a one acre site across the street received zoning approval for two residential towers. Developer Fengate Asset Mqanagement cites access to the St Laurent mall as an important benefit for residents.

The shopping centre is thriving with 96% occupancy, but the excellent location, infrastructure, and large acreage could also support an ambitious long-term plan. This walkthrough gives a sense of the mall’s current condition. The value of future residential development might be enhanced in MRT invested some money to make the mall more bright and fun.

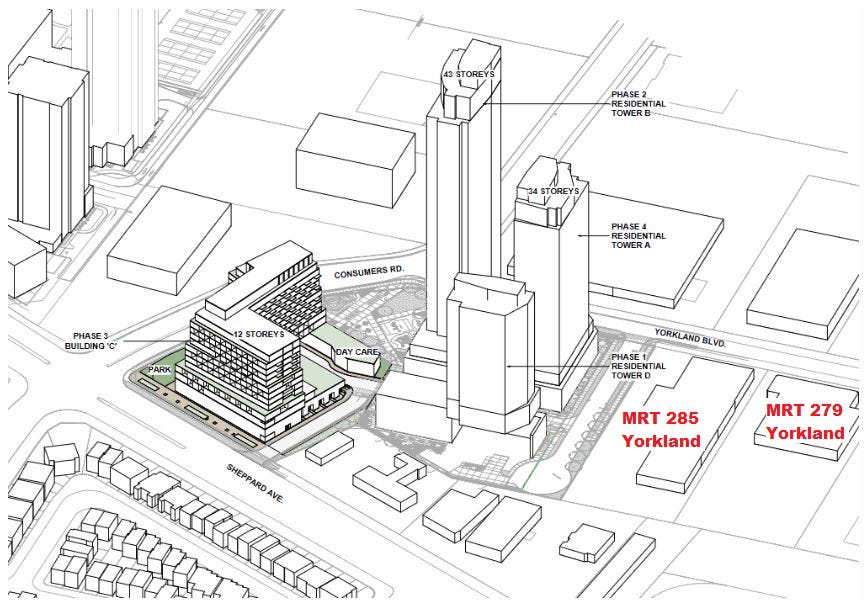

Possible Development: Yorkland Avenue Toronto

MRT holds two nondescript Class C industrial properties on Yorkland Avenue in Toronto. 285 is vacant and 279 has one tenant.

Directly across the street a 3 tower residential development is under construction (Parkside Square) with current monthly asking rents from $2580-$4304.

MRT's properties probably generate minimal current income and have minimal carrying value, but have significant potential. These look like excellent candidates for disposal.

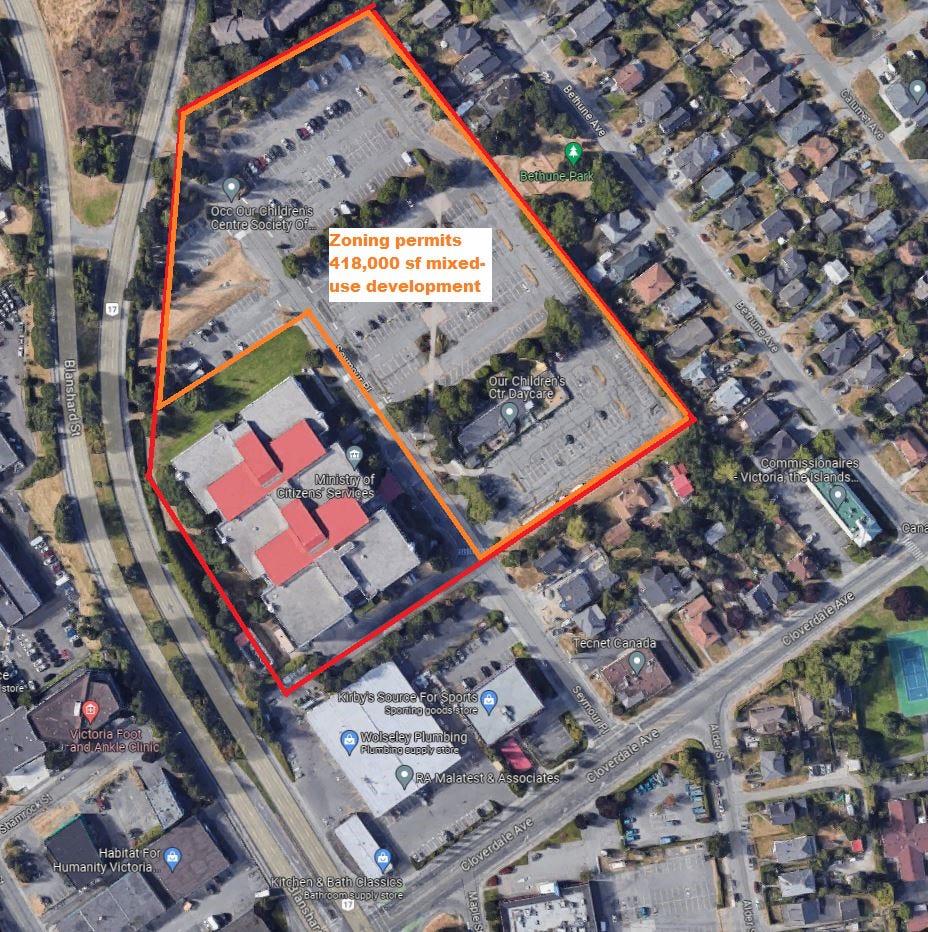

Possible Development: Victoria

MRT has a 4-storey office building on Seymour Place in Victoria that is 100% leased to a government agency, however the 11.7 acre site already has approval for an additional 418000 sf of mixed use development that could replace part of the existing parking lot. Residential homes are on one side of the site and commercial properties are on the other so a variety of uses are conceivable.

The government rent for the current 1983 building is probably modest, but the potential value from additional development is significant.

Possible Development: Place Innovation Montreal

In 2010 MRT acquired a 122 acre former Nortel campus immediately adjacent to Montreal's Trudeau airport. A metro station under construction immediately in front of the property will provide access to the airport in 2 minutes and to downtown locations in 20-30 minutes. The buildings are currently 93% leased, but the site also has 55 undeveloped acres on which MRT had a long-term plan to add office and industrial (research/lab rather than logistics) buildings.

Airport (plus metro) access and natural environment make the property attractive to science and engineering firms such as the largest current tenant Bombardier. Place Innovation is not competing with downtown buildings where there may currently be high vacancy.

Potential Development: Shopping Centre Intensification

Many of MRT's retail properties were at the fringes of communities when they were constructed but have since seen considerable growth in their surrounding area. The centres have a classic format of a large parking lot next to a main road with 1-2 storey retail buildings at the back of the site. In many cases mixed-use development would enable cities to accommodate residential demand from growing populations while creating modern community centres.

As an example, the city of Prince George BC has grown from a population of about 55000 in 1974 when MRT’s Pine Centre Mall opened to 87000 now. Growth is constrained by surrounding parklands. The mall has an excellent location with convenient access to transportation, parks, and schools. MRT is currently spending $2mm to prepare an abandoned Sears space for a new tenant. Multifamily development could be added to the site - the city’s Regional Plan released in 2010 envisioned several growth options for the mall.

Assets at Risk

MRT has a few large multi-tenant office properties with vacancy challenges. Some perspective on the Calgary assets was in my October article. Canadian mortgages have recourse so MRT does not have the option to forfeit any weak assets to lenders.

In Calgary at 207/215 9th avenue the leases it signed with Penn West (now Obsidian) will expire in 01/25. Most of that space is now occupied by sublease tenants and MRT indicated in its 3Q conference call that half the space has already been renewed past 2025 and additional discussions are underway. Even with high occupancy Morguard's income from the property is likely to drop from 2025 as market rents are below the level when the Penn West lease began in 2010. The building was new at that time and the location is pretty good.

Morguard has another multi-tenant property downtown in Calgary at 505 3rd Street which is currently only 67% leased. It’s an unattractive 1978 building in a weak market.

Morguard also has a large vacancy at the Rice Howard Place in Edmonton which is only 42% occupied - the property was Scotia Place until Scotia left. Fortunately MRT only owns 20% in partnership with a Canadian pension fund. MRT’s MD&A disclosed a $5.5mm budget “to replace the existing podium level granite facade, signage bands and storefronts with more modern finishes, refresh the interior common areas, relocate the existing concourse food court to the main floor retail areas, and construct a new tenant fitness centre, staff lounge and conference centre”. If the disclosed cost is only MRT’s portion and the full budget is $27.5mm then it could make a difference.

Investment Conclusion

Morguard Chairman Rai Sahi became a billionaire through real estate investing. I believe his success is more attributable to buying cheaply than to management of assets after acquisition. An outsider might want MRT or MRC to do something differently, but the most likely path is that Morguard and Sahi will operate as they have for many years.

Despite weak operating results, the value of MRT is supported by growth potential at many of its properties and as the surrounding communities expand that potential will increase over time. Morguard will not lose money by delaying development and that’s what it will probably continue to do.

If you buy MRT units at their current discounted price then they are highly likely to be worth more in 5-10 years, but if you are anticipating a catalyst such as privatization to quickly unlock that value then you may be disappointed. It’s an appealing investment for an individual or family office, but difficult for an institution subject to frequent performance evaluation.

Disclosures and Notes

At the time of publication the author owned units of Morguard REIT. The author does not make any recommendation regarding any investment in any company mentioned in this article. Investors are encouraged to check all of the key facts cited here from SEDAR filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.

Another great piece!

City of Ottawa approved a 3 tower 1100 unit residential development near Morguard's Green Valley Office Park. It's another example of the hidden development potential within the MRT portfolio.

https://www.threads.net/@konekofinance/post/C3GJx-XrRqt