Dream Unlimited’s announcement of the sale of its Arapahoe Basin Ski Resort mentioned: “Dream is also evaluating other investments throughout the Company to maximize shareholder value and increase liquidity.” Dream previously suggested sale of Arapahoe Basin was unlikely because it would trigger a significant tax liability. Willingness to sell suggests that other assets may also be examined from a fresh perspective. Let’s consider some opportunities…

Key observations:

Dream Residential is performing well. Organic growth could be supplemented by an acquisition or investment in 2024. <jump to DRR comments>

Dream Office is suffering from sector challenges, but is relatively well-positioned after changes it began in 2016. One property sale in 2024 would improve financial flexibility. Possible non-renewal of the primary lease at 74 Victoria Street could create an exciting development opportunity. Office privatization might be a once in a generation bargain for an acquiror while providing Dream with a large capital infusion for other investments. <jump to D comments>

Dream Industrial continues to perform extremely well. Its management agreement was restructured in 2022 to facilitate future sale of its European assets. <jump to DIR comments>

Dream Unlimited has built a lot of value over the past three years in Asset Management, Residential and Industrial. The rapid growth outlook for its retained portfolio of residential rental property in Western Canada creates an opportunity for launch of a new Canadian Residential REIT. The management agreement with Dream Impact must be restructured as part of a plan to make that entity viable. <jump to DRM comments>

Dream Impact is not viable without changes to its crippling management agreement, failed strategy, heavy debt, and ineffective leadership. <jump to MPCT comments>

This article is largely opinion and imagination. It does not contain any stock pick, but may provide new information and perspectives for investors. Nothing here should be read as fact unless an external source is linked/cited. A prior Koneko article (Canadian REIT Valuations And 2024 Opportunities) provides context for sector trends. The Dream 2023 Investor Day presentation includes abundant detail about group businesses.

Corporate Structure

The Dream group has $24Bn of assets held in 4 public entities and several private funds. A good guideline with insider controlled conglomerates is to invest with the insiders because they will maximize your returns when you hold the same security.

In a capital intensive real estate conglomerate the typical roles are:

The parent will incubate and develop assets for sale to subsidiaries. The developer has high asset turnover, volatile ROEs of 15-20%, recycles capital from mature investments into new ventures, and does not raise equity capital (especially if it has high insider ownership). The parent profits from sale of assets to subsidiaries, ongoing management and incentive fees, and appreciation of retained equity stakes. Dream Unlimited followed this model for Industrial and Office assets, but has a growing portfolio of other stabilized assets without a long-term ownership plan.

Controlled subsidiaries are formed to attract outside equity capital and increase the long-term earnings of the parent without ceding control. They have low asset turnover, stabilized assets funded with low cost equity and debt capital, and low but predictable ROEs of 6-10% enhanced by modest internal development/redevelopment. Dream Industrial, Residential, and Office fit the template. Dream Impact fails because it has far too much development, negative ROE, and very high cost of capital.

Dream Residential REIT (DRR)

Dream Residential has delivered the organic growth promised at the time of its IPO through a disciplined program of internally managed suite renovations. The REIT has waited prudently for acquisition opportunities and preserved its strong balance sheet, but lost investor interest. I believe an underappreciated change has been the appointment of Brian Pauls as CEO following his extremely successful time at Dream Industrial from 2017-2023. On DRR’s 4Q23 conference call he said that many acquisition and partnership opportunities are becoming available.

Dream Industrial (DIR)

Dream Industrial has been a phenomenal success since it was launched in 2012 with just $400mm in properties spun off from Dream Office. DIR reported strong 2023 results and an optimistic outlook. DIR has low leverage and strong financial capacity to continue its development program while the surge of competing supply under construction is fading due to higher interest rates. DIR’s 4Q23 conference call indicated that it continues to evaluate accretive property acquisitions and dispositions in the ordinary course of business.

DIR’s management agreement with DRM includes a modest base fee which amounted to $14.4mm in 2023 (0.32% of average equity) and additional transaction related fees of $11.5mm (0.25% of average equity). The agreement also includes an incentive fee payable from realized gains on asset sales. DIR disclosed that if its entire portfolio were sold at the 12/31/23 carrying values then $271mm would be paid to DRM (6% of DIR’s equity and $6.67 per DRM share). DIR has not accrued this potential fee as an liability and DRM did not include the amount in its estimated NAV.

I believe sale of DIR is very unlikely in the next 5 years because Dream established industrial partnerships with leading global investors (Dream Summit JV with Government Investment Corporation of Singapore and GTA Development Joint Venture with an unnamed sovereign wealth fund) and it would be strange to walk out on them. However, on 1/1/22 DRM and DIR divided their management agreement into separate contracts for European and North American operations (see DIR Annual Information Form). If an opportunity arose to sell the entire European portfolio (35% of all properties at IFRS fair value) then it could trigger a large termination fee and incentive fee payment to DRM without affecting the GIC and SWF relationships in North America. I don’t foresee a transaction anytime soon, but it’s interesting that the management agreement has been structured to accommodate it.

Dream Office (D)

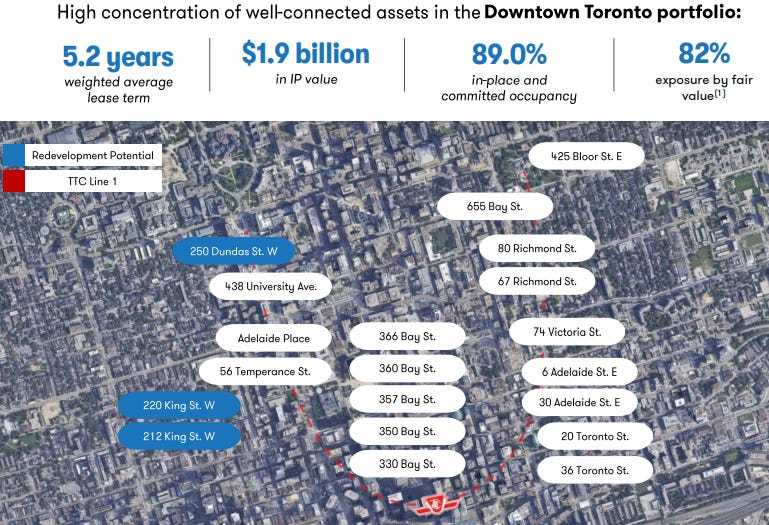

D faces the well-known sector challenges of elevated vacancy, hybrid work, and flight-to-quality. D is relatively well-positioned for the new environment as a result of a transformation begun in 2016. Since 12/31/15 D exited most Canadian markets and shrank its portfolio from 166 properties to 29, while sharply raising its concentration in downtown Toronto from 36% of IFRS Fair Value to 78%. In 2019 D launched an $80mm program to renovate and reimagine a cluster of 9 downtown boutique office properties with distinctive design and amenities. Effectively, this transforms a portfolio of individual buildings into a single trophy asset well suited to current office market demand trends.

In 2019 Toronto was North America’s strongest office market with vacancy under 5% and rapidly rising rents. COVID killed the boom, however the city’s financial core properties should retain value over the long-term:

The heart of the city at the heart of the Canadian economy.

Canada’s financial center with the Toronto stock exchange, regulators, and professional service firms (e.g. ratings agency DBRS which just renewed a large lease at a D property).

Large talented labor pool from local universities and skilled immigrants. Toronto can adapt to the evolution of Canada’s economy and is not heavily dependent on any sector.

International gateway with transportation links and cultural institutions.

These characteristics make D’s portfolio attractive to potential acquirors with a very long-term outlook such as sovereign wealth funds, endowments, family offices, and other Koneko Research subscribers. Using the 2/26/24 unit price of $8.02 I estimate an equity implied cap rate of 9.7% which is a huge premium to IFRS property valuation at a rate of 5.75%. An acquisition at $20/unit would imply a cap rate of 7.3%. DRM was willing to sell 7mm units last summer at $15.50 through D’s Substantial Issuer Bid so it is obviously willing to accept less than full NAV. Perhaps D could be privatized through an arrangement similar to the Summit Industrial JV through which DRM retained a 10% equity stake and a management advisory agreement. DRM has many other ways to allocate proceeds of a possible D privatization. The institution leading the privatization would acquire this core office portfolio at a valuation that might never be available again.

D’s leverage is relatively high with Debt/Assets of 50.0% and Debt/EBITDA of 11.5 at 12/31/23. Operating Cash flow for 2023 of +$70mm did not cover funds used for capex ($38mm), distributions ($44mm), and interest expense ($56mm). The recently announced distribution cut will save $19mm for 2024, but it would provide financial comfort if D could complete at least one asset sale. The company has discussed these options:

438 University - D is marketing 438 University which is a 98% leased multi-tenant property in the Discovery District close to 720 Bay Street which D sold one year ago for $135mm ($544/sf) The same valuation for 438 would bring proceeds of $175mm. Management spoke optimistically during the 4Q23 conference call:

212 King West - D has a partnership with Humboldt Properties for an 80-storey hotel/residential development on this site. It’s an outstanding location near several other 5-star hotels and the market for hospitality real estate has been strong. In the 4Q23 conference call management commented:

Some of the unit price drop after 4Q23 earnings is attributable to disclosure of a possible large vacancy from November 2024 if the primary tenant at 74 Victoria Street (a/k/a 137 Yonge Street) does not renew. The tenant was not mentioned, but I believe it’s the federal government. While renewal would be the lowest risk outcome, considerable value could be created through redevelopment. The existing 1968 design is unattractive and its 10-storey height makes low use of the large plot. The property was once home to the Toronto Arcade, a high-end shopping centre built around an enclosed passage from Yonge to Victoria Streets. No heritage elements remain, and the neighborhood doesn’t need more shopping with the Eaton Centre two blocks north, but the arcade concept could be reimagined with an all-season public park, art installations, and maybe a performance spot. Rather than relying on retail rents, the developer could be compensated with zoning allowing greater vertical density. It would be great to incorporate the four ugly storefronts immediately south on Yonge Street. It would be great to find a creative use for Ching Lane, an alley named after Sam Ching who, according to local legends was the first Chinese to own a business in the city It’s a popular film location for murders, but that might not be its highest and best use. Redevelopment would enhance the value of D’s heritage building at 6 Adelaide. 74 Victoria / 137 Yonge is a few blocks north of 55 Yonge where H&R plans to replace its 12 storey 163ksf building with a new 66 story mixed-use tower - D has a larger site and slightly better location. Lease renewal by the current tenant would be safe outcome, but indefinitely defer the greater value that could be achieved. D would need a partner to fund planning costs, but I don’t believe that would be a problem because Dream has an outstanding record of finding appropriate partnerships for development projects.

D has other non-core properties that can be sold at an opportune time including:

Calgary block facing Courthouse Square - As described in my Calgary visit article, these 3 adjacent properties have the stability from nearby courts and long-term potential above their low density.

Sussex Centre in Mississauga - a hideous 1987 complex at a great location close to the Square One District mega-development. I shared a few comments.

425 Bloor Street - now a satellite campus of Georgian College and ILAC. This could have been a great divestiture candidate similar to H&R’s recent sale of Corus Quay to George Brown College. Unfortunately (at least for landlords) a change in visa rules for international students has created uncertainty over education demand.

Dream Unlimited (DRM)

Most of DRM’s businesses are well-structured, performing well, and building long-term value despite the volatile macro environment. Sale of D (suggested above) could generate proceeds of about $250mm (12.3mm shares at $20). Restructuring of MPCT (as described below) could require a capital contribution of up to $50mm.

In addition to DRM’s equity interest in subsidiaries and development assets, it has a retained investment property portfolio that could be sold to managed REITs or third parties:

Properties that are part of ongoing Dream developments will appreciate in value as the developments grow - more homes will draw more customers to the retail centres. Once a development is completed the related commercial property should achieve stable performance and can be sold at a fair value. Properties unrelated to other Dream assets may be individually attractive, but not an optimal investment when capital is scarce because there is no incremental value-creation from operating synergies. That may apply to the Streetcar Hotel interests with an estimated value of $39mm and I can’t find any information about the Streetcar Retail.

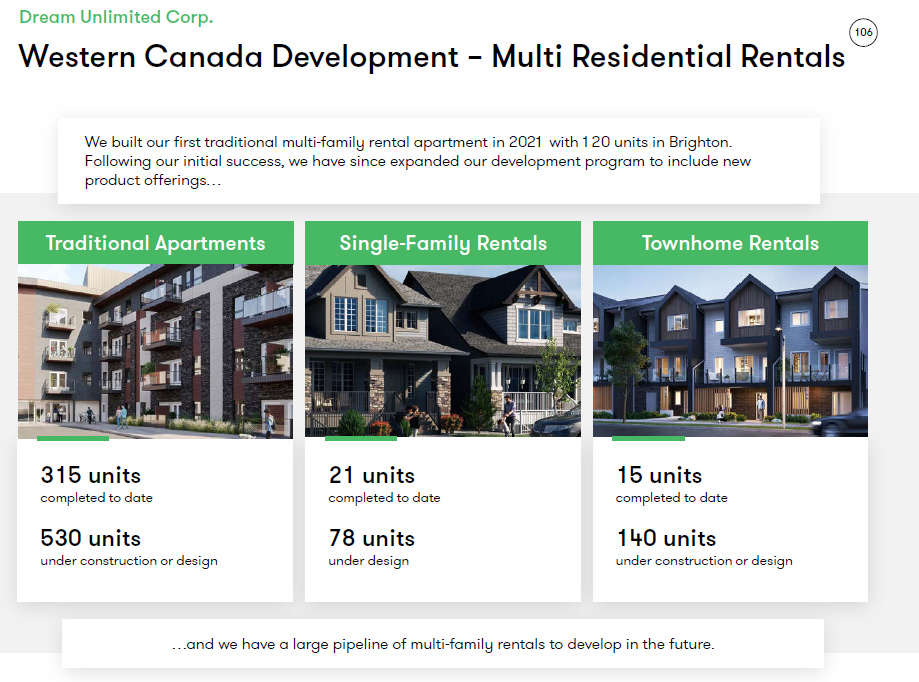

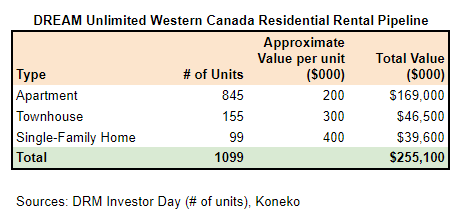

The current small Western Canada Apartments Portfolio is on the verge of rapid growth which will be a fantastic opportunity for DRM, but could consume a significant amount of scarce capital. DRM should consider a long-term ownership plan as occupancy stabilizes.

Very roughly, the existing completed, under construction, and planned units could have a fair value over $250mm. DRM’s Investor Day said that its 8000 acre land bank had an “Unlimited Development Pipeline” of rental units. These properties would be a strong foundation for launch of a Dream Canadian Residential REIT (DCR) which would acquire completed units from DRM at fair value, earn stable, predictable and growing rental yields, raise public equity, pay management and incentive fees to DRM. Focus on single-family, townhomes, and low rise new construction in Western Canada would make DCR a unique and very attractive investment in the Canadian REIT market. DCR could expand its model to work with other homebuilders on adding build-for-rent units in their planned communities.

Dream Impact (MPCT)

Dream Impact has delivered a terrible total return of -72% since it was formed in 2014 through the merger of three closed-end income funds and DRM’s acquisition of their management contracts. Absolute and relative performance has significantly deteriorated since the 2020 announcement of a focus on Impact Investing.

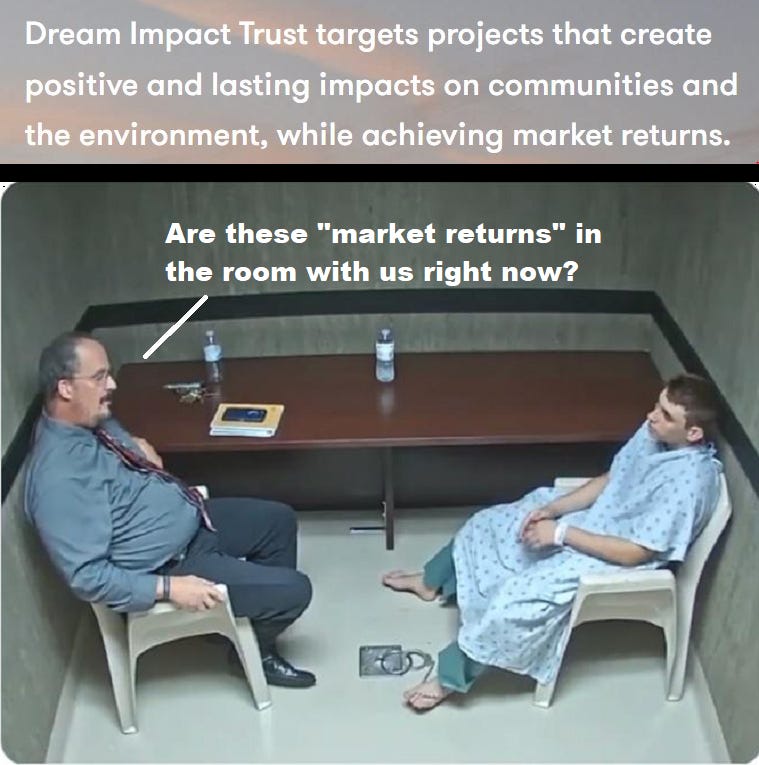

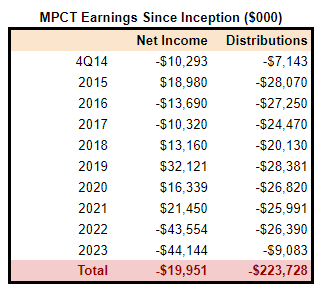

MPCT has failed to grow AUM as unitholder equity declined from $722mm in the trust’s first post-merger financial statement at 9/30/14 to $429mm at 12/31/23. The decline reflects a cumulative 10-year loss of nearly $20mm, distributions of $224mm, and the balance of unit buyback and other equity entries. Boldly ignoring its accelerating losses. MPCT makes a delusional claim to be “achieving market returns”

Poor performance is the result of fundamental flaws and strategic blunders rather external surprises like COVID and interest rates.

Flawed and poorly executed mandate: MPCT hoped to attract capital from what it described as '“the $3.2 trillion sustainable investing market,” but has completely failed to do so. Explanations:

Not a unique thesis - every company has an ESG policy. The highest GRESB score among Canadian listed real estate companies belongs to Riocan rather than any of the Dream entities.

New name, but same strategy - MPCT launched by simply adding an “Impact” label to most of its existing assets. There was no change to the pre-existing “Alternatives” portfolio. For example, the aging and hideous looking 1987 Sussex Centre in Mississauga that was last renovated in 2003 is labelled an “inclusive community” even though there’s no evidence of it on the building’s leasing page.

Vague and intangible goals - Affordable housing is a rational investment thesis measured using concessionary rents, market rents, and available government incentives such as low cost financing. In contrast, the costs and benefits of “Inclusive community” are intangible or possibly meaningless:

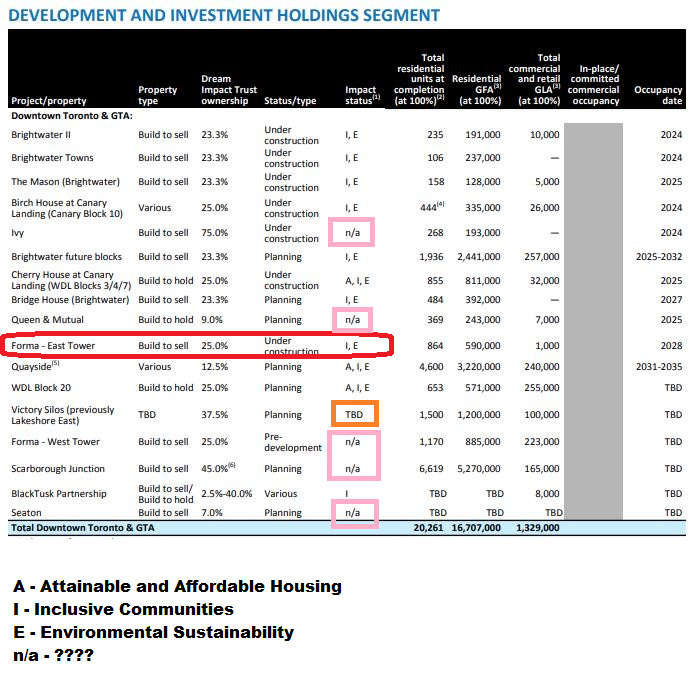

Dream Impact Report - if you eat too much of this bloated word salad then you wont have room for word dessert! MPCT determined that most (but somehow not all?) of its projects are able to satisfy those non-criteria:

MPCT’s ultra-luxury Forma condo project is an “inclusive community”? Forma architect Frank Gehry said: “I hope that we have succeeded in making a sculpture on the skyline to reflect the light and essence of this city that I love” - so maybe it will brighten the lives of the poors when they look upon it from a distance.

TBD - Some assets in MPCT’s portfolio cannot even conform to the mandate and their Impact is labelled “TBD”. If the impact cannot be determined then it’s evident that Impact is not a critical catalyst for development of those projects. I guess “n/a” means MPCT won’t even pretend there will be any maximization or minimization of intangibles.

Poor Financial Management: MPCT and Dream have made a series of errors:

Too much capital intensive development in an entity with no access to capital.

Excessive distributions - MPCT shrank its capital base and its ability to realize the potential value of its developments by consistently distributing dividends in excess of earnings.

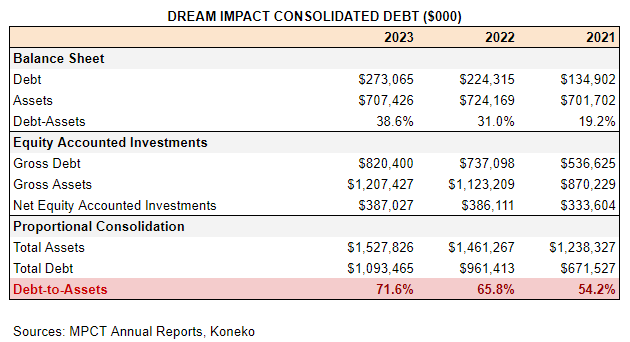

Excessive Leverage - the trust has negative operating cash flow of $7mm in 2022 and $21mm in 2023 and will have to repay $30mm of debentures at 12/31/26 and $40mm at 12/31/27. The balance sheet debt-to-assets ratio of 38.6% is close to breach of financial covenants with a 40% limit. MPCT stopped disclosure of debt on a consolidated basis (including its proportionate share of equity accounted investments), but I calculate a dangerously high 71.6%. Total debt is up an astounding $422mm since 12/31/21, many of MPCT’s developments are far from finished, and some have barely started.

Land Loans - the trust has significant debt secured by development projects ($80mm for 49 Ontario and $31mm for Victory Silos) that are at a planning stage and have no current cash flow. The rate on the 49 Ontario debt is Prime + 165bp (currently 7.20% + 1.65% = 8.85%) and is currently costing $7mm/year which will have to be covered by proceeds of asset sales.

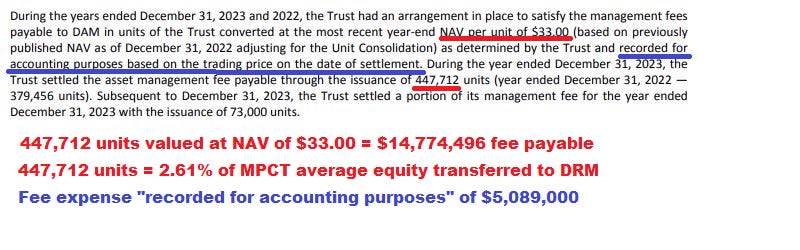

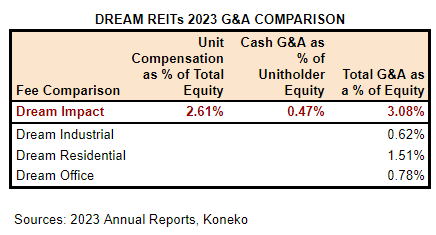

Crippling Management Agreement: MPCT incurs an annual expense burden of over $14mm in management fees payable to DRM, but the true cost is obscured by accounting for the units issued to DRM at their collapsing market price.

If MPCT achieved extraordinary returns then this expense might be affordable, but instead it has simply added to destruction of unitholder value. No REIT with a stabilized property portfolio valued at 4-6% cap rates could bear this 3% expense burden.

Disinterested Underqualified and Ineffective Board of Trustees: MPCT’s Trustees have failed in their most important responsibilities:

MPCT’s Management Information Circular provides background on each Trustee and their purported qualifications. All are reported to be “Financially Literate” which has perhaps been proven by their unwillingness to invest in MPCT:

Amar Bhalla is Impact’s longest serving Trustee and purportedly has experience/expertise in Corporate Finance, Capital Markets, and Governance. He must share responsibility for Impact’s terrible record in those areas. “During his free time, Amar hones his skills as fine wine connoisseur” so he’ll be able to enjoy that when Impact replaces him.

Catherine Brownstein is a pediatrician and geneticist in Boston. It would be cool if Carrie Brownstein were on the Board, but maybe she doesn’t know anything about real estate development in Toronto. Then again, if Catherine Brownstein knew anything about real estate development in Toronto then Impact would have mentioned it in her bio.

Jennifer Lee Koss is a cellist and co founder of BRIKA (“a retailer that curates artisanal finds and small brands through pop-ups, an online marketplace, two standalone stores, and concept shops”). She purportedly has expertise in Corporate Finance, Capital Markets, and Governance. She must share responsibility for Impact’s terrible record in those areas. So far she has not been able to pop-up Impact’s unit price.

Karine MacIndoe is a former REIT Research Analyst who purportedly has experience/expertise in Corporate Finance, Capital Markets, and Governance. She must share responsibility for Impact’s terrible record in those areas. In particular she should have been aware that MPCT’s crippling expense burden is far beyond industry norms.

Robert Goodall is the founder and CEO of Canadian Mortgage Capital (“a trusted voice in Canadian real estate financing”). CMCC (TSX:AI) has had a total investor return of +99% during the time that Impact has been public. Impact’s proxy says that he brings a “Diverse Perspective” to the Board. Perhaps that’s because he’s the only Caucasian male. Or perhaps it’s because he’s the only trustee with a record of success as a public company executive.

A Plan: I believe the following steps could transform the current Impact Trust into a viable entity that would provide an attractive return to its investors and contribute to the success of the Dream group:

Strategy - immediately commence a review of the Trust’s mandate to determine a narrower strategy that is achievable, measurable, and appealing to the investment community. The Trustees and Advisors (TD Scotia and CIBC) who participated in the last review that resulted in the current failed strategy and its disastrous return should be excluded. One possible outcome would be to reduce the Trust’s mandate to Affordable Housing.

Management & Board - The current leadership team who are responsible for the Trust’s comprehensive failures should be replaced by individuals with fresh perspectives and experience aligned with the result of the Strategy review.

Portfolio - MPCT should divest all assets not aligned with the new strategy to other Dream entities or third parties within a limited time frame (perhaps 3 years). MPCT recently disclosed that non-core properties at 10 Lower Spadina and 347 Carlaw are being marketed for sale with potential proceeds of $25mm so that’s a start. MPCT once hoped to develop a tower over the 7-storey Spadina building that it acquired from D in 2017, but that opportunity will now be available to a more financially competent entity.

New Management Agreement with DRM - the existing Management Agreement should be replaced by one with terms closer to standard industry practice. MPCT is not entitled to terminate the agreement except for fault (fraud or gross negligence), but the crippling burden of current management fees ensures that MPCT will never be able to grow, will never be able to raise public equity, will never acquire new assets, and will be a perpetual stain on the performance record of the Dream group. MPCT will need to compensate DRM for the reduced fees payable after restructuring of their agreement which DRM values as a $43mm intangible asset (about 3X annual fees). If future fees dropped to $4mm/year then the value of the intangible asset could drop to $12mm and MPCT could compensate DRM with transfer of $31mm of assets or equity.

Capital Raise - MPCT should raise $50-100mm of capital to stabilize its portfolio, avoid distressed asset sales, and reduce high interest expense and looming debt maturities. The changes described above would make MPCT appealing to one or more new strategic investors, in addition to a commitment from DRM, who could receive a perpetual preferred security with a coupon about 6%, mandatory conversion to common when the unit price exceeds about $10 (based on a 50% discount to BVPU adjusted for cost of the new management agreement), and ability to appoint a Trustee. New capital would dilute some of the upside for current holders, but also eliminate much of the downside and should be perceived favorably.

Disclosures & Notes

At the time of publication the author owned shares of Dream Unlimited and units of Dream Office REIT, Dream Residential, and Dream Impact. These holdings vary in size and could change at any time. These disclosures should not be interpreted as a recommendation to purchase any of these securities. In particular, Dream Impact is likely to be a bad investment unless it achieves tremendous development success in the next two years (possible, but insiders are not betting on it) or restructures as I advocate.

Everything in this article should be read as opinion and imagination unless an external source is referenced. Those sources should be double-checked to ensure facts have been correctly cited. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible. A link to the article was sent to Dream’s Investor Relations representative at the time of publication.

Impact insiders may disagree with my opinions, but with a -72% cumulative total return and units trading at an 82% discount to NAV they are not going to change the Impact narrative until they change the Impact facts.

Good article. I am in for "the plunge" with Cooper on Dream Office. Can't see how you lose from current valuation and feeling good about my position with a recent add prior to the cut of course, which I always thought was a possibility albeit likely to be accompanied with asset sales. Seems like major asset sales could be coming this year plus a joint venture residential deal. Excited for this and won't be surprised to see it as a top winner if Cooper can execute the asset sales.

Regarding fees charged to MPCT by DRM: both DRR and DIR have 15% incentive fees, MPCT does not. Also DRM is acting as the developer for MPCT. Developers might typically receive 3-4% of the end value of each project. I think if you adjust for that the differences in fees that DRM charges its subs may not be very meaningful.