Star Holdings (STHO) was formed in 2023 to manage the liquidation of the assets of iStar mortgage REIT following the spinoff of its successful ground lease business (Safehold – SAFE). There was an initial burst of value investor excitement over the 60% discount to an NAV that could be realized over a projected 4-year liquidation period. 18 months later the discount remains around 60%, but investor interest faded due to absence of apparent progress and minimal disclosures. I estimate that STHO could deliver an IRR near 40% if it met the original timeline.

Local government records and a visit to Asbury Park reveal that STHO has made meaningful progress, and its assets are worth more than carrying value, but that final liquidation is likely to extend beyond the original expectation of 1Q27.

Topics:

BRIEF HISTORY OF iSTAR/STAR HOLDINGS

iStar was founded by Jay Sugarman, a onetime associate of Barry Sternlicht, and became a leading commercial mortgage REIT in the pre-GFC period. The company had $15.8Bn of assets at 12/31/07 and then lost $1.1Bn over the next 2 years. It has spent the subsequent 15 years working through the assets it acquired through loan foreclosures. Just two significant pieces remain: Magnolia Green housing development in Virginia, and Asbury Park Waterfront Redevelopment in New Jersey.

In 2016 iStar launched the Safehold ground lease business (details in Safehold investor presentation). Sugarman describes it as separating the low risk value of land from the value of buildings and improvements. Recovering the capital locked up in land enables a ground lessor to increase the efficiency of its balance sheet and improve improve its ROE. Ground leases historically had a bad reputation because many had unique terms that could be unpredictable or punitive for lessors. SAFE leases are standardized, legally sound, financially predictable, and attractive for counterparties.

In 2022 iStar announced a restructuring (completed in March 2023) through which it would distribute most of its SAFE shares and leave the Star Holdings stub which would liquidate its remaining assets. This presentation describing the restructuring focuses nearly exclusively on the outlook for Safehold. The only meaningful conference call comment about STHO was that liquidation was expected to take 4 years.

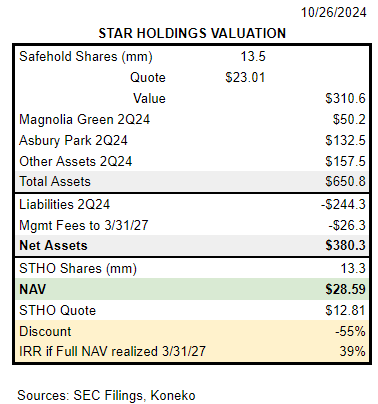

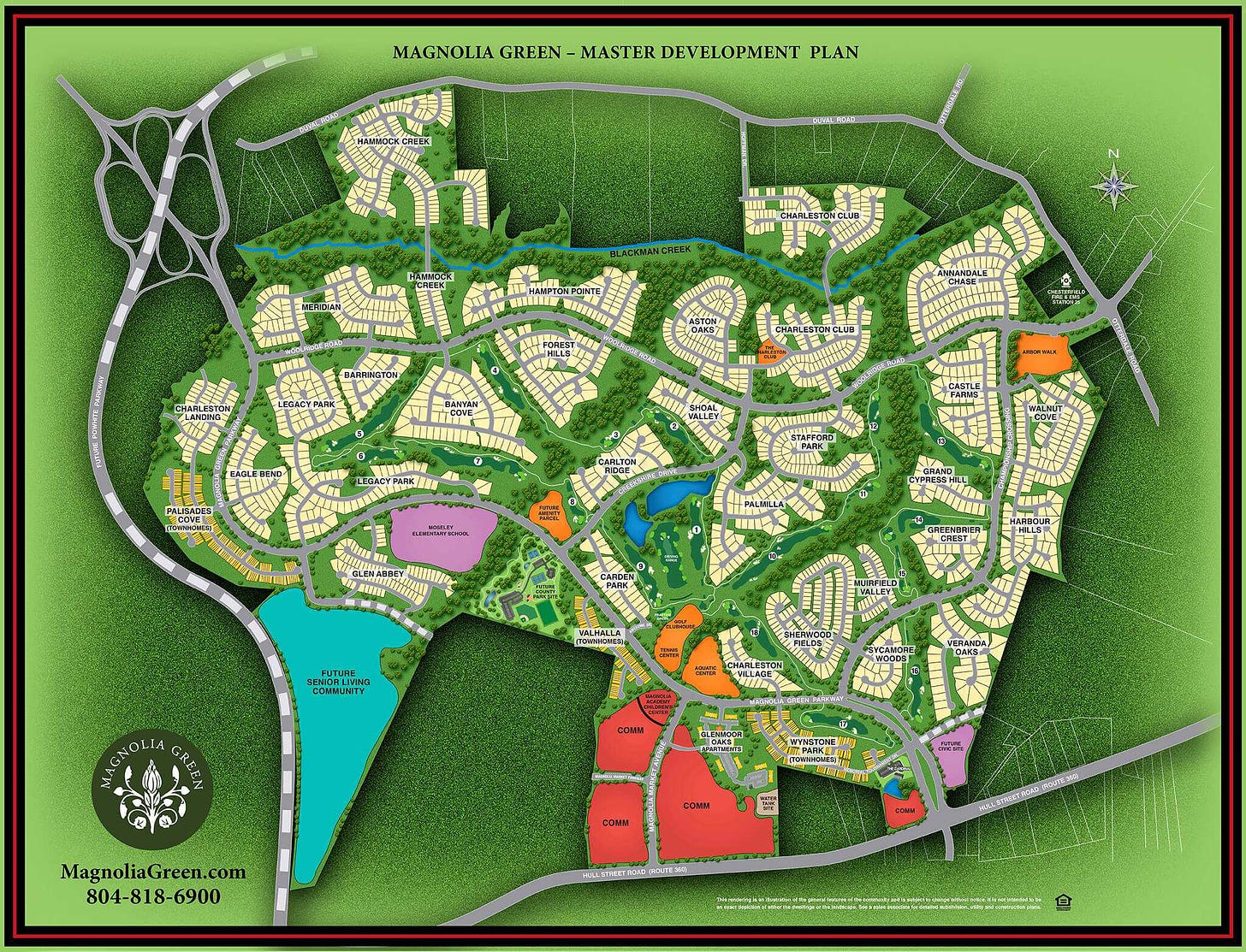

STAR HOLDINGS VALUATION SUMMARY

The discount realization thesis has been described several times online (VIC, Clark Street Value, Seeking Alpha), but none of these authors examined the assets in detail.

The illustrative IRR in the table assumes that 100% of NAV will be returned in a single distribution on 3/31/27. As described in the following sections, I believe that STHO can probably realize a higher amount that will be distributed in multiple payments over a time frame lasting beyond 3/31/27. So of course the actual IRR will be different.

STAR HOLDINGS SAFEHOLD INVESTMENT

STHO retained 13.5mm SAFE shares in the restructuring. CEO Jay Sugarman explained:

“One is just the critical mass, just having a handful of assets was probably not the best profile for SpinCo. Look, it's our job to monetize those assets and capture the upside we think still exists there. That's true for both the real estate assets, but it's also true for the Safehold shares. We obviously don't think the current market price [$43.89 close on 8/19/22] reflects full value.”

The shares were restricted from sale for nine months (until 12/31/23). They could now be sold at any time, but none have yet been sold. The position has been pledged as collateral for a $85.5mm margin loan facility.

While Sugarman said that SAFE was undervalued at the time of the restructuring, it did make a small secondary offering in August 2023 at $21.40. The company cited the offering as helpful in achieving a credit rating upgrade two months later. SAFE traded as low as $15 a year ago. My guess is that STHO will continue holding its SAFE shares until proceeds of other asset sales are sufficient to pay off the margin loan, and then distribute the SAFE shares to its investors rather than selling in the market.

Analysis of STHO can bog down in attempt to assess the fair value of SAFE due to the extremely long duration of its leases, their variable CPI adjustment, and the variable land/property value at ground lease expiration after 99 years. SAFE suggests discounting future value and cash flows using the yield of the 2116 bond issued by Massachusetts Institute of Technology (yielding 5.18% on 10/24). Morgan Stanley suggests using a 6.5% estimate of SAFE's cost of equity. For the purposes of analyzing STHO, I think the best way to value its stake in Safehold is to use the current market price. SAFE Is actively traded, covered by 13 analysts, and has savvy institutional investors including MSD Capital with an 8.1% stake.

MAGNOLIA GREEN

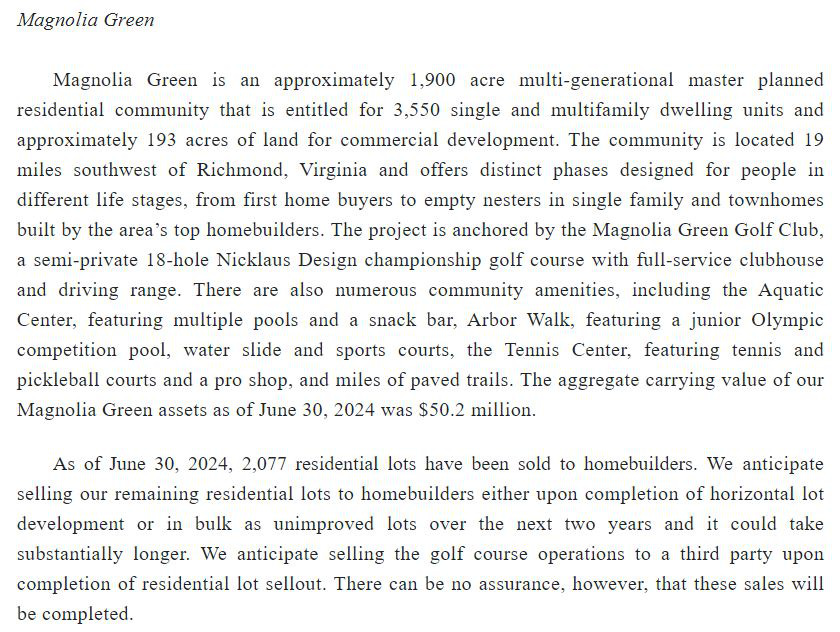

Magnolia Green is a planned community 22 miles southwest of Richmond

At first glance it appears that sales are moving slowly because only 252 lots have sold since the 3/31/23 restructuring, however comparing the community Master Plan against a recent satellite image suggests that nearly all of the single family and townhouse lots have been developed.

STHO's disclosure suggests there are 1473 unsold residential sites, but I believe that approximately 1322 will be within the Senior Community. It would make sense to sell that in a single block to a developer with experience in that market. That would leave just about 150 standard residential sites which looks about right from the satellite image. Single family homes in the community are selling for over $600k and townhomes over $400k so an average lot is probably priced over $100k. Nearing successful completion of the residential community provides a solid foundation for the commercial Marketplace at the entrance to the community on State Highway 360. A conceptual plan suggests that the Marketplace could include shopping, office, and condominiums, but development will require extension of a road and utilities. On the satellite image it looks like street construction already commenced.

Remaining risk appears low and STHO should at least recover its $50mm carrying value through sales of remaining lots, senior community, commercial space (possibly including condos), and the golf operations. $34k per unit for 1473 residential sites appears low, but lack of disclosure about composition of the inventory and details about the realization plan make it difficult to quantify potential upside.

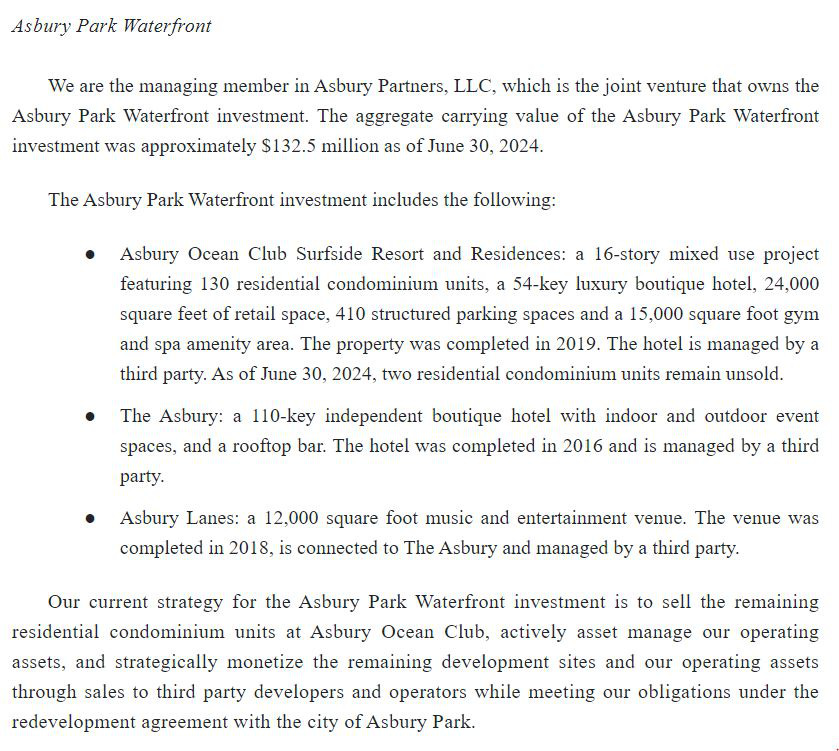

ASBURY PARK WATERFRONT DEVELOPMENT

Asbury Park waterfront is the rejuvenation of a beach and boardwalk neighborhood two hours by train from New York City.

iStar acquired the equity of Asbury Partners in 2009 through a loan foreclosure, but the holding has always been treated as a non-core asset with minimal disclosure about the underlying real estate. It's hard for investors to feel comfortable that 2 small hotels, a bowling alley / music venue, and “remaining development sites” are worth $132.5mm.

Frustrated by the lack of information from iStar/STHO, I reviewed New Jersey property records, filings with the Asbury Park Planning Board, and made a trip. I have not seen any of this information posted online by analysts or investors. There's nothing for me to doublecheck the work against, and the company's Investor Relations representative has not responded to email, so I may have made some errors, but I nevertheless believe the work provides confidence that the value of this asset can by realized by STHO.

What is the appeal of the Asbury Park Waterfront? I never go to the beach so I can't compare it with competing locations on the Jersey Shore or Long Island, however The Times of London says it’s “the coolest place on the east coast”. Attractions:

Historic legacy from when it was a leading resort community before WW2. The city has landmarks and older buildings with character such as the Carousel building at one end of the boardwalk.

Musical heritage highlighted by Bruce Springsteen's debut album, but also featuring performances at the Convention Hall on the Boardwalk by acts from The Rolling Stones to 50 Cent. The 3600 seat performance space has been closed for structural repairs for the past 4 years. The boardwalk manager is currently negotiating for state incentives to support a $75-100mm repair and restoration project. The legendary Stone Pony Bar is also next to the waterfront (Fantastic Cat is playing 11/2)

Boardwalk and beach offer snacks, drinks, and casual shopping (SHOP EAT PLAY). The retail properties all belong to Madison Asbury Retail which was reportedly a unit of Madison Marquette. In January 2024 Avison Young acquired Madison Marquette's retail property management business, including the Asbury boardwalk. Star Holdings 10-K List of Subsidiaries includes Madison Asbury Retail, but does not show an ownership percentage and the financial statements do not seem to include any significant assets, equity, or revenues that might be attributable to Boardwalk operations. So I don't know whether the beneficial owner of the Boardwalk properties is Madison Marquette, Avison Young, STHO, or some third party. In any case, Avison Young is an experienced property manager and has prepared Boardwalk marketing materials for potential tenants.

As described in the 10-Q (excerpt above), STHO owns two completed blocks, one holds the Asbury Ocean Club hotel and condos (128 sold, 2 remaining). The second holds the Asbury Hotel and Asbury Lanes entertainment venue. The development opportunity is that most of the remaining land facing the boardwalk belongs to STHO and is vacant. The entire area will become more attractive, vibrant, and valuable as these empty lots are developed.

STHO's very limited investor disclosures can leave the impression that there has been little progress and uncertain value. However municipal planning documents and a personal visit show that the company has been active. Looking at each highlighted block from top to bottom...

The Views At North Shore – STHO has applied to the city planning board for approval to build two buildings with a total of 54 condos.

Delta Townhouse – STHO has applied to the city planning board for approval to build 45 townhome units.

Block 4307 – There is no active planning proposal for this site which is currently used as a paid parking lot. A city planning document in 2018 mentioned an iStar expectation of adding 204 condo units at the site. Immediately north is the city's water treatment plant. I noticed no smell or emissions. The tall building on the other side of the plant is The Asbury Tower, a senior living center.

Beach Club – STHO, in partnership with Madison Asbury, received approval in 2021 to build a private membership beach club adjacent to the boardwalk. It would include a pool, food service, private cabanas, showers, storage, and a roof deck. As a condition of approval, STHO is also required to build a separate public beach club within 18 months. STHO claims that it has not been able to get Madison Asbury's approval to proceed and in June received two one year extensions to begin development. The reason for Madison Asbury's failure to grant consent is unknown, but perhaps the new Avison Young management can get things moving. The club should be profitable on its own and it would also enhance the appeal of local luxury residential developments.

The Lido – STHO closed the $15mm sale of this site in December 2023 to Somerset Development which has approval to build 155 luxury condos plus some ground level retail. There's a marketing website, but the development timeline is unclear.

The Asbury Hotel – iStar spent $50mm on redevelopment of a derelict Salvation Army building into a 110 room boutique hotel (official site) which opened in 2016. It's rated 4.4 stars on tripadvisor and rates are around $180-200/night.

The Asbury Lanes – iStar renovated this bowling alley into an event space, retro diner, and bowling alley (official site). Just missed Mannequin Pussy on 9/27.

The Asbury Ocean Club – iStar completed this 17 story tower in 2020 with 130 condo units and a 54 room boutique hotel (official site). It's rated 4.5 stars on Tripadvisor and rates are around $350-400/night. The condos sold at prices up to $5.5mm and just 2 remain, maybe worth $5-10mm. It's impressive that the project sold so well even as the surrounding lots were still empty.

Surfhouse – STHO sold this site in 2023 to a vehicle funded through Crowdstreet in 2022. I believe this is the entity referred to as “The Venture” in STHO's financial statements with a $10.6mm mezzanine loan and completion guarantee of an $80mm construction loan. The rental project (official site) will have 206 apartments and 20 townhouses with completion expected in 2025. The Venture is consolidated in STHO financial statements as a $27.5mm asset with a $21mm minority interest (the crowd equity).

Block 4004 - There is no active planning proposal for this site which is currently used as a paid parking lot. A city planning document in 2018 mentioned an iStar expectation of adding 160 condo units and a 110 room hotel. Completion of this site would make the adjacent Asbury Ocean Club and Surfhouse more appealing.

Block 3902 - There is no active planning proposal for this site. A city planning document in 2018 mentioned an iStar expectation of adding 160 condo units. At one corner is the legendary Stone Pony Bar and Performance venue. Part of the lot is used by the Pony as an outdoor stage, but the long-term plan is to move that to the beach as an extension of the Carousel & Casino – a great idea. The rest of the site is currently used as a paid parking lot. Completion of this site would make the nearby Asbury Ocean Club and Surfhouse more appealing.

Block 3904 - There is no active planning proposal for this site. A city planning document in 2018 mentioned an iStar expectation of adding 80 rental units and a public parking garage with 400 spaces. The Ocean Avenue side is occupied by the Empress Hotel and Paradise Lounge (Tuesday Night Drag Bingo!). The rest is a parking lot.

Blocks 3802 3803 and 4503 - There is no active planning proposal for these sites. A city planning document in 2018 mentioned an iStar expectation of adding 55 condos, 149 condos, and a 66 room hotel. The sites are currently used for parking.

Block 3801 - There is no active planning proposal for this site. A city planning document in 2018 mentioned an iStar expectation of adding 56 townhomes and 147 condos.

Land Value

In 2023 STHO closed sales of the 4105 partial block (Lido) for $15mm and the 4001 block (Surfhouse) at a $27.5mm valuation. The 8 remaining undeveloped lots are different sizes, some locations are better than others, some would be developed more densely than others, and some could be developed by STHO rather than sold to third parties. At an average lot valuation of $15mm the undeveloped land would be worth $120mm in total compared to a 12/31/23 carrying value of about $82mm (not updated quarterly).

STHO provides very limited financial disclosure about its completed operating properties. It invested $91mm in the hotels plus Asbury Lanes and carried them at a 12/31/23 depreciated value of $70mm. Hotel revenues were $8.4mm in 1H24 and hotel expense is not broken out. There's no operating information about occupancy, ADR, or REVPAR.

All of these properties are likely to be highly valuable in ten years once the waterfront development development is completed, including restoration and reopening of the classic boardwalk Carousel, Casino space, and Convention Hall. The area's entertainment venues add all season and all-weather appeal. However it's hard to estimate what value could be realized within the 2.5 remaining years of the liquidation timeframe indicated at the formation of STHO. The short-term potential will be affected by factors beyond the control of the company such as mortgage rates and homebuyer sentiment (employment and stock prices).

I believe STHO can realize more than the $133mm 6/30/24 carrying value of its Asbury Park assets, but that liquidation will take more time. Hopefully a phased approach will reduce risk, maximize proceeds, and minimize the need to invest additional capital. Proceeds from other asset sales (Magnolia Green and other) could be distributed to shareholders within two years along with some of the SAFE shares.

OTHER ASSETS

STHO reported $85mm of “Other” development assets at 6/30/24 including:

$17mm of performing loans

$13mm of Available-for-sale CMBS, including $9mm purchased in 1H24

$23mm of land. A portion of this may be attributable to a site in Coney Island where there is an agreement with a developer for a 282 unit apartment development at 3027 West 21st street.

$27mm related to the Surfhouse “Venture”

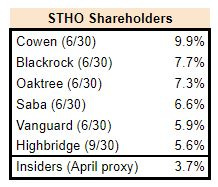

SHARE OWNERSHIP

The most recently disclosed stakes include several savvy active managers:

A 941k share block (7.1%) traded on 9/24 so we may see a new disclosure soon.

INCENTIVES

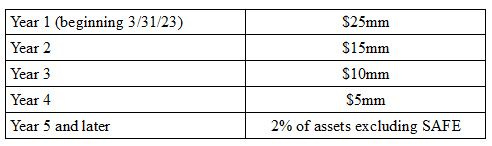

Safehold is managing STHO in exchange for an annual fee that will decline as STHO assets are expected to be wound down:

The declining fixed fee means that Safehold does not benefit from dragging out the liquidation process, but Safehold is not receiving an incentive to maximize proceeds.

An entity called Starfield Companies employing former iStar executives Brian Cheripka and David Furgal claims to be responsible for managing the development of Asbury Park and Magnolia Green. Starfield is not a subsidiary of STHO or SAFE and is not referred to in either company's financial statements. I don't now whether Safehold is compensating Starfield out of the management fee it receives from STHO, or if Starfield compensation, possibly including a promote, is buried in project expenses and cost of sales.

For conservatism I deducted the remaining 2.75 years of fees payable to SAFE from my estimate of STHO's NAV.

RISKS

Star Holdings has potential to deliver an excellent return, however it has significant risks:

Dependent on demand for second homes. Higher interest rates, a weaker economy, or a weaker wealth effect could lead to delays in development and lower proceeds.

Community opposition. STHO has broad rights to develop the Asbury Park lots based on a master agreement signed by Asbury Partners in 2002, however each individual project still requires planning board approval and recent submissions have generated opposition to gentrification and increased traffic.

Governance is opaque. Starfield is somehow managing these developments on behalf of Safehold for the benefit of STHO. Incentives and accountability are unclear. Disclosures to investors about the assets and the monetization strategy have been minimal and STHO has no apparent active investor relations function.

Liquidation timing is unclear. STHO was formed with an intention, but not an obligation, to liquidate. Magnolia Green is on a path to completion, but it might take 8-10 years to fully develop all of the sites in Asbury Park. STHO could sell its assets at any time as-is, or rationalize delay.

SEA.HEAR.NOW

Springsteen & The E Street Band playing for 35,000 people on the Asbury Park Beach as part of the city’s Sea.Hear.Now festival in September 2024. Many fan videos have been posted.

Disclosures & Notes

At the time of publication I held shares of Star Holdings. This article and disclosure should not be interpreted as a recommendation to purchase any securities and this holding could change at any time. Investors are encouraged to check all of the key facts cited here from SEC filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.

I hope that publication of this article will encourage greater investor understanding and scrutiny of Star Holdings. I welcome comments or messages from anybody who has additional information about its assets.

Of course the title is an homage to the soulful Sixto Rodriguez … and STHO’s CEO is named Sugarman … so you see what I did there 🐱

Great in depth research! a joy to read!

The Stone Pony*