Noah Holdings: China's Largest Private Wealth Management Company

Consistently Profitable, High Dividend Payout, Growth, Net-Net Valuation

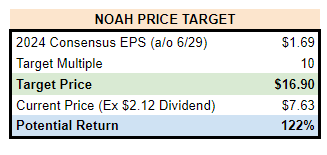

Noah Holdings (NOAH and HKG:6686) is an investment advisor to high net worth Chinese clients. I estimate a one-year potential price return of +122% (adjusted for the 7/3 dividend of $2.12/ADS). Key financial data:

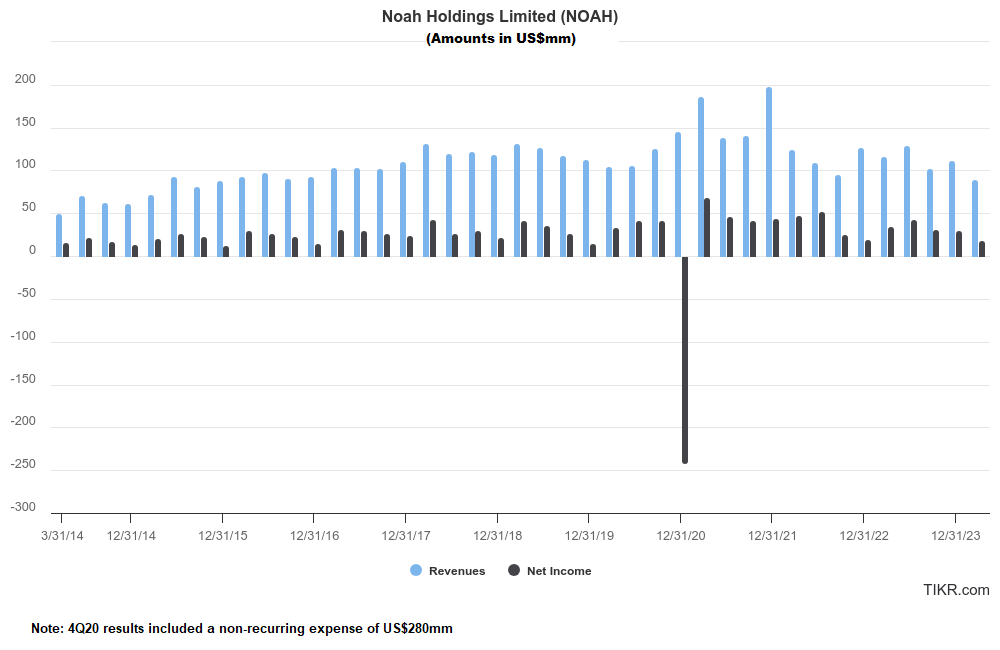

Consistently profitable: Average EPADS of $1.55 from 2014-2023 and profitable every year except 2020 which had a non-recurring expense.

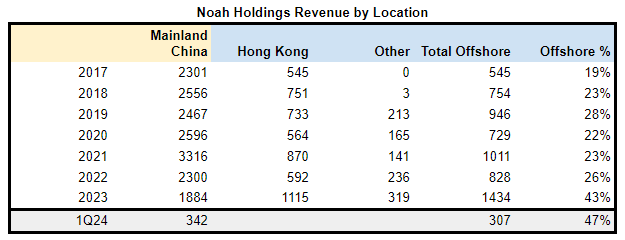

Growth: Revenue +17% from 2017-2023 driven by Overseas business +163%

Capital Return Target: 50% of annual non-GAAP net income with at least 35% in cash dividend. Actual distribution attributable to 2023 earnings was a 100% payout.

Valuation: Cash and short-term investments at 3/31/24 of $813mm. Net of the 7/3 dividend Noah will have cash of $665mm ($10.18/ADS), greater than its market cap of $504mm ($7.63/ADS post-dividend).

Key facts about the business:

Founded in 2003 by current management team. Nasdaq listed 2010. HKEX listed since 2022.

Capital-light fee-generating advisory and fund management business.

Main products are private equity and mutual funds.

International growth is reducing dependence on the Chinese equity market. Overseas Assets Under Management rose 8% to $5.1Bn (23% of total) in 2023 and 43% of Revenue was generated outside mainland China.

Noah’s ADS will trade ex-dividend on 7/3/24 by US$2.124929. Noah’s Hong Kong shares will trade ex-dividend on 7/2/24.

THE INVESTMENT OPPORTUNITY:

Remained substantially profitable in recent years despite pressure on fees from depressed Chinese equity markets

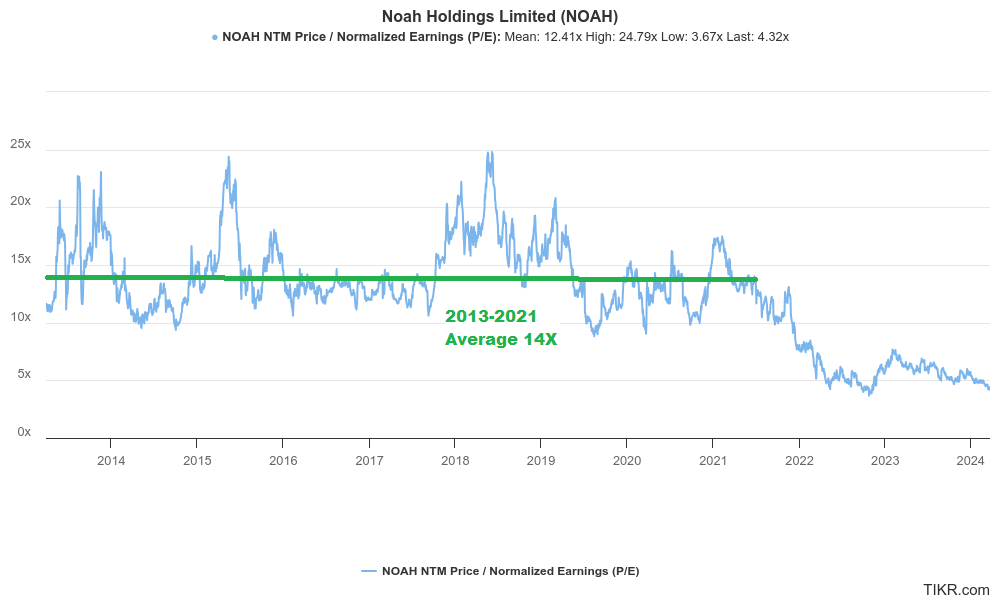

Valuation at 4.5 P/E should rerate to historical range that averaged 14X from 2013-2021 (almost never dropping below 10).

Cash dividend policy will deliver profits every year directly to investors.

Stabilization of Chinese equity markets and international investor sentiment can support recovery to a 10P/E over the next year which would provide a +122% return.

Recovery of Chinese equity markets would lead to higher earnings (perhaps $3/ADS) and a more optimistic P/E ratio of 15 that could push the share price to $45 (it passed $50 in 2019 and 2021).

BACKGROUND

Noah’s November 2023 Investor Day presentation is highly recommended.

Noah serves high net worth clients (at least 10mm RMB in investment assets – US$1.4mm) with 1,375 relationship managers in 63 domestic and international branches. Noah is the 8th largest wealth manager in China - the top 7 are all units of the major Chinese banks.

Deposit-taking gives banks an advantage in cash management and fixed income products. Noah has focused on private equity and is known for its close relationships with leading fund managers, including some like Sequoia and Hillhouse that are difficult to access. Sequoia China owns 5.3% of Noah acquired in 2007 and its founder Neil Shen owns an additional 0.6%. Shen served as an independent director of Noah from 2016-2023 and then was replaced by another senior Sequoia executive (Kai Wang). Noah partnerships in China:

Noah is now achieving rapid growth in international products driven by the offshore assets of existing mainland clients. Noah serves as a distributor for leading international PE firms and hedge funds eager to access capital from its Mandarin-speaking China-resident clients. International offerings are a significant competitive advantage relative to domestic peers. Noah hopes to grow its current US$8Bn of overseas AUA to US$20Bn in 3-5 years.

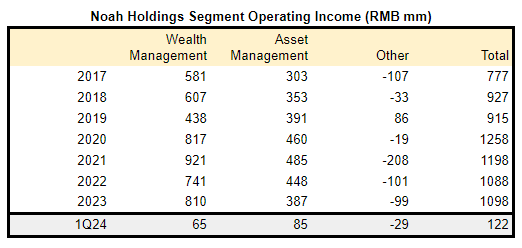

Noah reports two operating segments:

Wealth Management earns sales commissions and participation in base management and performance fees for funds it distributes.

Asset Management operates Private Equity funds (including Fund of Funds, feeder funds, and co-investment funds) and earns management and performance fees.

VALUATION PERSPECTIVE

Historical performance has demonstrated consistent profitability, but weak growth. Depressed Chinese financial markets have eroded fund values and performance fees. It has not been a favorable environment for private equity firms to realize gains through IPOs or M&A. A fee-based business with no growth in revenue and income might be fairly valued at a 10 P/E.

A bright spot has been Noah's rapid growth in international revenues. Capital controls mean that most clients have distinct pools of assets (onshore and offshore) which cannot easily be shifted. A bullish outcome would be continued growth in international business plus a recovery in the domestic Chinese business. One could argue that the international business already deserves a 15+ P/E closer to international private equity and asset management firms.

Noah's book value at 12/31/23 was $21.99/ADS, nearly all tangible and including $11.88 of cash and short-term investments. Tangible asset value should protect the fundamental downside risk, although Chinese issuers have sometimes traded far below their tangible asset value. Of the cash, $405mm ($5.90/ADS) at 12/31/23 was required to held in China as a statutory reserve available for any use in the ordinary course of business, but not for dividends except in the liquidation of the company. So the free cash is about half the stated amount. Noah also purchased its headquarters building in Shanghai in 2021 for 2.2Bn RMB ($4.66/ADS).

Noah repurchased $100mm of shares in 2020-2021 at an average price of $44.77/ADS. Oops. In 2022 the company adopted a policy to distribute a dividend of at least 10% of annual non-GAAP income. Based on the final 2022 results a payment of $0.60/ADS was distributed in August 2023 (about 18% of 2022 non-GAAP results). In November 2023 the company adopted a new guideline that a minimum of 35% of non-GAAP income would be distributed as dividends and that a total of up to 50% could be used for dividends and share buyback. At Noah's 11/14 Investor Day presentation the Chairwoman (and 22% owner) said “As a shareholder, I hope 100% dividend of the profit that is my target, 100% dividend payout of the profit or maybe 50% and some buyback. More dividend, better buyback.” The final announcement of 2023 results included a regular dividend payment based on 50% of 2023 non-GAAP income, plus a special dividend equal to an additional 50% of 2023 non-GAAP income.

Noah’s share price dropped after 1Q24 earnings were weaker than expectations. Management offered several explanations:

Absence of commissions from new fund launches in China due to cautious investor sentiment.

Absence of corporate actions (e.g. IPOs and M&A) that would trigger performance fees from fund products in China.

Increased overseas product sales were concentrated in short-term fixed income investment products due to the appeal of high current US Dollar interest rates. Management still considers the increase in overseas accounts (HNW clients +40% yoy) and AUA (+8% yoy) positive leading indicators as these clients can shift to more profitable products over time.

KEY RISKS

Noah's offshore business is growing, but still dependent on Chinese client relationships. If Chinese economic and financial market weakness persists then aggregate wealth may decline and wealth management will be an unrewarding industry. Investor sentiment may remain depressed regardless of Noah’s valuation.

Noah’s 2023 20-F indicated that RMB 305mm would be remitted from China to facilitate the upcoming dividend payment. There’s no certainty that the company will always be able to withdraw funds from China in the future. The 2023 report also showed that 76% of that year's pretax income was earned outside of China so presumably cash generation was comparable and can support continued capital return through dividends and buybacks.

Fraud has been a concern in any China-related investment. Noah's long history, high public visibility, institutional relationships (leading Chinese and international PE firms), blue chip investors (Sequoia), absence of share issuance, and developing history of shareholder returns make it unlikely that it has defrauded investors. However, Noah itself has been a victim of fraud. For several years it managed a credit fund that factored payments from JD to Camsing, a HK-listed producer of electronic equipment. In 2018 Noah discovered that Camsing has forged the JD contracts and payables. Noah was not a party to the fraud and was not legally liable for the losses incurred by the funds, but offered a settlement of 1.8Bn RMB which is being paid in shares over a 10-year period and was fully expensed against 2020 Net Income.

Rapid growth in the wealth management industry in China amid lax regulation led to some reckless behavior during the boom years. Private credit funds offered loans to real estate developers at yields of 10-12% with less restrictions on use of funds than bank loans that cost 5-6%. If a project ran into trouble then investors would demand that the fund manger or syndicator reimburse their losses. The uncertain default risk and the uncertain sponsor liability made Noah a potentially risky investment and a short seller confidently claimed in 2016 that it would be wiped out. Noah proactively ceased managing new real estate credit in 2016 and incurred zero losses. However Noah continued managing and distributing other credit investments which resulted in the “Camsing incident”. Noah ceased all credit-related investments in 2019 and thereby avoided damage from the deleveraging of the Chinese economy in recent years. The current business focuses on private equity and mutual funds which do not expose the company to the risk of fraud or any client expectations of implicit support.

Corporate structure has been a fading risk for investors in securities of Chinese issuers. Sectors that remain off-limits to foreign ownership (e.g. ecommerce) have been accessed for many years through Variable Interest Entities (VIEs) in which a Chinese operating business has a nominee owner that signs a personal contract with a Chinese subsidiary of a foreign investor. The contract conveys the right to all income and net assets of the operating business, however the validity of such contracts has been a long-standing question. Skeptics would point to the contracts and claim the foreign company has no direct title to the assets. Legal precedents are gradually accumulating to demonstrate that the contracts are enforceable and they are no longer a leading investor concern. Noah uses VIE's for a portion of its asset management business so that its private equity funds are able to invest in sectors prohibited to foreign ownership. Noah's VIEs contributed 30% of its 2023 revenue, 21% of net income, and held 28% of total assets.

Disclosures & Notes

At the time of publication the author held ADS of Noah Holdings. This disclosure should not be interpreted as a recommendation to purchase or avoid any security and these holdings could change at any time. Investors are encouraged to check all of the key facts cited here from SEC filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.

Once again please be aware that the ADS will trade ex-dividend on July 3, 2024. Calculations in this article are based on an ADS price of $7.63 (6/27 close of $9.85 adjusted for $2.12 dividend with 7/3 ex-dividend date).

Any thoughts on buying US listing vs. Hong Kong?

No, my earlier comment is directed at how incredulously its share price has sold off in the past years, -78% to be exact in the past 5 years. Yours was a v good read; first time I got to learn of the company as well, so thanks. Unless this company is a fraud — mkt seemingly suggesting it is but nothing in your article suggests that it is — then surely the stock is a strong buy at current.