Dream Office Bay Street Collection Property Visits

I recently toured Dream Office’s heritage Bay Street Collection properties with Dawoon Chung (VP, Strategic Finance and Asset Management) and the Dream Office (Dream) leasing team. The design aspects of the property renovations have been widely praised:

Restorations ready a downtown Toronto niche for the next generation (Globe & Mail)

Bay Street Village: Corridor Chronicles (Canadian Interiors August 2024)

Design Space: Daphne by Studio Paolo Ferrari (Nuvo Magazine November 2023)

Want to revitalize the office? Think about it like a tourist attraction (Globe & Mail)

A piece of Bay Street heritage preserved in downtown redevelopment (Globe & Mail)

Some perspectives on how these assets fit within Dream’s business:

Budget of $80mm ($129 psf) covered a thorough revitalization of every building to a boutique luxury hotel standard. The represent 19% of Dream’s downtown Toronto GLA.

Toronto office market remains oversupplied, but the renovated Bay Street properties may enjoy a 42% increase in annual revenue when conditions stabilize.

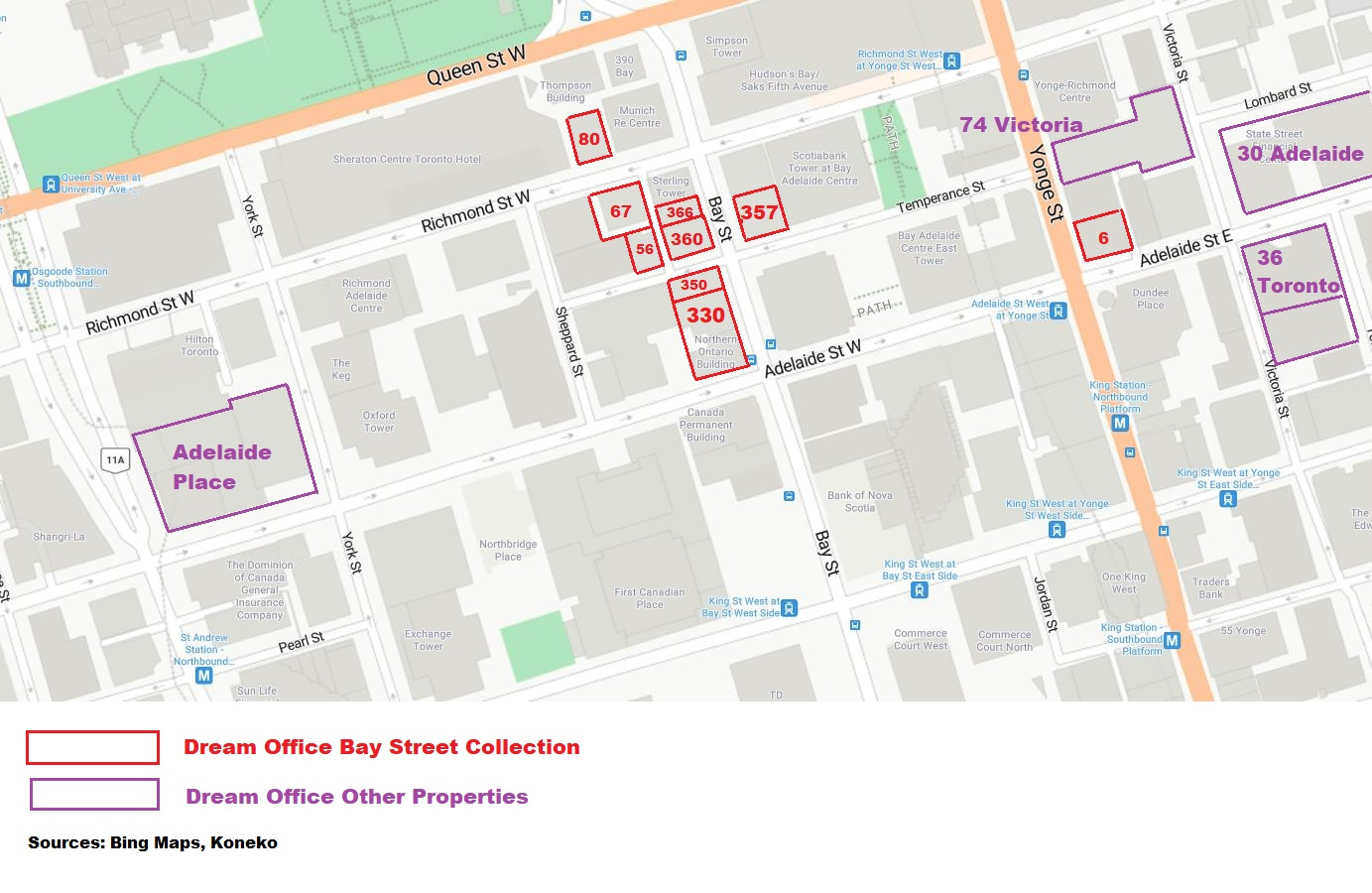

Contiguous locations create a synergistic neighborhood effect. Ground floor retail spaces have been leased to high quality tenants.

Pre-built suites in these buildings with small floor plates are ideal workspaces for boutique client service companies (financial, legal, consulting). Suite cost of $125-140 psf is significant, but replaces tenant incentives.

Other nearby Dream buildings have had some some signs of success.

This article provides context for understanding Dream’s business and may be helpful in understanding future developments. It does not provide a complete company profile or make any recommendation about investing in Dream Office. As previously disclosed, I have held Dream Office units and shares of Dream Unlimited for the whole year.

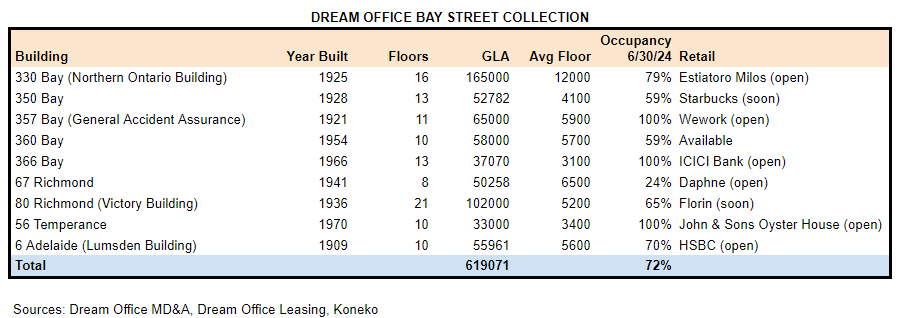

Overview (Property List and Location)

The Bay Street Collection properties comprise 619,071 sf, accounting for 19% of Dream’s Downtown Toronto GLA, and 12% of total GLA. The tight geographic concentration and common characteristics of the nine buildings make them a prize asset with the REIT’s larger portfolio.

Toronto Office Market

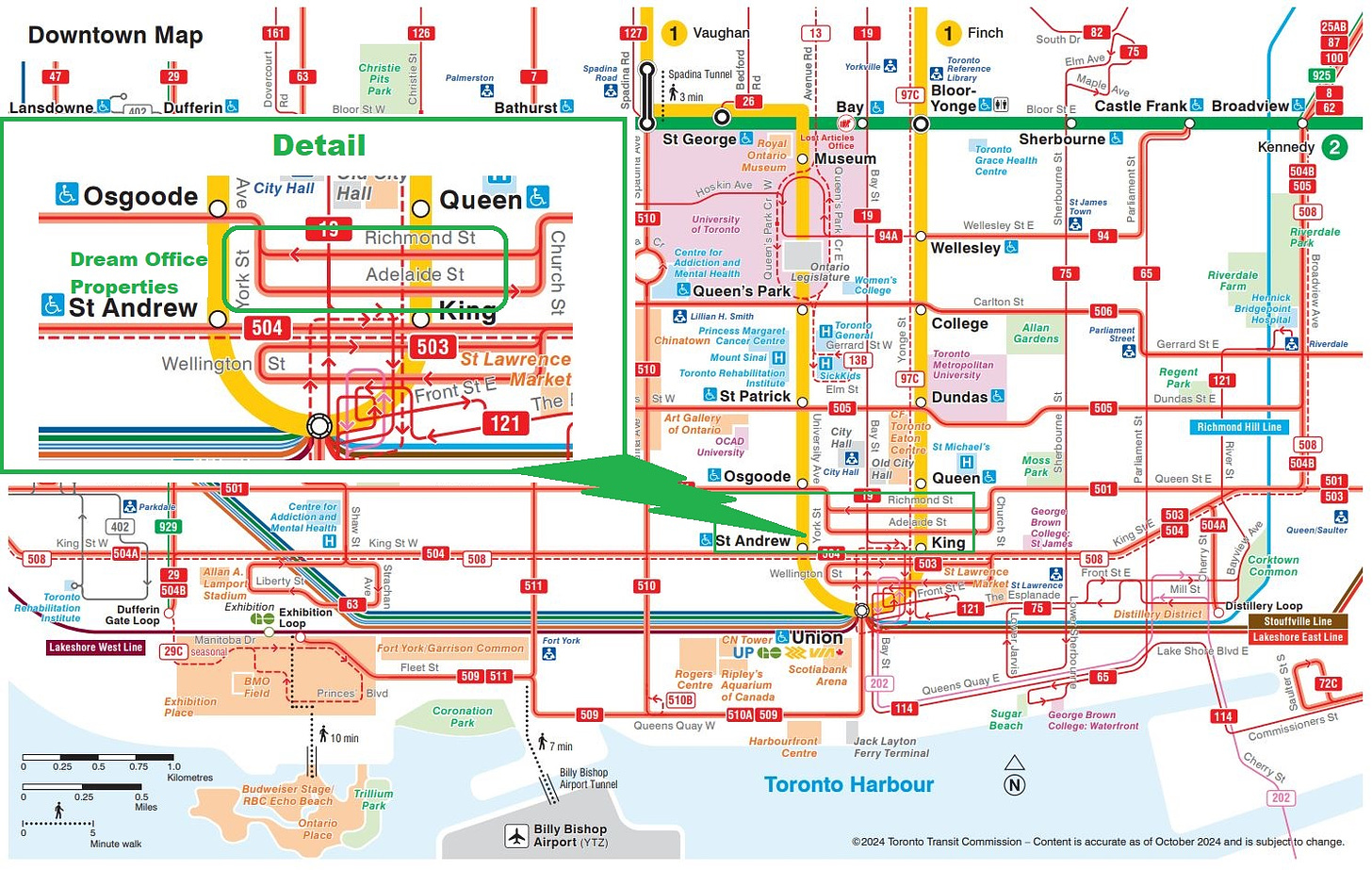

Toronto office market conditions have drastically changed since Dream came up with the Bay Street renovation plan in 2018 and began construction in 2019. The availability rate in the Financial Core has risen from 3.8% at 12/31/19 to 16.8% at 9/30/24 (per Colliers). COVID demonstrated that office workspace is not essential, but employers have concluded that it’s more efficient and productive. The challenge has come in getting employees to give up the lifestyle flexibility they enjoy from working at home, or remotely, or not really working at all. The best way to motivate skilled and valuable employees to work together in office is to “Create a magnet, not a mandate”. Desirability can come from location, community, design, and amenities.

Toronto’s high capacity mass transit rail is still oriented towards delivering people to the downtown core. Access to the central area is convenient for the largest number of employees.

Downtown office usage has been steadily increasing.

My random video from the underground PATH network on a Wednesday afternoon at 2PM shows the area is full of people. Retail spaces are all open.

Workplaces have passed the structural challenge of whether employees will return to offices, but continue to face a challenge of cyclical oversupply. Tenants can get great deals, at great buildings, and in great locations. Bargains for tenants leave lean returns for property owners, but quality buildings can outperform by maintaining occupancy and positioning for a market recovery.

The widely reported market vacancy includes buildings without good transit access (e.g. T3 Bayside, Portland Commons, T3 Sterling) and Class B/C properties that clients can leave for good deals in better properties.

Bay Street Collection Capex and Upside

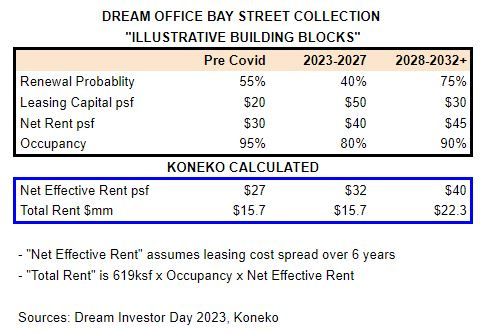

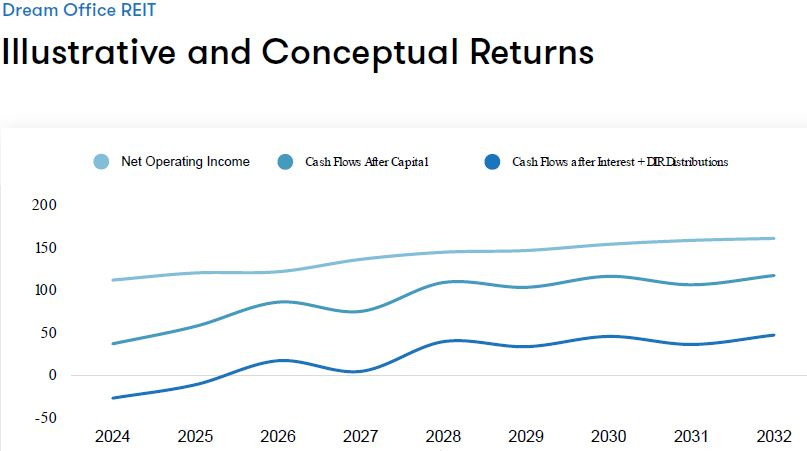

Dream’s 2023 Investor Day presentation illustrated the potential impact of difficult conditions persisting through 2027. Using Dream’s inputs I estimate revenue upside of 42% from the Bay Street properties when the market stabilizes.

Dream also suggested that its free cash flow after distributions and capex would be negative in 2024 and 2025 before turning positive in 2026. It’s obvious from a visit to the Bay Street properties that their ambitious capex plan will be completed in 2024 and now some cash is being used in leasing them up.

The $80mm Bay Street capex represented about 35% of Dream’s capital expenditures since 2018. The work is nearly done, the spending is done, and now revenue will increase as tenants move into the improved space. Dream’s other nearby buildings are also in excellent shape with no large pending project expenditures.

Bay Street Collection Value for Tenants

Dream’s heritage properties offer stylish design, modern utilities, a vibrant neighborhood, and a central location with 4000-6000sf floorplates. They are an attractive solution for smaller client service companies (finance, professional services, and consulting) that want an impressive workspace accessible for visitors or from which it’s convenient to visit nearby clients and partners.

They are not Trophy buildings like the new glass towers around Union Station, but if you only need 5000sf then that would be a fraction of a middle floor halfway up Brookfield Place. You don’t look special or important when you lease 0.4% of a building. At a Dream property, a small business can lease an entire floor - step off the elevator into its own private space. The older downtown buildings are surrounded by laneways so there are usually windows on 3-4 sides of a floor - nearly every seat will be within 20ft of a window.

A search for 3000-6000sf of available office space in downtown Toronto shows many options, including listings for the Dream properties.

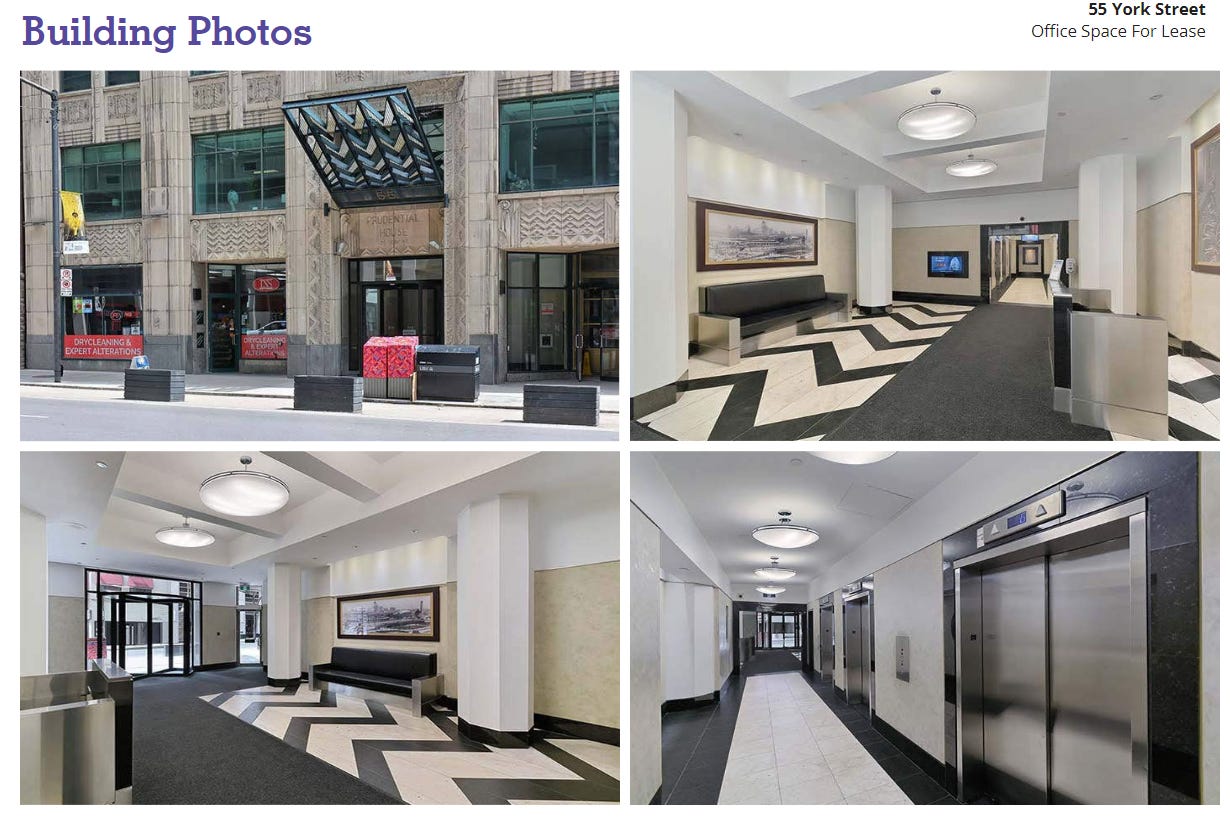

However the listings reveal that few competitors have made investments comparable to Dream. As an example here is 55 York Street (owned by Adgar Canada) - it’s an attractive 1930 heritage building with a bland “modernized” interior. It looks like the floor patterns were inspired by WW1 dazzle camouflage.

Here is 365 Bay Street; a 1961 building from the same era as several of Dream’s buildings and right across the street, but with a tile and metal entryway like an airport restroom.

Neighborhood Effect

Dream’s properties are immediately adjacent so there is a synergistic benefit from shared design themes and premium ground level tenants.

An upscale cocktail bar (Florin) will be filling the space in the award winning facade of the Victory Building. Only one retail space remains unleased (360 Bay).

Multiple unique dining options elevate the atmosphere of the buildings and the neighborhood. It’s similar to the strategy that Allied Properties has followed in the King West neighborhood and with La Cite in Montreal. Dream’s property management can be more efficient and effective with multiple nearby buildings.

The contiguous properties form a land assembly that could provide opportunities for value creation >10 years in the future. For example, 330 Bay Street combines a 1925 heritage structure with a 1980s extension. The more modern side could be replaced with a super-structure.

Dream could take advantage of the skills and market presence developed through the Bay Street Collection restoration program to acquire and redevelop nearby buildings. Of course Dream does not currently have capital for any acquisitions, but that could evolve over time, or the knowledge base might be a motivation for a private capital buyout of Dream Office.

Suites

Office space ready for immediate occupancy has become a popular solution for both landlords and tenants. Dream provides this overview of its offering (some links on that page don’t work).

Financial implications:

Significant upfront cost of $125-$140/sf born by Dream and mostly recorded as building improvements. Gross rents around $70psf for the Bay Street buildings mean that it requires about 2 years to recover the cash outlay. Landlords without access to capital can’t compete.

Suite capex replaces funds that would have been provided as Leasing Incentives and used for a tenant’s own investment in design, furniture, and fixtures. Even with model suites a period of free rent may be available as part of contract terms.

All furniture and fixtures remain the property of Dream so they can be offered to a new tenant in the event of non-renewal.

Standardized design simplifies procurement, leasing, and property management.

Suites boost occupancy which will hopefully pay off when clients renew leases under more favorable market conditions.

Move-in ready space is especially valuable for smaller businesses such as the occupants of Dream’s Bay Street buildings. That size of company does not have a facilities department to manage design etc… Completed space eliminates their risks of delays or cost overruns.

Suites provide some of the convenience and innovations of co-working businesses. In addition to immediate availability, Dream has also drafted simple leases available for terms as short as one year. Dream’s leasing team said that many tenants have postponed decisions about office occupancy and have waited until they need to be able to move within a few months. In the current market they can still find a great deal.

Other Dream Properties

Some brief observations from Dream’s other downtown properties, all of which have been well-maintained. They don’t have the same heritage design elements as the Bay Street Collection buildings, but some have their own strengths:

Adelaide Place - this is Dream’s largest property and is comprised of two towers (DBRS Tower at 181 University and 150 York Street) with a shared plaza. Reconstruction of the mezzanine level plaza will add food/drink service and seating, a portion of which can be enclosed. There’s an opportunity to create a great amenity since it’s public, but also elevated and removed from street traffic. DBRS renewed its lease as anchor tenant for ten years.

36 Toronto - This address combines a heritage structure (The Excelsior Building) with a well designed 1980s extension around a large central indoor atrium. Dream mentioned on its 4Q23 call that Paramount Entertainment Group has moved its Canadian head office into the building (leaving Duncan Street in the “Entertainment District”). Bar Goa, an upscale Indian restaurant has moved into a retail space.

I can describe positive impressions form these buildings, but the true test is always leasing. If DBRS and Paramount see the positives then the buildings are viable.

Investment Implications

I estimate an equity implied cap rate of 9.0% from Dream Office’s 11/4 unit price of C$20.55. That’s a premium of about 600bp over Government of Canada bond yields. For comparison, US Office REITs with high quality NYC exposure (SLG VNO BXP) are trading at 6-7% cap rates, a premium of 200-300bp over US treasuries. Dream’s short interest remains high at 1.15mm shares (7% of outstanding, or 15% of float) - I don’t know what those people are thinking since Dream’s properties are viable through the downturn and the upside if the equity cap rate moves to 6-7% is significant. I did not observe or hear about any material changes in Dream properties, however I was encouraged by these factors:

Capex for the Bay Street properties is nearly complete. The REIT’s negative free cash flow has concerned investors, but that is certain to ease.

Retail properties will modestly boost NOI because their ground level rents are about 2X office. The quality of the tenants is a favorable signal.

Renovation of the Bay Street properties is essentially complete and they are ready for occupancy. Office leasing progress in coming quarters will be of great interest. Will new tenants embrace the premium space? I think they look appealing, but contracts will be the true test. Property NOI will still be depressed by incentives, but if the space fills then the long-term outlook will be favorable.

The REITs geographic concentration is even tighter than “Downtown Toronto” and creates beneficial synergies.

The Bay Street Properties are an unusual and impressive asset, however at this time they represent a modest portion of the overall business.

Success for the Bay Street Collection would enhance the image of the Dream Office brand and become a platform for long-term growth opportunities. These properties could be more important to the future of the company than their current share of GLA and revenue. They could shift the REIT’s investment narrative from “survival” to “value creation”.

I recently commented on other aspects of Dream’s business. Sale of 438 University to Infrastructure Ontario is still likely as a win-win transaction. Dream is likely to recover $45mm in April 2025 from a vendor-take-back mortgage issued in 2018. In March I described the redevelopment potential of 74 Victoria Street and it was briefly discussed on the August conference call - it sounds like the company has considered the possibility and Dream’s leases have some optionality if it wants to redevelop.

Disclosures & Notes

At the time of publication the author owned units of Dream Office and shares of Dream Unlimited. These holdings vary in size and could change at any time. These disclosures should not be interpreted as a recommendation to purchase any of these securities.

Everything in this article should be read as opinion unless an external source is referenced or direct photo evidence is included. Those sources should be double-checked to ensure facts have been correctly cited. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.