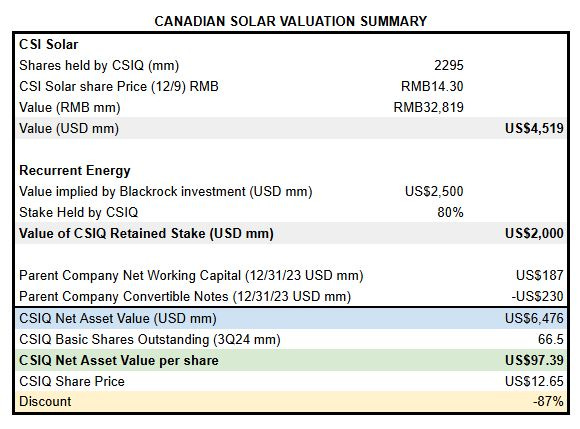

Canadian Solar (CSIQ) is an industry leading solar energy company trading at an 87% discount to its transparent sum-of-the parts valuation. Investors have been concerned about intense competition and overcapacity in China plus an uncertain outlook for renewable energy policies in the US. The price does not fairly reflect key strengths that should be catalysts for appreciation over the next 2 years:

China-based manufacturing segment is targeting at least 40% growth in Net Income for 2025. Rapidly growing energy storage business offsets the adverse impact of weak module pricing.

Recurrent Energy (project development segment) is shifting to a build-and-hold business model that will deliver steady long-term earnings.

Recurrent Energy is likely to have a US IPO within 2 years that will provide greater visibility and access to capital for continued growth.

US manufacturing should insulate the company from tariff and import controls.

Diverse global business provides exposure to markets outside of US and China

Topics:

Valuation Summary (NAV Discount()

Key Issues (Competitive environment and US Policy)

BACKGROUND

Canadian Solar is a Canadian company (Ontario incorporation) founded in 2001. It has two operating segments:

CSI Solar

CSI Solar is the China-based manufacturing business. It is fully integrated with production of polysilicon → wafers → cells → modules. It has added substantial battery storage production capacity so that it can offer a complete solar energy solution. There is also a large opportunity to add increasingly efficient batteries to existing solar installations. The company added module production capacity in Thailand as a way to avoid tariffs on Chinese production. It is making significant investments in the US:

$250mm solar module plant in Mesquite TX began production in 4Q23 and will reach full capacity by the end of 2024.

$800mm solar cell plant in Jeffersonville IN will begin production by 4Q25

$712mm battery plant in Shelbyville KY will begin production by 4Q25

CSI Solar listed on the Shanghai Stock Exchange (SHA688472) in June 2023, raising RMB6.0Bn of capital (about US$850mm). CSIQ retained a 62% stake.

Wood Mackenzie ranks Canadian Solar #4 among global producers of solar modules.

Recurrent Energy

Recurrent Energy is an international solar project development business. It manages every aspect of development from market research → site selection → permitting → financing → design, engineering, procurement, and construction. Recurrent traditionally sold completed projects in order to recycle its capital. In 2023 it began shifting its business model to retain completed projects in developed markets for long-term return.

In 2024 Recurrent sold US$500mm preferred shares to Blackrock that will be convertible into 20% of its equity. An IPO is expected within a few years, but the company has not given specific guidance.

VALUATION SUMMARY

CSIQ has $230mm of notes maturing in 2025 (convertible at $36.67) that will be primarily refinanced using a $200mm convertible note issuance facility. If that were fully drawn (convertibility at $18.20) then diluted NAV would drop to $85.73/share. The standalone parent company financial statements are not disclosed quarterly, but I do not expect meaningful changes since 12/31.

It would feel arbitrary to set a price target. 87% discount is a bargain - is fair value at 77%? Or 67%? 17%? 97%?

Instead, I believe the valuation provides a large margin of safety ahead of catalysts for improved sentiment. As those are realized, the price can be reassessed.

KEY ISSUES

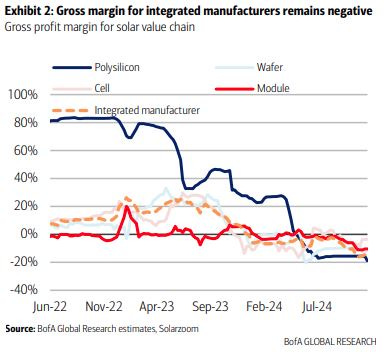

China's domestic solar industry is suffering from overcapacity that has driven gross margins below zero (NYT: China Rules Solar Energy, but Its Industry at Home Is in Trouble)

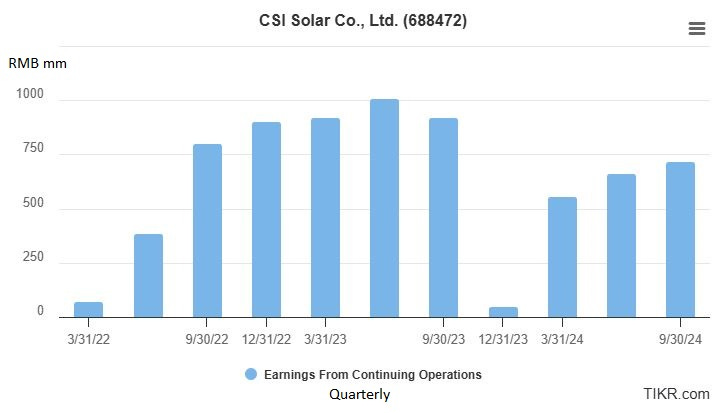

CSI Solar has remained profitable:

“profit-first” business model – not selling at a loss just to maintain volume.

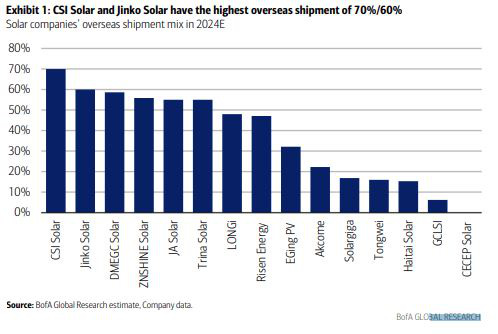

Lower dependence than peers on the highly competitive domestic market. Higher export share where customers pay for higher product quality and established supplier relationships.

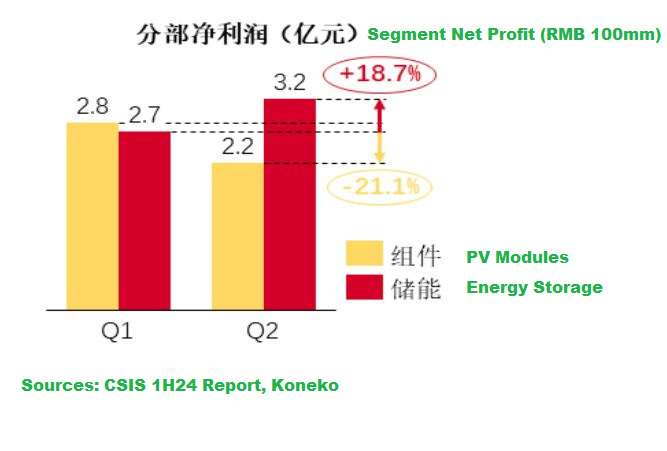

Surging volumes, revenues, and profits from battery storage products. In its 1H24 semi-annual report, CSIS disclosed ytd segment profit of 500mm RMB from solar products and 590mm RMB from battery products. A segment breakdown was not provided with 3Q results (released 10/31 and English translation provided by CSIQ), but the company commented: “From January to September 2024, the Company’s utility-scale battery energy storage shipments was 4.4 GWh, with 1.8 GWh shipped in the third quarter of 2024—a record high for a single quarter. The energy storage segment achieved rapid growth in net profit compared to the second quarter of 2024, making a significant contribution to the Company’s overall performance in the third quarter.”

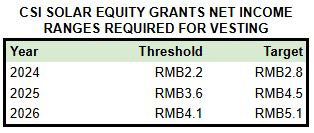

In September CSI Solar issued employee incentive equity grants that will vest if the company achieves aggressive targets for growth in Net Income (excluding non-recurring gains and losses).

If profit is below the threshold then 0% will vest. Between threshold and target 80% will vest. Above target 100% will vest. CSIS net income through 9M24 was 1.9Bn RMB – so it looks like they'll be getting 80%. Canadian Solar has not issued any 2025 guidance, but CSIS net income will have to rise over 40% to trigger the management compensation, so that might happen!

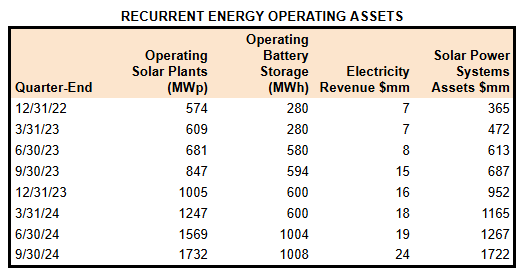

Lower Recurrent Energy profits: The change to a build-and-hold business model will result in recognition of higher revenues, but over a much longer time frame than the build-and-sell model. CSIQ has not made it easy for investors to see the financial statement impact – so far it just looks like segment profits are down. The 2Q24 conference call said: “Recurrent Energy currently owns 1.6 gigawatts of projects in operation and 1.7 gigawatts under construction along with 1 gigawatt hour of battery projects in operation and 3.8 gigawatt hours under construction. The vast majority of these projects are fully funded and secured with PPA contracts, positioning us to begin generating substantial revenues from 2025 onwards”, but did not give any specific guidance.

Several indicators show the plan is proceeding:

CSIQ undoubtedly has a good idea what return it will be earning from these $1.7Bn of solar system assets. In 2025 investors should have more visibility into the stabilized earning potential which will facilitate valuation comparison with clean power peers and pave the way for a 2026 public offering that would raise equity for continued growth.

US Policy uncertainty: US policy has had a disruptive impact on the solar industry:

Incentives at federal and state level to install solar panels: tax credits, rebates, and low-interest loans. Many of these programs provide the greatest benefit to residential installation which is the least efficient way to generate power. Trump might seek to eliminate the federal incentives.

Antidumping tariffs intended to protect American production of solar modules from “unfair” Chinese competition. Tariffs were first imposed by the Obama administration in 2012, then expanded to include imports from Southeast Asia where Chinese manufacturers (including CSI Solar) built factories to escape the original tariffs.

Domestic production incentives under the “Inflation Reduction Act” directly compensate producers of solar power equipment with transferable tax credits that will phase out between 2030-2032. These incentives led to billions of dollars of investment, including the 3 plants being built by Canadian Solar. Trump may seek to eliminate these credits, however they are aligned with his desire to revitalize American manufacturing and the overwhelming majority of new plants are being built in Republican districts and states.

Exclusion of Chinese-controlled companies from IRA tax credits has been proposed by senators representing states with American and Korean controlled solar manufacturing plants. While this has a simplistic populist appeal, the large imbalance of investments between the US and China would give China abundant options for retaliation against American interests, including those of “first buddy” Elon Musk. US FDI into China was $127Bn of FDI in 2023 and cumulative investment is well over $1Tn, while Chinese FDI into the US was $28Bn of FDI in 2023 and cumulative investment is around $250Bn. Treatment of Canadian Solar would depend on the fine print of the exclusion. CSIQ is a Canadian corporation with a Canadian HQ and a diverse international institutional shareholder base. CSI Solar is China-headquartered, but 62% controlled by CSIQ. The Texas, Indiana, and Kentucky plants are currently owned through CSI Solar, but that could probably be restructured if it would preserve access to tax benefits. CSIQ CEO Shawn Qu commented on the 3Q24 conference call: “we don't feel anything that risky for us, given we're actually a Canadian-owned company. And so we actually are highly confident about our robust presence in the U.S.”

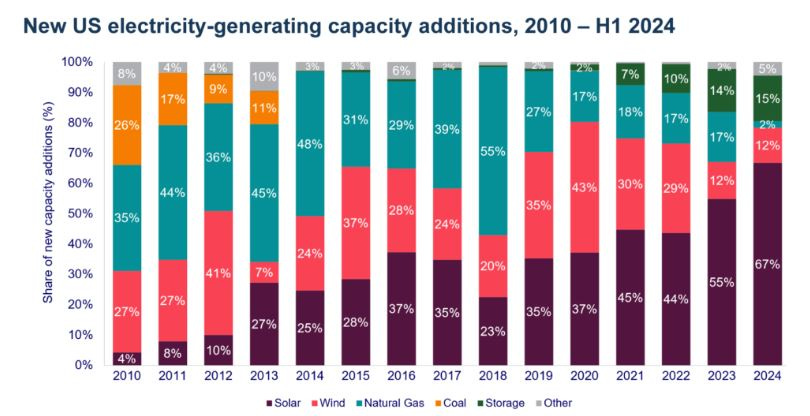

Despite the policy uncertainty, solar and battery have been the leading sources of new electrical generation capacity as the US copes with surging demand from data centers, onshoring of industrial production, and electrification of transportation. All of those users are stakeholders in continued solar energy development.

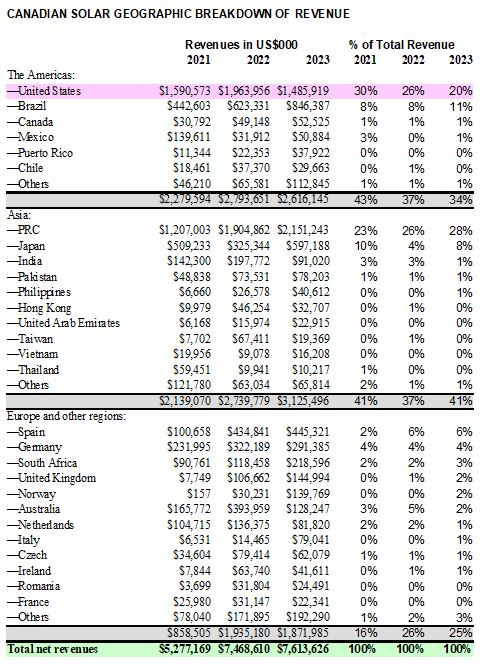

There's considerable uncertainty and risk of scary policy headlines. CSIQ and peer share prices react to every story, however, Canadian Solar's diverse global business limits its vulnerability to adverse developments. Only 20% of 2023 revenue was from the US:

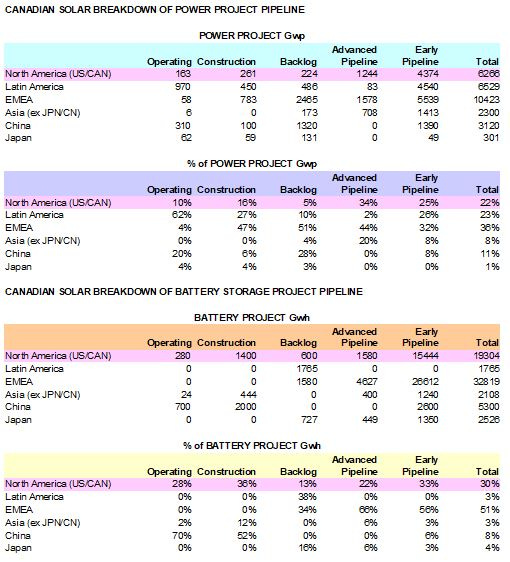

And only 22% of its power project pipeline and 30% of its battery project pipeline was from North America (includes Canada, but that's small)

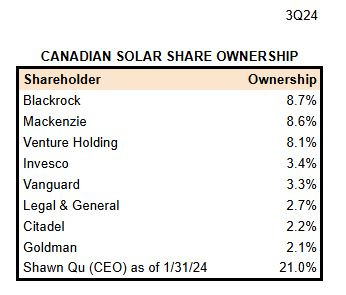

SHARE OWNERSHIP & GOVERNANCE

Canadian Solar has a diverse shareholder base. CEO Shawn Qu has a large, but not controlling, interest.

The company's independent directors appear well-qualified, but have minimal equity stakes.

CSIQ has two blue chip equity partners:

Blackrock acquired a 20% stake in Recurrent Energy

PAG, a leading Asian private equity firm with extensive solar power investment experience, provided a US$200mm convertible bond facility to the CSIQ parent company

COMP VALUATIONS

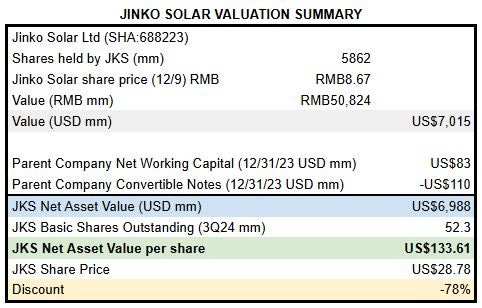

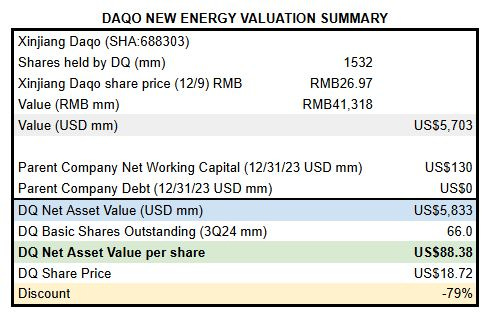

Two solar industry peers have US parent and China subsidiary listings similar to Canadian Solar.

Jinko Solar (JKS) is the #3 module producer according to Wood Mackenzie, slightly ahead of CSIQ. It has international plants in Vietnam, Malaysia, and the US (module assembly in Jacksonville FL). JKS does not have a project development business. JKS has only a small storage manufacturing business (2024 capacity of 4GWh vs CSIQ capacity of 30 GWh of YE25). JKS has a less attractive business model than CSIQ, a less attractive governance setup with nearly all operations held through a Chinese subsidiary, yet trades at a higher valuation.

Daqo New Energy (DQ) is primarily a producer of polysilicon, the first step in the solar module manufacturing process. The narrow business scope and dependence on the domestic Chinese market are much less attractive than CSIQ’s integrated and international operations, yet DQ trades at a higher valuation.

Financial Disclosures and Investor Communications

Solar module production and energy development are very capital intensive. Access to capital on attractive terms can be an important competitive advantage. CSIQ achieved this through the Shanghai IPO of CSI Solar and the Recurrent Energy private placement. Unfortunately, the low equity valuation of the Canadian Solar parent company limits corporate flexibility.

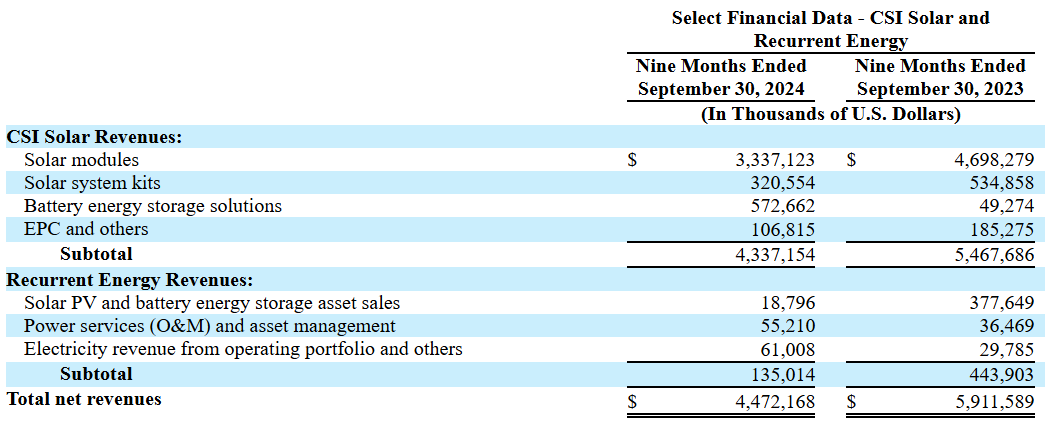

CSIQ’s current segment reporting provides only limited visibility into the strong parts of its business that are key competitive advantages (storage sales and power plant operations). Quarterly results include this revenue breakdown, but not full segment accounting:

Canadian Solar should take these steps to improve investor understanding of its business:

CSI Solar segment reporting (Modules and Storage) should be reported by the parent company. CSIS segment financials and commentary provide helpful insight into the growth and profitability of the storage segment. Omitting these details from CSIQ’s reporting to internal investors leaves the focus on the higher profile module business where the margin pressures in the sector have been widely reported. CSIQ’s 3Q conference call had zero questions about storage. The CSIS incentive plan implies high expectations for 2025 storage profits, but international investors don’t see that.

Recurrent Energy should begin reporting two operating segments:

Development - the traditional build to sell business that will continue in Emerging Markets. The segment will have volatile earnings, but high asset turnover and ROE.

Utility - stabilized operating assets in developed markets. The segment will have very steady earnings with excellent visibility, low asset turnover, and modest ROE.

The Utility business is a key corporate initiative that attracted a $500mm investment from Blackrock, but CSIQ’s 3Q24 conference call had zero questions about it. The company should explain the typical business model for these retained operations (capex to reach stabilization, revenue agreement, secured debt, target ROE) and report performance separately from development for sale. Canadian Solar issues press releases for major PPA signings, but investors don’t give the company credit for these achievements because the company shares very little understanding of how they will impact its financial statements.

Disclosures & Notes

At the time of publication I held shares of Canadian Solar. This article and disclosure should not be interpreted as a recommendation to purchase any securities and this holding could change at any time. Investors are encouraged to check all of the key facts cited here from SEC filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.

At the time of publication an article link was sent to Canadian Solar’s investor relations department to encourage them to enhance segment disclosures. I hope that other investors will advocate for the same changes.

Thank you for this deep dive, but my big concern is the almost $6 Billion in debt they carry on the balance sheet which gives me a lot of pause before investing in something like this

The very lack of disclosures you mention in the article is the key reason most investors will continue to avoid CSIQ.

The NAV discount itself is irrelevant as there is a zero likelihood that anyone would buy out CSIQ to realise that discount.

Even FSLR with all it's advantages is not able to rally within the solar sector.